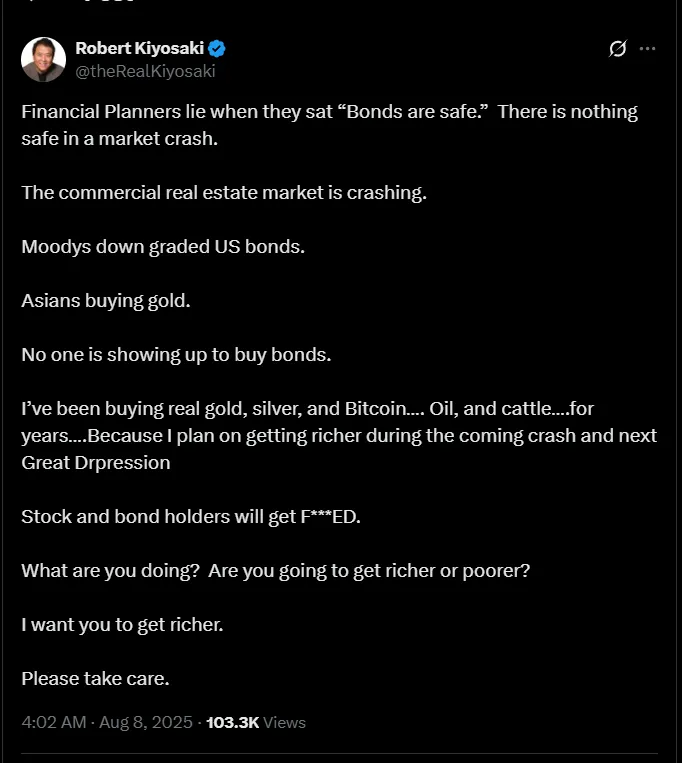

Robert Kiyosaki, the renowned author of Rich Dad Poor Dad, has issued a stark warning about the state of the global financial system. In a recent post on X, he claimed that the commonly held belief that bonds are a “safe” investment is a dangerous myth in the face of an impending market crash.

Robert criticised financial planners for misleading investors by promoting bonds as low-risk assets. He argued that “nothing is safe in a market crash” and cited several red flags in the financial landscape. Among them is the downgrade of U.S. bonds by Moody’s, a signal that even traditionally strong assets are under pressure.

“No one is showing up to buy bonds,” Robert added, suggesting a serious loss of confidence among global investors.

Source: X

According to Rich Dad Poor Dad author, the commercial real estate sector is also collapsing—an event that often signals deeper economic troubles. With real estate faltering and bonds losing credibility, the traditional pillars of a balanced portfolio seem to be cracking.

This scenario aligns with rising global uncertainty. The downgrade of the U.S. in recent years highlights the fears of the national debt position, inflation, and deteriorating economic fundamentals.

Robert Kiyosaki confessed that he has been stockpiling physical gold, silver, Bitcoin, oil, and even cattle throughout the years. He feels that these physical and decentralized assets can be used as a shelter and even a source of income in case of economic recession.

He added, citing a worldwide tendency in wealth protection, that Asians are purchasing gold. In 2025, the demand for gold in Asia, especially China and India, is expected to increase as consumers and institutions hedge against the devaluation and inflation of their currencies.

Robert Kiyosaki likened the present economic warning signs to those that occurred before the Great Depression. He encourages individuals to question their financial strategies: “Are you going to get richer or poorer?” he asked, urging his followers to act now before it’s too late.

Robert has been supporting Bitcoin and gold from very early on. He usually insists that people invest in Bitcoin, gold, and silver rather than traditional assets like stocks or bonds. According to him, these real assets are more beneficial and represent the bright future of the crypto world. In his recent tweets, he not only promotes these but also warns people about the current and upcoming market conditions.

Here’s how he has consistently predicted financial shifts:

Bitcoin Price Predictions: Robert predicted that Bitcoin could be $1 million by 2030. Despite market dips, he sees Bitcoin as a long-term opportunity for massive wealth creation.

Criticism of Fiat Currency: He says, fiat money is continuously losing its value in terms of inflation and government debt, and so real assets are a safer option.

Rich Dad Poor Dad Author on ETFs: ETFs are easy-to-access assets, but Kiyosaki cautions that they are not stable in times of financial crisis. He likens them to possessing a “pictorial representation of a gun”- something that is of no use in times of need- and encourages the ownership of physical assets.

At the culmination of his speech, Robert Kiyosaki hoped that his followers would accumulate wealth instead of losing it in the imminent financial hurricane. While his message is alarming, it serves as a reminder to investors to evaluate their portfolios carefully.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.