The stage is set for one of the most important market events of the year. Nvidia earnings results are coming today, and the world is watching closely. $NVDA, now the undisputed king of the AI boom, is expected to report nearly $46 billion in revenue this quarter.

What makes it even more dramatic? Options traders are pricing NVIDIA earnings swing $270 billion in market cap after the report. That’s bigger than the market cap of 95% of S&P 500 companies and larger than most public firms worldwide.

Source: The Kobeissi Letter X Account

This is not just a simple earnings report. It is a direct test of the AI Revolution and whether the world’s hunger for artificial intelligence remains unstoppable despite tariffs, high interest rates, and slowing consumer spending.

You may wonder — what does the earning report have to do with crypto king? The answer: more than most realize.

Crypto analyst Ali has pointed out that $BTC often shows weakness about five days before stock’s earnings. This trend usually stretches into the day of the report and the 2–3 days that follow.

The logic is simple: This AI chip leader is a barometer of artificial investment, and Aartificial intelligence has become tightly linked with risk appetite across tech and crypto.

But this time is different. Bitcoin price today is holding strong near all-time highs. That raises the big question: will stock numbers break cryptocurrency's bullish streak, or will BTC finally move against this old pattern?

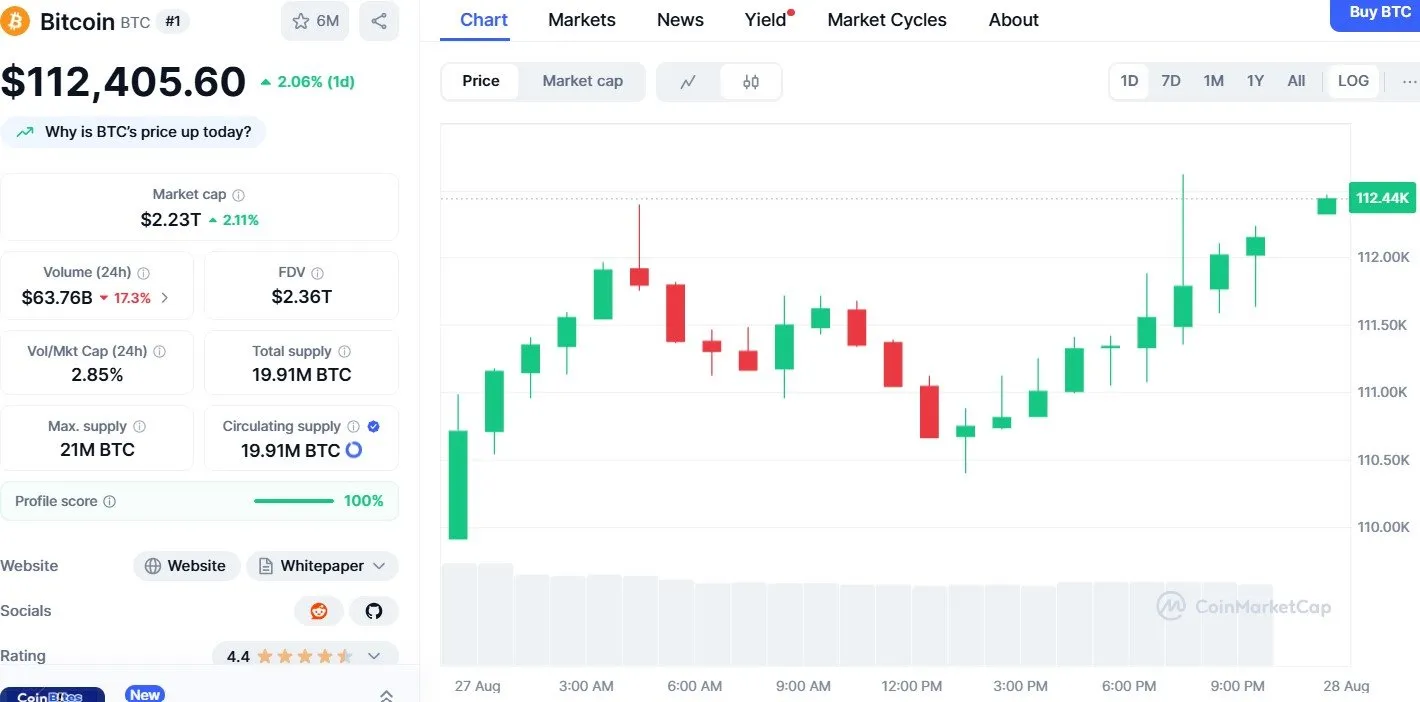

Here’s the current market picture according to the CoinMarketCap data:

Price: $112,405 (+2.06% in 24h)

Market Cap: $2.23T (+2.11%)

Volume: $63.76B (down 17.3%) — buying is strong, but activity is cooling

Strong support at $111K

Intraday highs above $112.4K show bulls are active

Recent candles point to steady upward momentum with small pullbacks

Short-Term: Likely move toward $113,000–$115,000.

Mid-Term: If BTC holds above $111,000, the next run could test $118K–$120K.

Risk: Breaking $111,000 may pull BTC down to $109,000–$110,000.

This snapshot clearly shows why the bitcoin price prediction is being closely linked with the upcoming Nvidia news today.

So why are Nvidia and Bitcoin moving in sync? The reasons are clear:

AI Spending: Tech Optimism, if the earning document beats expectations, it will confirm that AI spending is still exploding. That optimism easily spills into crypto markets.

Market Correlation: Investors group Bitcoin and this share into the same “innovation trade.” Strong stock earnings boost risk appetite, while weak numbers may drag crypto lower.

Psychology of Innovation: A monster beat by the share would remind markets that we are still very early in the AI Revolution. And when investors feel “early,” they often double down on $BTC too.

What to Watch After Nvidia Earning Report Today

Here’s what comes next:

If it smashes expectations, expect artificial intelligence stocks to surge. $BTC could ride that momentum and push above the $115K target.

If the stock disappoints, the $270 billion earnings swing could hurt broader markets, sending the crypto king back to $111K support or even lower.

Either way, today’s earnings report will not just decide $NVDA’s future but also show how closely crypto and AI are tied in market psychology.

Today’s Nvidia earning report is more than just another corporate update. It is a clear test of the artificial intelligence boom’s strength and a clue to $BTC's short-term direction.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.