Why is the Pi Coin price crash getting worse when Bitcoin hits all-time highs? While Ethereum, Solana, and other altcoins are reaching new highs, this token continues to fall.

Is it tokenomics, KYC delays, or something deeper than this? Let’s uncover the hidden risks of a booming market.

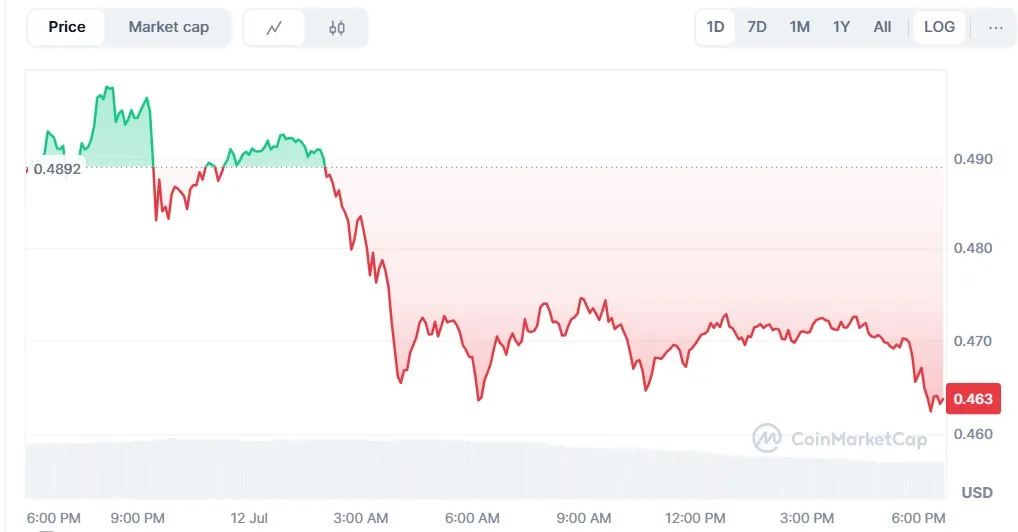

While Bitcoin just surged to a new all-time high above $118,000 and Ethereum reclaimed $3,000, this token's price is bleeding. As of writing, it stands at $0.4641, up just 5.42% in the last 24 hours but down over 25% in the past month. Volume is collapsing too—down 31.79% to $134 million, as per the CoinMarketCap chart.

In a market where most altcoins are rallying, this token’s continued fall raises serious questions. Why is Pi Coin price crashing while the rest of the market celebrates?

There are three core reasons driving the crash:

The Pi2Day Letdown: This celebration was supposed to ignite bullish sentiment, but it fell flat. In the past month, it has fallen by more than 25%, indicating a deepening downtrend.

100 Million Tokens Unlocked: Between July 8 and July 15, more than 100 million tokens—about 1.5% of the total supply—are being unlocked. On a single day, 10.1 million tokens were released, flooding the market with fresh sell-side liquidity. From my experience, this unlock feels like a classic oversupply event—too many sellers, not enough demand to hold the price.

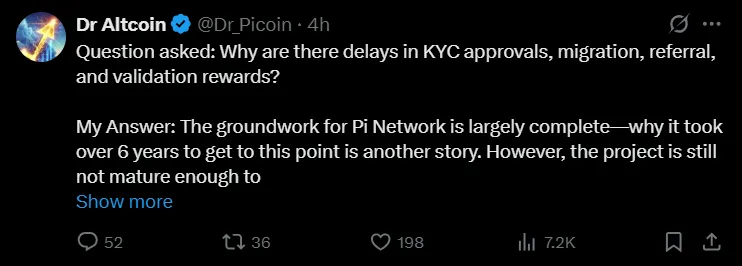

Rewards, Migration, and KYC delays: In the latest news today, these delays are holding back the real utility.

Dr. Altcoin , a well-known analyst, stated:

"The groundwork is done, but the token is still not mature. Until the price reaches $10 and real DApp utility begins, delays are intentional to prevent a mass sell-off."

These 3 price drop reasons are weighing heavily on sentiment, and selling pressure is overpowering any short-term bounce.

The TradingView chart is clearly showing a downtrend, currently at $0.4614. Let’s look at the indicators:

RSI is at 38.25: Near oversold, but no reversal signal yet.

MACD: Still bearish, with no bullish crossover.

Support zone: $0.44 to $0.38

Resistance zone: $0.50 to $0.57

Short-Term:

If current weakness continues, it may fall to $0.38 or even $0.28. However, if KYC migration is fixed, the price could jump to $0.75 to $1.

Long-Term:

Some analysts remain cautiously optimistic. Tom Tucker, a respected crypto chartist, believes it is showing two classic bullish reversal signs:

A clean double bottom near the $0.40 level

A falling wedge pattern, which often precedes upside breakouts

Tucker stated:

“If it breaks above $1 with volume, the next possible target could be $1.66 or higher.”

While speculative, his technical view aligns with the community’s question: Will it Hit $1? Only when its ecosystem reaches maturity and demand increases after unlocking.

Despite the crypto market booming, the Pi Coin price crash shows no signs of stopping. The cryptocurrency doesn’t just need hype—it needs hard utility, transparency, and timely execution. Until then, the downtrend may continue.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.