As the sixth red candle streak continues to bleed the altcoin, many investors wonder: Will $0.40 hold up as a reliable support amid growing sell pressure and the unlocking of so much token supply? This article ventures deeply into short-term prospects with bearish price action, weak sentiment after Pi2Day, and technical indications towards a reversal.

July 29th saw the community celebrate Pi2Day by launching an AI-powered no-code Pi App Studio to increase the strength of its ecosystem, allowing easier app creation. Meanwhile, Ecosystem Directory Staking was launched as a ranking system whereby apps gain visibility based on the quantity of token staked behind them.

But, despite these strategic updates, the larger market remained indifferent. Downward price action let it be known that the announcements had not managed to make investors enthusiastic yet. The muted response by Pi underscores the trend sidelining roadmap promises in favor of utility execution.

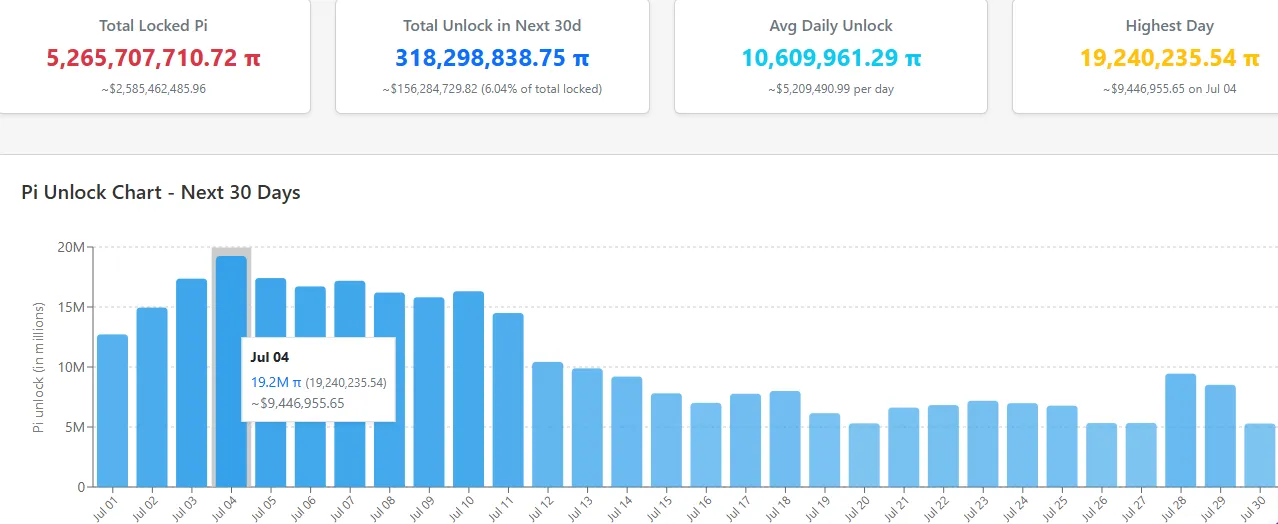

With more than 318.29 million tokens, roughly 6.04% of the locked supply, on the verge of unlocking in the coming 30 days, it is all set to be an obstacle in the way of growing short-term speculation pressure. The major unlock will be for 19.24 million on July 4th within one day (about $9.45 million in worth) at the date itself, and on the average of 10.6 million, $5.2 million worth gets unlocked daily, which will only add more pressure of sell in the short term.

Source: Piscan.io

Usually, such unlocks stir FUD among retail holders, but one could consider that still over 5.26 billion tokens remain locked away, greatly protecting the market from flooding by the total supply. However, the unrealized unlock peaks may still put the market sentiment to the test while stirring volatility.

The daily chart may see prices exhibiting a descending wedge pattern—a classic indicator for an imminent bullish reversal. The asset now hovers along the all-important lower boundary of the wedge at $0.49, just above the structural plus psychological support of $0.40.

The technicals are echoing the oversold zone. RSI at 35.75 suggests that a strong selling pressure might have been over-exerted, paving the way for a bounce. The real test will be to get over the 50-day EMA near $0.639. In case the bulls can clear the dynamic resistance, targets of $0.75 to $0.90 could come into play in the short term.

Source: TradigngView

A drop below $0.40 would invalidate the wedge, which might open doors for an aggressive slide toward the old lows. So, the forthcoming daily candles will play a crucial role for determining whether the wedge will hold on or cash out into a bearish doorway.

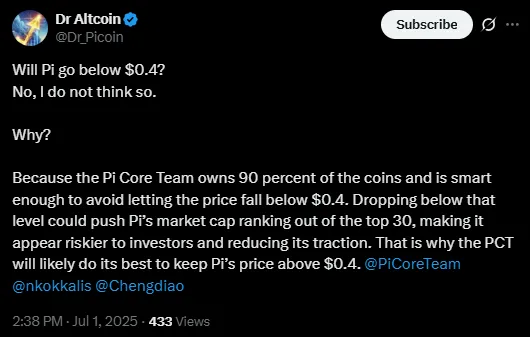

Famous analyst Dr Altcoin remains bullish. He considers it very unlikely to be broken below $0.40, mainly due to 90% of the total supply being held strategically by the Core Team.

Source: X

A price bottom, according to him, needs to be maintained so that the altcoin retains a top 30 market cap status, an important psychological and marketing milestone that will enhance its growth and adoption in the future.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.

6 months ago

fine