Key Highlights

The DUCK token has finished its TGE and is listed on 20+ top exchanges, including the OKX DuckChain listing, which has enhanced global access and liquidity.

The release of QuackAI, staking, and RWA integrations triggered real usage in Telegram, AI, and on-chain ownership.

Although there was a positive development in the ecosystem, token's price was under pressure because of liquidity constraints and an airdrop-based supply, which established a decisive moment in 2026.

2025 turned out to be a hallmark year of this project, as it had transformed into a promising Telegram-native blockchain into a globally recognized Web3 ecosystem.

Since its Token Generation Event (TGE) to significant ecosystem collaboration, the project was more about adoption, utility, and growth by the community and not hype.

One of the biggest highlights in the Duckchain token cryptocurrency status 2025 narrative was the successful DUCK Token listing across 20+ major exchanges. Exchanges like OKX, KuCoin, Gate, MEXC, Bitget, HashKey, and Kraken open access and liquidity globally.

The OKX DuckChain listing specifically increased awareness, with its more integrations throughout the OKX ecosystem, such as the DuckChain OKX MiniApp, which assisted in onboarding new users directly from Web2 to Web3.

Source: Official X

OKX Ventures' strategic investment enhanced credibility, and 8+ offline events in Seoul, Singapore, Dubai, Hong Kong, and Denver facilitated the building of real-world relationships. These initiatives made DuckChain OKX collaborations more than alliances. They became growth facilitators to both the builders and the consumers.

The theme of utility was still prevalent during the year. With the introduction of staking, long-term incentives were added, and QuackAI DuckChain became one of the major driving forces of adoption, reaching 1 million users with the help of AI tools via Telegram.

Moreover, the LiveArt collaboration introduced the asset of the real world on-chain, and users could mint iconic art with the token, which was a significant move in the direction of cultural and financial utility.

The AI Unchained Hackathon sponsored by AWS and AWS, with a prize pool of 1.11 million, increased the rate of innovation. More than 100 projects were tried in AI, EVM, and Telegram-native applications, and 25+ integrations in AI, gaming, RWA, and launchpads increased the coverage of the network. Any credible research report on DuckChain in 2025 would highlight this builder momentum as a long-term strength.

DuckChain price today faced pressure. The token currently trades around $0.001062 due to airdrop-related selling. The market cap stands at $7.6M with trading volume $1.51M. The DuckChain airdrop strategy assisted distribution, though it also presented short-term dilution risks, which influenced a reserved mood.

Source: Coinmarketcap Com

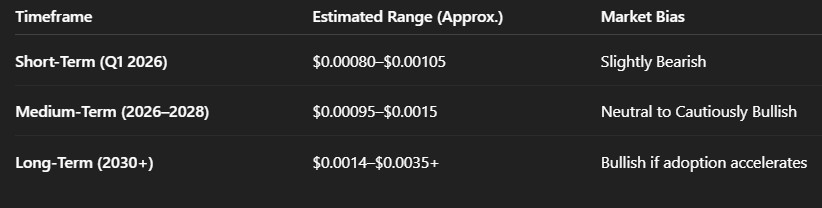

DuckChain Price Prediction: Looking Ahead to 2026

It has not performed well in terms of its price performance in late 2025, as it is trading around the price of $0.00105 with low liquidity and continued selling pressure.

In the short term (Q1 2026), $DUCK price can be in the range of about $0.000825, about a 20-25% decline from the current values.

During the medium term (2026), QuackAI, Telegram MiniApps, and staking would likely stabilise DUCK at $0.0011- $0.0015 with moderate growth (approximately 5% per year).

Long-Term Scenarios (2029-2035) upside will depend on continued user growth and better liquidity, and not speculation alone, around $0.0014-0.0023 at the start of the 2030s. Other statistical projections vary at 2030 at a range of $0.003 - $0.004.

Source: Official website

Liquidity & Volume: An increase in turnover minimizes volatility and may facilitate more powerful trend continuation.

Utility Adoption: An increase in the usage of QuackAI, MiniApp, and on-chain transactions will boost the demand for $DUCK.

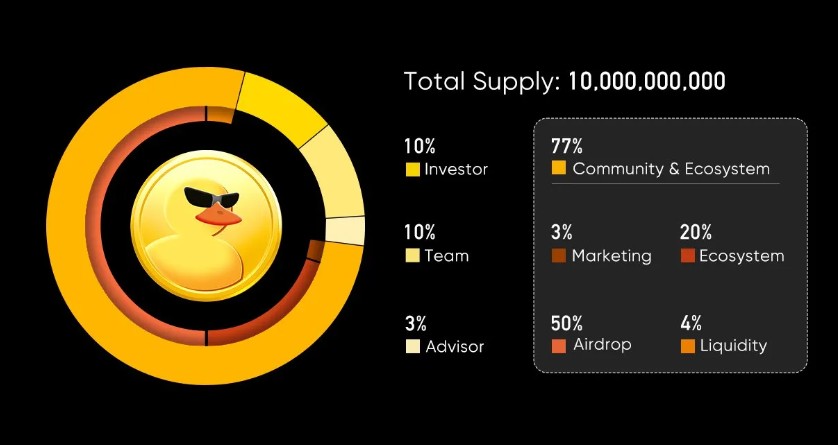

Tokenomics: The impact of airdrop and unlock schedules can be borne on price; increased staking adoption can offset the pressure of selling.

Macro Market Cycle: The performance of altcoins is generally associated with the dominance of Bitcoin and the overall mood in the crypto market.

Source: Website

The 2025 wrap-up is a tale of disciplined action rather than air. The foundation is established with effective exchange listing, AI-powered tools, and the development of an ecosystem. The 2026 problem will be to convert reach into retention - utility into long-term demand.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar does not have any financial losses. Cryptocurrencies are extremely unstable, and you can lose all your money.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.