Reservoir Binance listing has been officially confirmed for August 18. It is a permissionless Ethereum protocol that enables cross-chain minting and redeeming of its stablecoin rUSD and its yielding asset srUSD. Its utility token, DAM, is all set to launch on Binance Alpha and Binance Futures this August 18, 2025. The team shared the details over X (formerly Twitter).

Source: X

According to the announcement, trading for DAM on Binance Alpha will begin at 11:00 UTC, followed by Futures trading at 12:30 UTC. At present, Binance is the first exchange to list it, though there’s still a chance that other platforms like KuCoin or MEXC may join before launch day.

One of the major highlights for early participants is the airdrop. With the Reservoir season 1 airdrop now complete, token claims are set to open alongside the token listing. The claim period will run for 60 days, divided into three phases:

Phase 1 – Starts August 18

Phase 2 – Starts September 1

Phase 3 – Starts September 15

Closing Date – October 17

In each phase, Season 1 holders will have two options:

Claim the full available amount and stake to earn rewards (with a 14-day unlock after unstaking).

Claim instantly at a 25% reduced rate.

Tokens left unclaimed will be redirected to staking rewards, further strengthening the ecosystem. This Reservoir Airdrop claim model shows how the project wants to balance early adoption with long-term participation.

Interestingly, Season 2 will also begin right after launch. The first season Points holders will gain a loyalty boost of 20%, while the season will last for six months and will associate with at least 5% of the total supply.

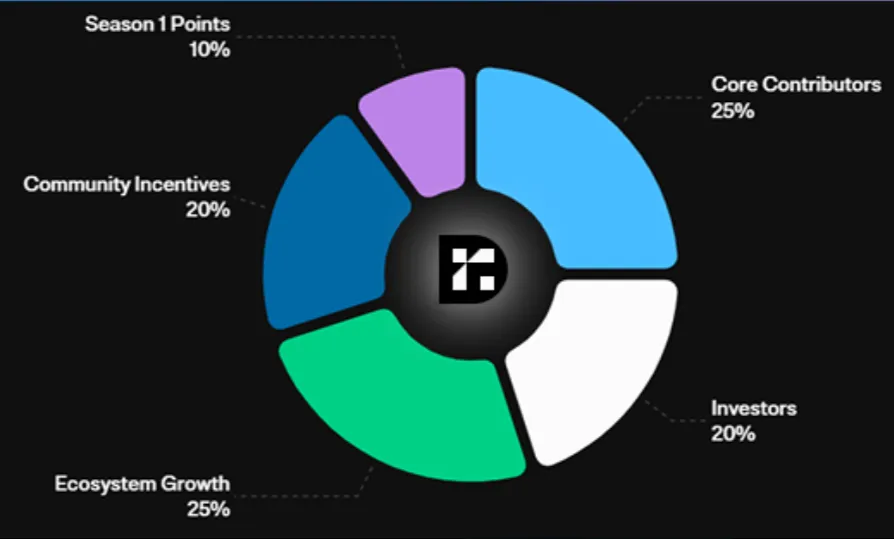

The tokenomics show that the total supply is 1 billion tokens, distributed as follows:

Source: X

Core Contributors: 25% (builders and advisors, vested over 36 months)

Ecosystem Growth: 25% (partnerships, integrations, audits, and expansion)

Investors: 20% (early backers, vested with lock periods)

Community Incentives: 20% (token airdrops, DAM staking, grants, and rewards)

Season 1 Points: 10% (rewarding early adopters)

Such a balanced distribution system ensures that the long-term growth is nurtured while the earliest members of the community would get rewarded.

Based on the DAM price prediction, the token is expected to go for somewhere between $0.50-$0.80 by the time of listing.

Bullish case – Strong demand and Binance liquidity may drive the token price to $2–$3 short term, with a possible target of $15–$20 by the end of 2025 if adoption continues.

Bearish case – Heavy investor selling or slower adoption could push the DAM coin price near $0.80 and $2.50 with a long-term ceiling of under $5.

August 18, as the Reservoir Airdrop listing date, is a valuable milestone for the project. With an efficient claim process, community incentives, and hard-set tokenomics, the preceding listing stage of the Reservoir crypto token could set a very strong precedent for the token's long-term success. However, like every new listing, price volatility is expected. Traders and investors should watch the coin price closely as the market reacts.

Disclaimer: This article is for informational purposes only. It is not financial advice. Cryptocurrency investments are subject to market risks, and readers should do their own research before making decisions.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.