The Ray Dalio Warning is sending shockwaves across global markets. The 76-year-old billionaire and founder of the world’s largest hedge fund has delivered a stark message: sell debt assets and buy gold. According to him, “the world order as we knew it is gone,” and we are heading into very dark times.

Source: X (formerly Twitter)

Ray Dalio’s comments come after major leaders at the Munich Security Conference said the post-World War II global system is effectively over. German Chancellor Friedrich Merz, French President Emmanuel Macron, and U.S. Secretary of State Marco Rubio all pointed to rising great-power rivalry. Dalio describes this period as “Stage 6” of his Big Cycle, a time when rules weaken and power politics dominate.

It focuses on growing global conflicts. He highlights five types of wars: trade wars, technology wars, capital wars such as sanctions, geopolitical conflicts, and military wars. History shows that economic pressure often comes before open conflict. He compares today’s environment to the 1930s, when financial stress, nationalism, and tariffs led to World War II.

Dalio also raised concerns about central bank digital currencies. In an interview, he warned that CBDCs could reduce financial privacy.

He said governments may be able to monitor transactions and even block access for politically disfavored individuals. This part of the Ray Dalio Warning has sparked debate among crypto supporters who value decentralization.

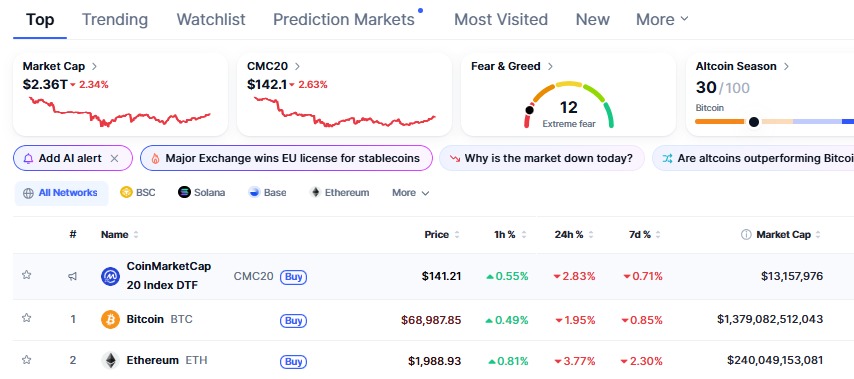

His warning is unfolding at a time when the crypto market is already under pressure. The total crypto market cap fell 3.44% in 24 hours to $2.35 trillion.

Bitcoin-led selling drove most of the decline, with BTC dominance at 58.4%. When Bitcoin drops, the broader market often follows.

Source: CoinMarketCap

Investor sentiment is extremely weak. The Fear and Greed Index stands at 12 out of 100, signaling “Extreme Fear.”

Ethereum underperformed, falling 5.4%, which added to overall market weakness.

Bitcoin is now testing the important $65,000 to $68,000 support zone. A breakdown below this level could trigger a deeper correction.

Markets are watching key U.S. economic events this week listed down by TKL. The December PCE inflation report is the main focus. Investors are also tracking Fed meeting minutes and several speeches from Federal Reserve officials. Around 15% of S&P 500 companies are reporting earnings, adding to volatility.

Source: The Kobeissi Letter

The warning suggests that rising debt, currency devaluation, and global tension could increase demand for safe-haven assets like gold. Interestingly, Bitcoin is showing a 36% correlation with gold, which may indicate that some investors see it as a hedge against inflation and instability.

The Ray Dalio Warning highlights serious global risks, from economic wars to political instability. At the same time, crypto markets remain sensitive to macro data and sentiment. The near-term outlook depends heavily on inflation data and whether Bitcoin can hold above $65,000.

For now, markets appear cautious and defensive. If inflation data surprises positively, we may see relief buying. If not, macro fears could continue to weigh on crypto prices.

YMYL Disclaimer: This content is for informational purposes only and not financial advice. Cryptocurrency and financial markets are volatile. Please do your own research and consult a licensed financial advisor before making any investment decisions.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.