What happens when crypto companies finally step into the US federal banking system?

This week, the crypto industry got some clarity on that after the US Office of the Comptroller of the Currency OCC approved conditional trust bank charters for some of the biggest names in the digital assets industry.

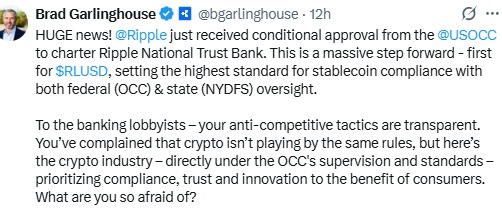

Source: X (formerly Twitter)

The firms that received this conditional approval include Ripple, Circle, BitGo, Fidelity, and Paxos.

For years, digital assets companies have operated mostly outside the federal banking system. The decision now signals that regulators are opening the door to crypto firms willing to meet strict compliance and oversight standards.

This may reshape the way cryptocurrencies, stablecoins, and custody services operate in the US, particularly for institutional investors.

The US Office of the Comptroller of the Currency announced that it has Approved five national trust bank charter applications after a detailed and rigorous review process.

Officials emphasized that those companies were evaluated by the very same standards as all banking applicants.

Two companies were cleared to establish new national banks. The entities are Ripple National Trust Bank and First National Digital Currency Bank, affiliated with Circle. These are considered “de novo” trust banks, meaning newly created.

In addition, three firms were OCC Approved to convert from state-regulated trust companies into federally supervised national trust banks: BitGo Bank & Trust, Fidelity Digital Assets, and Paxos Company.

All of these approvals are conditional. It only means the firms must still meet specific operational and regulatory requirements before they can fully launch under the federal system.

An US Office of the Comptroller of the Currency approval puts crypto firms directly under federal banking supervision.

Even though these banks are not allowed to take cash deposits or extend loans like banks do, they can legally custody digital assets and handle reserves for institutional clients.

Comptroller of the Currency Jonathan V. Gould said new entrants help modernize the banking system and increase competition, adding that "innovation, together with robust oversight, empowers consumers and strengthens confidence in the financial system.”

At a time when crypto regulation is under global scrutiny, the OCC Approved status gives clarity and credibility.

This is viewed as a key win for Ripple's stablecoin, RLUSD, and the broader ecosystem on XRPL.

Source: X (formerly Twitter)

Ripple CEO Brad Garlinghouse noted that approval represents a huge step toward setting the highest compliance standards in the stablecoin market.

Under the oversight of not only the OCC but also New York regulators, RLUSD stands to be one of the most regulation-ready stablecoins in the industry.

The OCC approved charter further cements confidence in the management of Circle's USDC reserves. BitGo and Paxos get a more specific path for expansion of their institutional digital currency custody services, while Fidelity Digital Assets' approval shows increasing acceptance within traditional finance.

It is also in furtherance of the GENIUS Act, forcing strict reserve backing onto stablecoin issuers. This makes federal bank charters more valuable than ever.

The OCC Approved decision marks a turning point in US. It shows that digital asset firms can operate inside of the federal banking system while continuing to innovate. With more and more companies such as Coinbase and Crypto.com looking to receive similar approvals, it may well be that regulated crypto banking will very quickly become the rule rather than the exception.

Disclaimer: This article is for informational purposes only, kindly do your own research before investing.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.