Binance Alpha has confirmed that it will be the first exchange to list the RTX token on December 19. Additionally, with the listing, qualifying members will also receive a chance to participate in the upcoming RateX Airdrop with their Binance Alpha Points.

After the token will be live, users can access the Alpha Events page to claim the airdrop allowance through Alpha Points. As per the previous update on December 14th, in excess of 42,000 wallet addresses are eligible to receive the Airdrop.

Source: Binance Wallet X (formerly Twitter)

This is composed of 84% of users who gained RTX Points during Season 1.

The screenshot was taken on the 1st of December. Points earned after that will be valid for Season 2. This will be announced at a later date. A user will be able to claim their allocated tokens immediately at TGE.

It is a yield trading protocol that operates on various blockchains. This platform enables users to trade yield assets in a flexible and efficient manner.

Among the important attributes includes the yield tokenization system, whereby the users are able to separate the yield and the principal and trade them independently. This makes it relatively easy to take a trading position with the yields without locking up a lot of funds.

Other than trading, the project also supports fixed yield earning, yield liquidity farming. It means that the project goes beyond mere trade facilitation. The additional use case brings more interesting aspects in the RateX launch.

The total supply of RTX tokens is fixed at 100 million.

Based on this consideration, the initial supply of tokens that will circulate during the initial stages will be 16.66 million tokens.

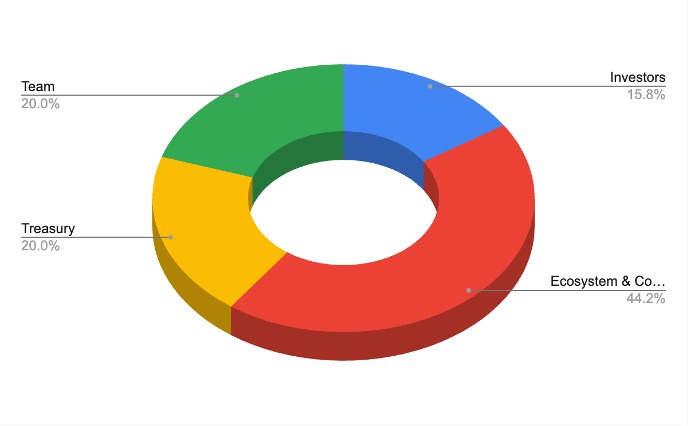

A massive 44.18% portion goes for the ecosystem and community development, these include rewards, partnerships and incentives.. 20% to team, 20% allocated towards treasury, and 15.8% to investors.

Source: Official Website

Out of these, 6.66% is specifically allocated for the airdrop and campaigns that come alongside Season 1.

It will not drop all at once. Instead, the tokens unlock in the following stages:

20% at TGE

30% after 3 months

50% in 6 months

This gradual release of shares acts to ease the impact of selling pressure and aids in overall stability within the marketplace following listing.

RTX listing price Projections compared with Talisman listing (SEEK), whose token supply also started at 100 million, launched at 0.6896 earlier this month. But following selling, illiquidity, and poor altcoin market performance, it is now down by almost 85%.

On the basis of above comparison, a basic RTX outlook is as follows:

Base Case: Spot prices are listed between $0.08 and $0.12, then normalized post-airdrop sales.

Bullish Case: The prominence of Binance Alpha and the interest in Yield Trading bring RTX to $0.18-$0.25.

Bearish Case: Excessive airdrop selling and limited starting liquidity cause the price to drop to the $0.05 to $0.06 range.

The RateX Airdrop shines because of its tokenomics, product usage, and the fact that it was introduced to the community via the Binance Alpha project. Although volatility is expected when it lists, the unlock schedule increases the probability of it not crashing.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.