Michael Saylor’s firm Strategy has made headlines by entering in the top 10 list of the largest U.S treasuries. It is only because of the powerful Bitcoin corporate treasury rally through which the firm has surpassed tech giant NVIDIA by securing 9th position among S&P 500 companies with the biggest reserves.

As the company is focusing on increasing its Bitcoin corporate treasury, it may compete with bigger firms in the coming times. As the all time has shown a huge rise in the recent days , it is now trading at $118,003.41

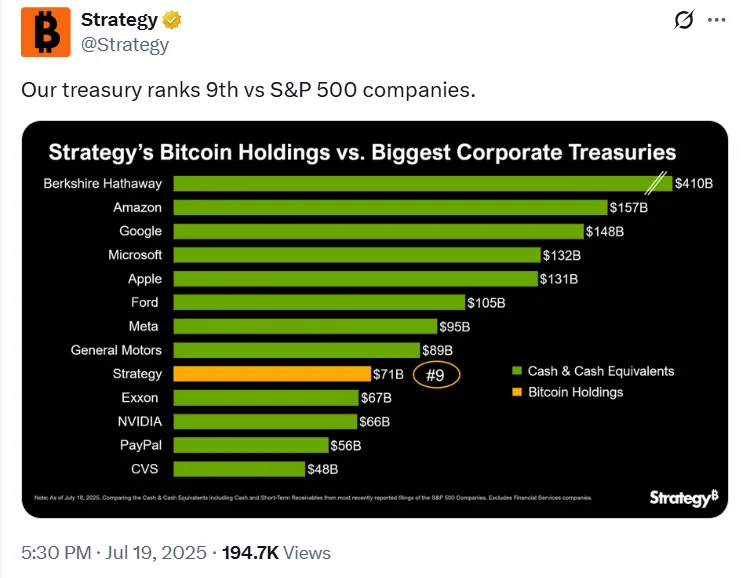

According to the recent post of Strategy on X(formerly twitter) mentioned, the company now holds $71 billion in fund reserves. The firm sits behind the major players like Berkshire Hathaway, Amazon, Google, Microsoft, Apple, Ford, Meta and General Motors.

Source: X

What sets the company apart is that unlike these firms that mostly hold cash or equivalents, Strategy’s reserves are dominated by Bitcoin corporate treasury which is a bold move that is paid off handsomely.

This rise is directly linked to Bitcoin’s recent surge which touched a new all-time high of $123,000 earlier this week. The firm’s early and consistent asset accumulation gives it a unique edge especially when it is compared to firms sticking to traditional reserve assets.

Rival company Metaplanet has also joined the race, recently buying 2,205 BTC to bring its total to 15, 555 BTC. The firm has announced plans to accumulate 210,000 BTC by 2027 which signals how firm's success is inspiring others.

Michael Saylor’s long term vision to hold golden asset as a reserve asset is now proving to be a game-changer. As asset adoption spreads and more firms follow this model, Strategy’s position may continue to strengthen , turning a risky bet into a historical financial plannings.

Akanksha is a dedicated crypto content writer with a strong enthusiasm for blockchain technology and digital innovation. With a growing footprint in the Web3 space, she specializes in turning intricate crypto topics into clear, engaging narratives that resonate with readers across all experience levels. Whether it's Bitcoin, emerging altcoins, DeFi platforms, or NFT trends, Akanksha delivers timely and insightful content that helps audiences stay informed in the ever-evolving crypto market. Her analytical approach, combined with a passion for decentralized finance, allows her to craft informative pieces that empower both new and experienced investors. Akanksha firmly believes in the transformative power of blockchain to reshape global systems and drive financial inclusion.