Hyperliquid Price Prediction 2026 is back in focus today as HYPE turns into one of the strongest movers in the market.

When crypto prices turn green, traders usually track the coins that outperform the rest.

Bitcoin is holding above the $75,500 area and some altcoins are in green.

Overall sentiment is shifting toward greed.

But HYPE rising faster than the broader market shows something more than a routine bounce.

So, why is HYPE price up today?

During bullish phases, traders naturally move toward platforms with deeper liquidity.

Hyperliquid nearing $1.8 billion in open interest shows where activity is building.

This looks more like ecosystem positioning than random buying.

This strength is also reshaping how traders look at Hyperliquid Price Prediction 2026.

HYPE is not just moving with the market. It is pushing higher on its own narrative.

The rally feels less like a single green candle and more like a signal that the token is trying to take a larger role in this cycle.

HYPE turning into a top gainer on February 3, 2026, is not accidental.

Several factors are driving today’s rally, with fresh product updates playing a central role.

1. HIP-4 Proposal and the Prediction Market Push

According to recent data, Hyperliquid has officially confirmed that HIP-4 will support outcome-based trading, moving the platform beyond crypto-only markets.

This includes contracts linked to elections, sports results, and major real-world events.

These outcome contracts are fully collateralized and settle within a fixed range.

That removes the risk of liquidation, which directly changes trader behavior. When downside pressure feels controlled, participation rises.

This shift is now visible in price action.

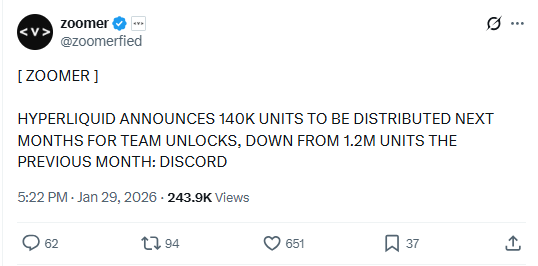

2. Massive Supply Cut and the Unlock Slowdown

According to a post shared by Zoomer, Hyperliquid has reduced its upcoming team token unlocks from 1.2 million units to just 140,000 units for the next month.

That is nearly an 88% cut in new supply entering the market.

Fewer tokens hitting circulation changes the balance.

When supply tightens while demand rises, price pressure naturally builds upward.

This shift is now being priced in.

3. Commodities Trading and HIP-3 Volume Boost

Hyperliquid reported that its HIP-3 markets have hit new highs, crossing $1B in open interest and nearly $4.8B in 24-hour volume.

This shows rising activity not just in crypto, but also in commodities like gold and silver.

Since around 97% of platform fees are used for HYPE buybacks and burns, higher trading volume directly reduces circulating supply.

More volume means more token burned, and that is adding upward pressure on price.

On the 1-hour TradingView chart, price formed a triple bottom between the $27–$28 zone after its January 29 drop.

This showed buyers stepping in at the same level multiple times.

Price then moved inside a rising channel and climbed above the 50 EMA, shifting short-term momentum upward.

The breakout came with volume as HYPE cleared the key resistance near $35.

If the move continues, the next upside area sits near $40.

However, RSI is near 77, which keeps the risk of a short-term pullback alive.

A retest toward $35 remains possible.

As long as the price holds above the 50 EMA, the short-term uptrend stays intact.

HYPE was trading inside a falling channel, but price found support near $22 and started an uptrend from there.

After that, it broke out of the falling channel and also moved above the 50 EMA, which shifted momentum in favor of buyers.

Right now, price is holding above the $36 resistance area.

If a daily close comes above this level, the next upside targets to watch are $40.73, $45.25, and $50.84.

If price moves lower, the first support sits near $30.

The current rally fits well into the broader Hyperliquid Price Prediction 2026 outlook.

HYPE is rising because its growth is being driven by real platform expansion rather than pure speculation.

The launch of HIP-4, reduced token unlocks, and rising HIP-3 trading volume are working together to tighten supply while activity increases.

That combination is shifting trader behavior from short-term trades toward position building.

From a forward view, HYPE’s strength suggests the market is starting to price Hyperliquid as more than just a derivatives platform.

If platform usage continues to grow and fee-based burns remain active, upside momentum can extend further.

Short-term pullbacks are possible after sharp moves, but as long as adoption trends stay intact, the broader structure supports a positive bias into 2026.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile, and market conditions can change quickly based on macro data. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.