Ripple is making another push toward institutional crypto adoption as Ripple Prime integrates Hyperliquid into its prime brokerage platform. Announced on February 4, the update gives large financial firms a way to access on-chain perpetual futures while keeping their risk controls in one place. The step reflects a wider trend: traditional finance is slowly getting more comfortable with decentralized markets.

Source: X (formerly Twitter)

Michael Higgins, International CEO of Ripple Prime, called the integration an important move in bringing decentralized liquidity closer to familiar brokerage systems. With this setup, institutions can cross-margin crypto positions alongside assets like forex and fixed income, helping them manage capital more efficiently without jumping between platforms.

Now that Ripple Prime integrates Hyperliquid, professional investors have a simpler path into decentralized derivatives trading. One of the biggest challenges for institutions entering DeFi has been operational complexity. A single platform with centralized risk management removes much of that stress.

Hyperliquid already ranks among the top decentralized derivatives venues, reporting over $5 billion in open interest and roughly $200 billion in monthly trading activity. That depth of liquidity is often what institutional traders look for before committing serious capital.

The reaction across the community has been mixed. Some XRP Ledger supporters felt Ripple could have promoted its native ecosystem more strongly. Others view the decision as strategic, arguing that stronger liquidity partnerships tend to benefit the broader market over time.

The fact that Ripple Prime integrates Hyperliquid suggests institutional demand for structured DeFi exposure is growing. Large investors usually prefer environments where risk is easier to monitor, and this model offers exactly that.

If more institutions follow this route, the crypto market could see improved liquidity and steadier trading conditions. It also shows how the gap between Wall Street and blockchain infrastructure is becoming smaller.

In simple terms, crypto is starting to look less experimental and more integrated into mainstream finance.

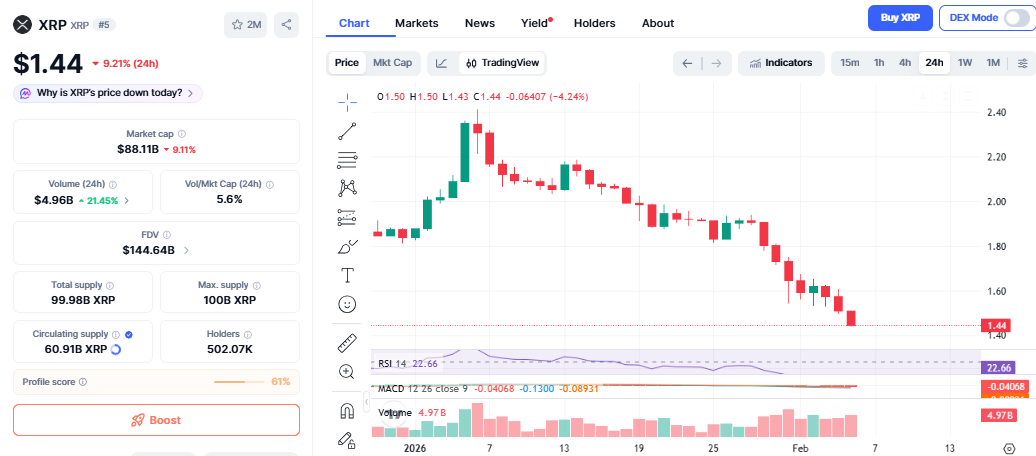

XRP is trading near $1.44, down more than 9% in the last 24 hours as per the CoinMarketCap. The drop picked up speed after the price fell below the important $1.60 support level, which triggered automated selling and weakened market confidence.

The Relative Strength Index is close to oversold territory, suggesting the sell-off has been sharp.

Source: CoinMarketCap

XRP price prediction:

If XRP cannot reclaim $1.60 soon, traders may watch the $1.00 psychological level as the next support. However, oversold conditions sometimes attract buyers, meaning a short relief bounce cannot be ruled out.

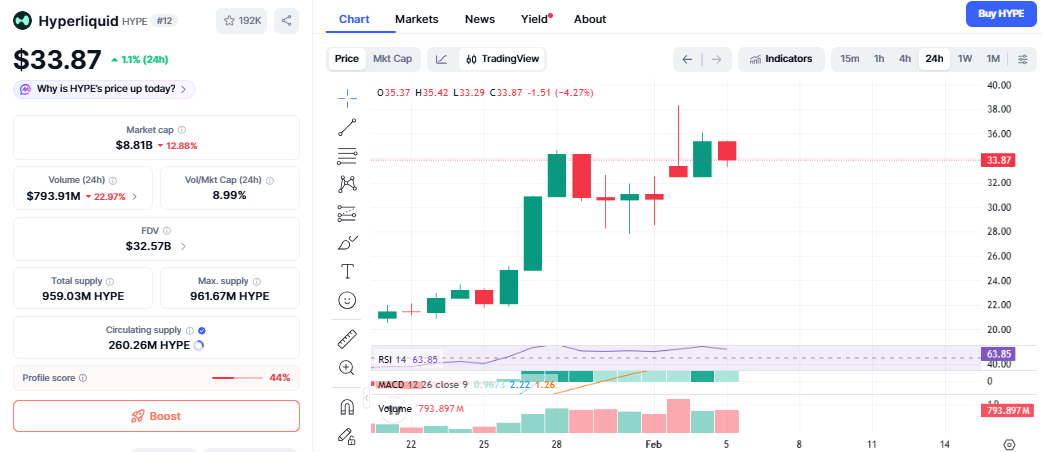

Following the news that Ripple Prime integrates Hyperliquid, the HYPE token is trading around $33.87 and showing relative strength despite a broader market decline. The price remains above key moving averages, pointing to underlying momentum.

Onchain data also shows whale accumulation, which is often taken as a sign that bigger players are preparing for the medium-term future.

Source: CoinmarketCap

A clear break above the $34.10 level of resistance could help fuel further gains. However, a high RSI reading indicates that the token may see small pullbacks before pushing higher.

The market today is one of contrasts. XRP is under pressure from technical issues and macro-driven fears, while Hyperliquid seems to be enjoying new institutional support following the integration of Ripple Prime and Hyperliquid.

Divergent markets like this tend to show where confidence is being built, and infrastructure-based platforms are always the ones that see new investment during uncertain market times.

With Ripple Prime’s integration of Hyperliquid, the future looks to be one where traditional finance and decentralized markets are much more intertwined. XRP may see some short-term market action, but the overall message is clear: institutional investment in DeFi is on the rise.

YMYL Disclaimer: This article is for informational purposes only and not a financial advice, cryptocurrency investments can be risky always conduct your own research or consult a investment advisor before investing in crypto markets.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.