The Federal Reserve kept interest rates unchanged in its July meeting, and it has sparked fresh debate in financial circles.

Among the most vocal critics is economist Peter Schiff, who says the Fed is now helping create another financial bubble instead of fighting inflation.

Peter Schiff on Fed policy is a warning sign for many. He believes the central bank is ignoring key signals and making risky decisions that could hurt the economy in the long run.

Source: X (Previously Twitter)

The main issue is how the Federal Reserve is reacting or not reacting to inflation is what discussed in Peter Schiff on Fed Tweet.

Right now, inflation sits around 2.7%, higher than the central bank's target of 2%.

In the past, when it was even slightly below 2%, the bank took bold steps like cutting interest rates and launching stimulus programs.

Back in 2014, price increases was just 1.5%, and the Fed introduced QE3 and kept rates near zero.

He is now asking: Why isn’t the Federal Reserve doing the opposite when rates is above the target?

Peter Schiff on Fed decisions points to a double standard. He believes the 2% target was never a true goal but a way to justify money printing.

He says the chairman Jerome Powell isn’t serious about price rates anymore and instead is trying to protect Wall Street from a market crash.

Another issue weighing on the market is the return of Trump tariffs. The U.S. has started placing new tariffs on imported goods on several countries globally.

This could raise prices on things like electronics, clothes, and home goods.

In fact, both the Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) have increased in the last two months.

If the price rises continues rising and the Fed still doesn’t raise rates, some traders fear the central bank is falling behind.

Peter Schiff on Fed inaction accuses the central bank of disregarding these warning signs. He believes that doing nothing as prices increase will only worsen the situation.

While Schiff typically trashes Bitcoin, the people in the crypto world are leveraging his remarks to bring out the utility of decentralized finance.

They argue that the bank’s poor decision-making is exactly why people need Bitcoin because it isn’t controlled by any central authority.

Peter Schiff on Fed credibility might not necessarily be for crypto, but his fears tend to lean in the same direction as individuals who see the importance of alternative assets.

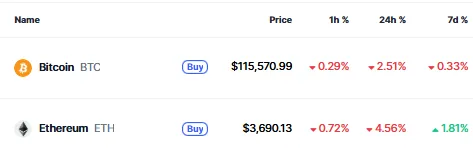

Currently the crypto market cap stands at $3.77 Trillion, experiencing a decrease of 3.03% in the last 24 hours. Bitcoin and Ethereum are trading at $115,570 and $3690 respectively.

Source: CoinMarketCap

As prices increases and faith in the Central Bank diminishes, Bitcoin and other cryptocurrencies could draw more interest.

The next FOMC meeting will be held in September. In the meantime, the market will be monitoring inflation reports, employment figures, and how consumers react to new tariffs that are announced today on August 1 by the US President Donald Trump.

Peter Schiff on Fed risk is a serious one: He states that maintaining rates at current levels in the face of higher prices may cause another bubble as happened in 2008. In case the Reserve delays action, the pain this time might be even greater.

The Federal Reserve for now is holding out for economy to moderate by itself. But many feel that wishful thinking is not a strategy.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.