What happens when a crypto company finally gets approval from one of the strictest financial regulators in the world? It means trust. And for the organisation, it means a big step forward. The Ripple FCA Approval shows that this is no longer just a crypto company. It is becoming part of the real financial system.

On January 9, 2026, Ripple Markets UK Ltd received two important approvals from the UK Financial Conduct Authority (FCA). It got an Electronic Money Institution (EMI) license and Cryptoasset Registration. This allows the firm to issue e-money and handle crypto services in a fully regulated way.

CEO Brad Garlinghouse said this approval adds to a very strong year for the company. He believes the organisation now has one of the best regulatory setups in the crypto industry and is ready for bigger growth in 2026.

Source: X (formerly Twitter)

With the UK FCA Approval, they can now offer complete financial services in the UK. Their business clients possess the ability to make transactions, engage in the trading of digital assets, as well as transfer funds among crypto and fiat currencies.

President Monica Long said this move will make it easier for businesses in the UK to use crypto safely. Additionally, this will help them reach its vision of providing financial infrastructure for the entire world by working together with governments and banks.

Why is that important? The reason is that banks only trust the platforms that strictly follow the rules and Ripple Labs is one of them.

The digital assets firm is not only focusing on regulation. It is also working on better technology. Reports suggest Ripple is exploring Amazon Bedrock tools from AWS to improve how the XRP Ledger is monitored.

Right now, checking huge system logs can take days. With AI tools, the same work could take just a few minutes. That would make the XRP Ledger faster, safer, and more stable.

They are also entering the banking system. Ripple's partner BNY Mellon has launched tokenized deposit services, with Ripple Prime as an early user.

Source: X (formerly Twitter)

Since BNY is the main reserve custodian for RLUSD, this move brings RLUSD and XRP closer to real banking infrastructure, connecting traditional finance with digital assets.

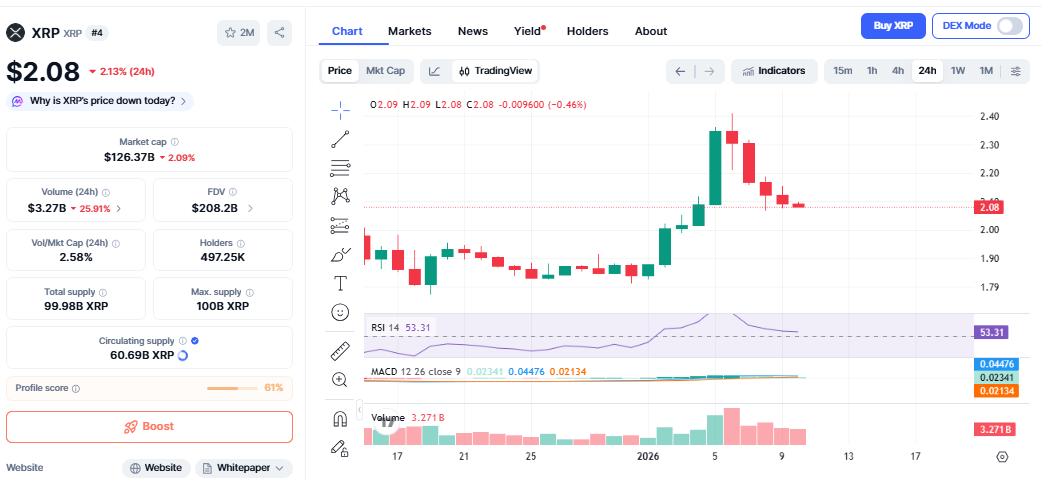

Even after the UK FCA Approval, XRP price is moving carefully. It is trading near $2.08, down around 2% in the last 24 hours.

Source: CoinMarketCap

This is because the whole crypto market is under pressure. Strong US jobs data reduced hopes of interest rate cuts, making investors more careful.

It also broke below an important support area between $2.09 and $2.11. When that happened, many automatic sell orders were triggered.

Still, It is doing well over longer periods. It is up around 2.6% in seven days and about 4.4% in one month.

Short term:

If it stays below $2.11, it may test $2.04 and even $2.00. RSI is near 53, which means the market is neutral. If it breaks above $2.20, it could move toward $2.35.

Long term:

If the organisation keeps winning approvals like this and expands its regulated payments network, XRP could return to the $2.80–$3.20 zone later in 2026.

Short-term price moves come and go. The Ripple FCA Approval is about long-term trust. It shows they are serious about working with regulators and banks.

This approval makes this digital assets giant more attractive to financial institutions. It also strengthens the role of XRP in real payment systems.

Disclaimer: This article is for informational purposes only and not a financial advice, kindly do your own research before investing in the crypto market.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.