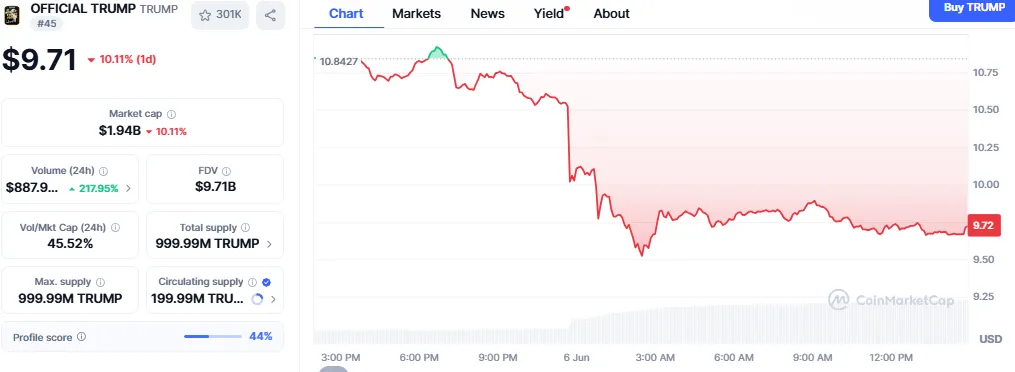

The Official Trump Coin price has seen a big fall in just one day, dropping by over 11% and Elon Musk controversy. The coin current price is now $9.71, compared to its previous high of $10.84. This crash has pulled its market cap down to $1.94 billion. In the last 24 hours alone, the coin saw a trading volume of over $887 million, according to CoinMarketCap.

Source: CoinMarketCap

Over the past week, the Official Trump Coin has fallen by 16%. In the last one month, the drop stands at 12%. This downward trend is surprising to many, especially since the coin is linked with U.S. President, a well-known crypto supporter.

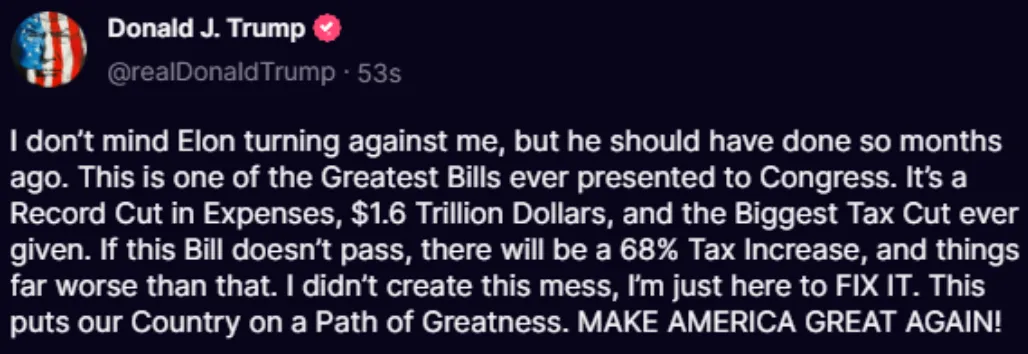

One key reason behind the fall could be the growing tension between Elon Musk and Trump. Recently, the president spoke in favor of what he called the “Big Beautiful Bill”, a proposal that includes $1.6 trillion in spending cuts and historic tax changes. He claimed the bill could reduce taxes and help fix the country’s economy.

Source: Truth Social

But Elon Musk didn’t agree. He strongly criticized the bill, calling it an “ugly bill” and warning that it could push the U.S. into a 2025 recession. In response, the US president said he doesn’t mind Musk turning against him but thinks it’s “a little late.”

This public battle—highlighted by Trump vs Elon Musk headlines—has added uncertainty around Donald-related tokens, shaking investor confidence. Some investors fear that the political clash and the Big beautiful bill tax changes debate may damage the public image of Donald-related assets, including this token.

This drama adds fuel to recent trump tariff news, which also caused market confusion. The timing of all these factors together may have pushed many traders to sell.

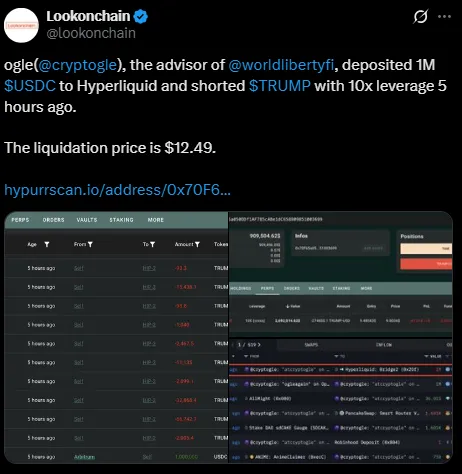

Another big reason for the crash is a huge short position placed on the memecoin. According to Lookonchain, a crypto advisor from World Liberty Financial named @cryptogle deposited $1 million USDC into Hyperliquid and opened a $2.69 million short trade using 10x leverage.

Source: X

This move alone sent shockwaves through the market. Though the position is now down by over $87,000, the panic it caused may have added to the selling pressure. Large movements such as this will intimidate small traders and trigger a price fall.

This indicates that the fall in the coin price is not just a political phenomenon, but also trading patterns and market fear.

From reviewing the charts, the price prediction for Official crypto does not look quite so solid in the short term. The price is at the support level of $8.50 to $9.00. The RSI is 33.45, so the coin is nearly in the oversold zone.

Source: TradingView

Also, the MACD lines are indicating a bearish trend, MACD at -0.63 and the signal line at -0.29. This indicates weak momentum and ongoing selling pressure.

Short-Term (1–3 Days): $8.50 to $9.20, with bearish pressure dominating.

Mid-Term (1–2 Weeks): If RSI rises above 40, a recovery to $11 is possible.

Long-Term (1–3 Months): $13 to $15 range if sentiment improves and market momentum shifts.

Even though the memecoin is linked to Donald, the market isn’t always predictable. Official Crypto price plummet demonstrates the effect of political drama, whale activity, and fear in the marketplace to produce dramatic price movements. With continued elon musk vs trump drama and shorting, the future of the memecoin is in doubt.

Disclaimer: It is only an analysis and investors are requested to keep a watch and not do anything in a hurry. Crypto life is fast, and it is well to keep pace.

Sourabh Agarwal is one of the co-founders of Coin Gabbar and a CA by profession. Besides being a crypto geek, Sourabh speaks the language called Finance. He contributes to #TeamGabbar by writing blogs on investment, finance, cryptocurrency, and the future of blockchain.

Sourabh is an explorer. When not writing, he can be found wandering through nature or journaling at a coffee shop. You can connect with Sourabh on Twitter and LinkedIn at (user name) or read out his blogs on (blog page link)