Financial author Robert Kiyosaki has given another bold market warning on his social media platform X (previously Twitter). He is claiming that the biggest financial crash of history is approaching fast, probably going to happen this summer. In his tweet, the Rich Dad Poor Dad author warned that the real state, stock, and bond markets may collapse. Signalling, wiping out millions of investors, particular from the older generation. While Bitcoin continues to hold its place as “digital gold,” Ethereum’s role in this shift is gaining attention.

However, Robert Kiyosaki also sees a path to wealth for those who act early. According to him, assets like gold, silver, and Bitcoin will become safe havens as panic spreads. He expects billions of dollars to flow into these alternatives in the coming months. Kiyosaki called silver the “biggest bargain” of the moment, suggesting that it could triple in value by the end of this year.

Source: Robert Kiyosaki

Bitcoin and Ethereum Mirror Gold and Silver

BTC recently hit a new all-time high of above $111,000, moving in line with the gold which was priced $3,500.05 per ounce at its all time high. These assets are considered as safe havens in uncertain situations. While silver remains 60% down from it's all-time high, ETH finds itself in the similar pattern.

Ethereum, sometimes viewed as the second most significant cryptocurrency in existence aside from Bitcoin, trades right around 50% below its all-time high. This has led to a new comparison: if Bitcoin is digital gold, ETH may be digital silver. The altcoin hit the last ATH in November 2021, at the price of $4,950, it has taken the price of $2500 as base right now, the next target for the All-time high is set at $5000.

The logic matches traditional market behavior. Silver often lags behind gold but tends to rally afterward. If this pattern holds, ETH could follow Bitcoin’s lead during the coming market shift. The present technical aspects also support this view, it will be neutral in the short run, but is considered as bullish in the long-run.

Adding to the optimism is growing talk of an incoming altcoin season, where smaller cryptocurrencies like ETH could outperform Bitcoin. Historically, this happens after Bitcoin completes a major rally and investors seek gains in other coins.

It's fundamentals also support a bullish case. At an event in Prague, Vitalik Buterin, the co-founder of Ethereum confirmed that the network is making efforts for a huge upgrade. The objective of the strategy is to scale Layer 1 by 10x over the next year. It will enhance the speed, lowering cost, and improving decentralization.

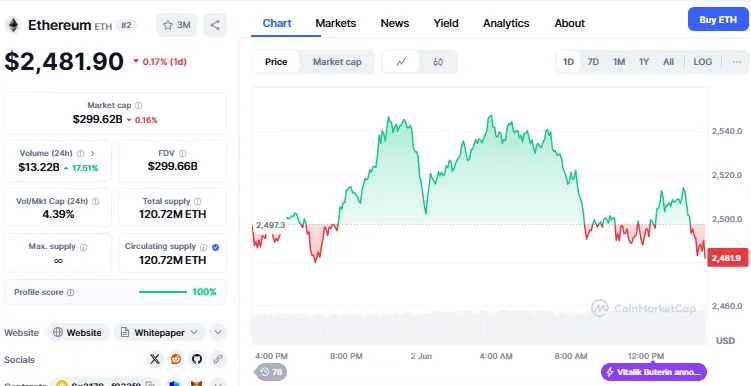

ETH is currently trading at $2481.90 with a slight decrease of 0.17% in a day and the trading volume has also increased by 17.51% as per the CoinMarketCap.

Source: CoinMarketCap

Buterin emphasized that, although the upgrade won’t happen in a blink. Appropriate time will be required to ensure the security of the network and how it remains censorship-resistant. This long-term strategy is perceived as a strong vote of confidence in the future of Ethereum.

Robert Kiyosaki’s latest market warning may stir fear, but it also reflects a larger trend: investors are preparing for a major shift toward trustworthy assets. While gold and Bitcoin are at their top, silver and Ethereum remain below all-time highs, with potential for upside.

With the technological advancements of Ethereum on the cards and growing investor attention, it might not be too long before the digital silver story materializes.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.