Robinhood Markets released its second-quarter financial reports, during which the brokerage got stronger in its long-term cryptocurrency goals. At $28 billion, the company's cryptocurrency trading volume spikes 32% year over year. In the second quarter, revenue from transaction-based cryptocurrencies increased by 98% to $160 million.

Source: X

Robinhood Q2 Results announced $46 billion in cryptocurrency trading volume and $252 million in transaction-based income connected to cryptocurrency in its first-quarter financial report.

"We delivered strong business reports in Quarter 2 driven by relentless product velocity, and we launched tokenization—which I believe is the biggest innovation our industry has seen in the past decade," said Chairman and CEO Vlad Tenev.

Source: Website

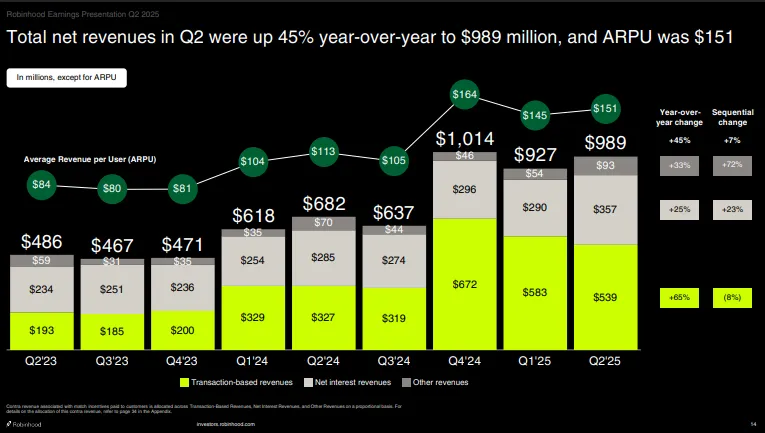

The company reported a 65% YoY increase in transaction-based revenues, a 25% YoY increase in net interest revenues, and a 33% YoY increase in other revenues. While quarterly revenue increased 45% to $989 million, Robinhood Q2 Results reported diluted earnings for the second quarter of $0.42 per share, which was double the amount reported a year earlier. MarketWatch data showed that both figures exceeded the consensus estimates.

Source: Website

Robinhood Q2 Results also had a 26.5M increase in funded customers, $279B total platform assets, $13.8B net deposits, and 3.5M RobinhoodGold subscribers.

The company has completed the acquisition of Bitstamp, expanded into 30 European countries, launched Stock Tokens, and reached $20B in Retirement Assets Under Custody. Robinhood Q2 Results shows the RobinhoodGold Card is now held by over 300,000 customers, and an agreement has been reached to acquire WonderFi.

The company's 2025 adjusted operating expenses and SBC outlook are revised to $2.15B - $2.25B, with WonderFi's acquisition expected to close in the second half of 2025, and plans for continued investment in new products and international expansion.

Source Yahoo Finance

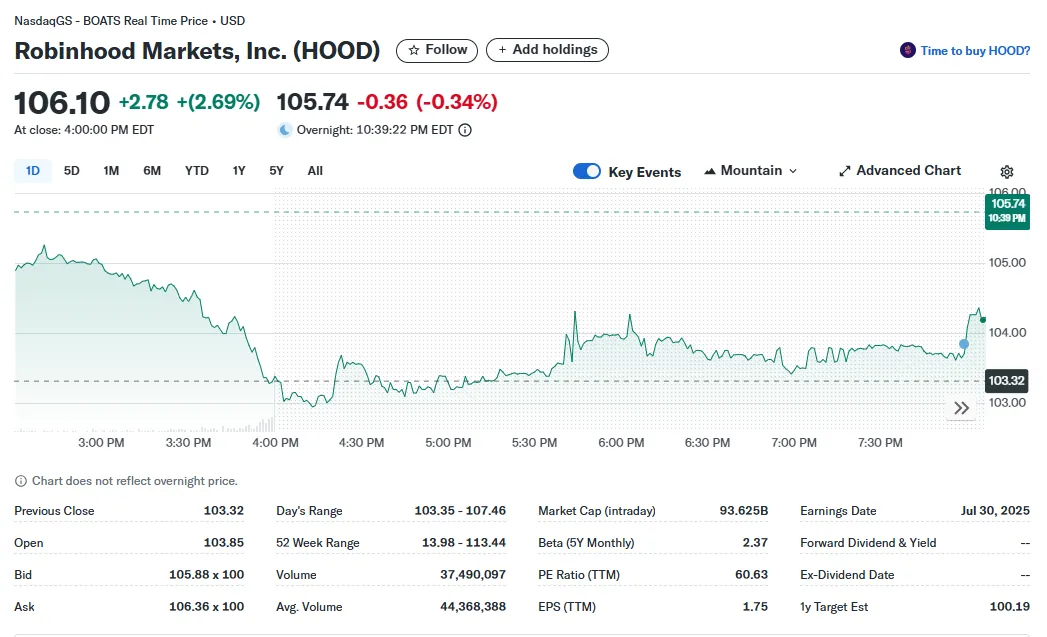

Robinhood Q2 Results reflected in the company's stock closed Wednesday's session up 2.6% at $106.10 per share, giving the company a $93 billion market cap, according to Yahoo financial price data.

CEO, Sergey Tenev, has announced that the company is focusing on tokenizing hard-to-reach alternative assets, including private shares, venture capital funds, and real estate. In Robinhood Q2 Results main focus in the US market is to tokenize these assets, which have traditionally been off-limits to retail investors due to regulatory and liquidity barriers. The company has already issued private equity tokens in Europe that resemble OpenAI and SpaceX shares, but these tokenization offerings have sparked a legal inquiry in Lithuania. OpenAI warned that its OpenAI token does not resemble actual equity in the company. The company's 25 million US users and $1 trillion in assets under custody make it difficult for others to replicate, and none of its competitors or blockchain-native firms are actively seeking this specific opportunity. The tokenization offerings have raised legal concerns, as they have already issued private equity tokens in Europe that resemble OpenAI and SpaceX shares.

Sheetal Jain is a seasoned crypto journalist, content strategist, and news writer with over three years of experience in the cryptocurrency industry. With a strong grasp of financial markets, she specializes in delivering exclusive news, in-depth research articles and expertly optimized on-page SEO content. As a Crypto Blog Writer at CoinGabbar, Sheetal meticulously analyzes blockchain technologies, cryptocurrency trends and the overall market landscape. Her ability to craft well-researched, insightful content, combined with her expertise in market analysis, positions her as a trusted voice in the crypto space.