The Christmas message from $RBLK team contained a routine offering of "Christmas wishes” along with “exciting things ahead in the New Year.” But for investors tracking Rollblock launch date Q1 2026 timelines closely, one detail stood out: the lack of a confirmed date and CEX listings.

This situation has reignited debate over the continuous delays in announcing the holiday updates, even after promising when the official RBLK presale ended.

With the presale finished and staking active and the macro trend collapsing, the question now comes: Are market conditions forcing a strategic debut shift?

Following the official closure of the presale, the steps according to the roadmap included three immediate actions:

Announcing the Q1 2026 listing date

CEX Top Listings Update

Staking platforms launching before token debut

So far, only staking has been launched. Later on, the group confirmed that the token launch will now occur in early 2026, with the final date still to be confirmed. This announcement came amid a slowdown in the overall market, and this connection is what investors are questioning now.

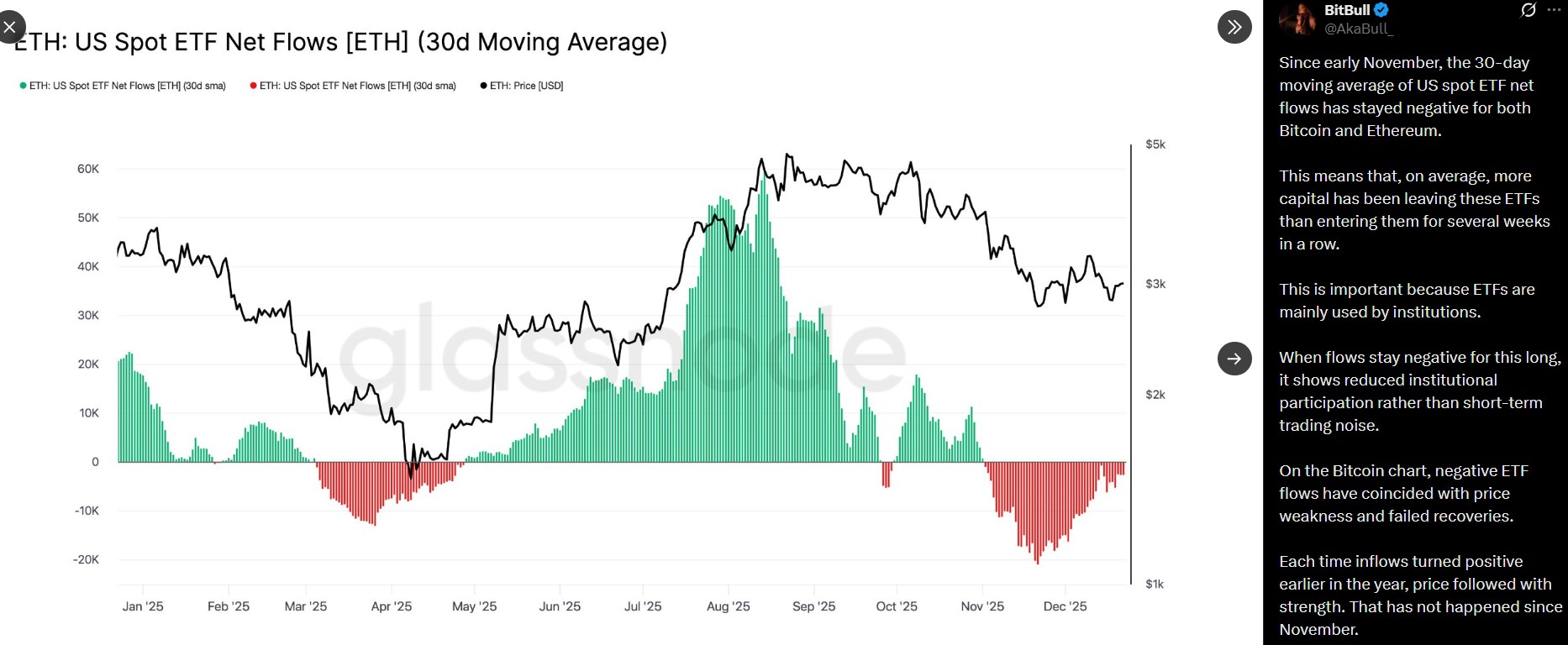

According to data cited by analyst BitBull, the 30-day moving average of US Spot ETF net flows for both Bitcoin and Ethereum have been negative since early November.

This implies that institutions are withdrawing their money from the market rather than investing. In the past, a continuous pattern of BTC ETH ETF outflows have weakened the:

BTC Price recovery signs

Lower altcoin liquidity

Disappointing debut performance for newly-listed coins

Notably, these ETF outflows started roughly around the time that Rollblock announced the presale closure and shifted its focus towards early 2026.

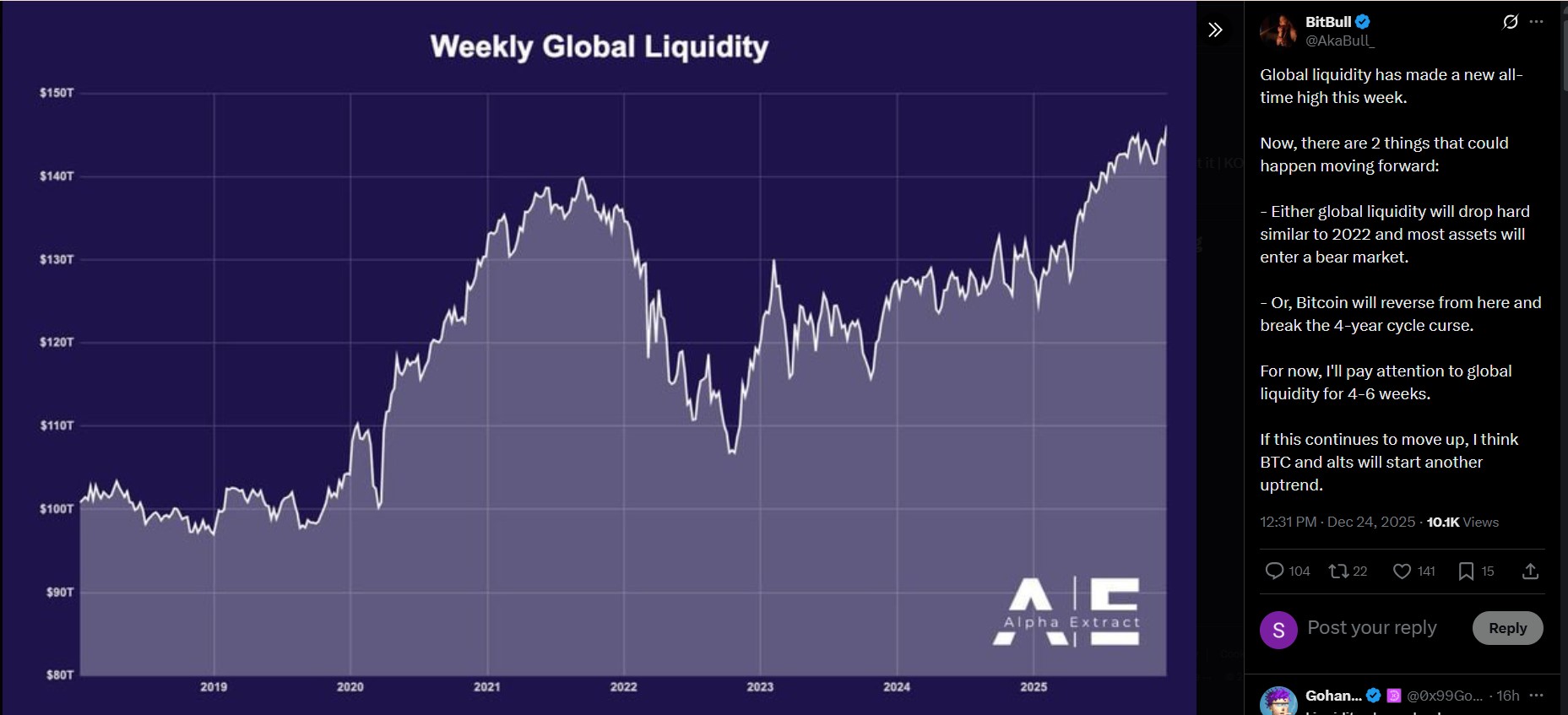

1. Global Liquidity Hits Record Highs — Bullish Signal or Hidden Trap?

The global crypto market liquidity stood at a new historic high this week. Though it may seem to be a positive trend, instances where liquidity hit ATH during past cycles have been associated with sharp reversals or funding shocks, including the one seen in 2022.

What will happen towards the end of 2025 will make a difference between whether a Rollblock Launch Date Q1 2026 is an advantage or a disadvantage.

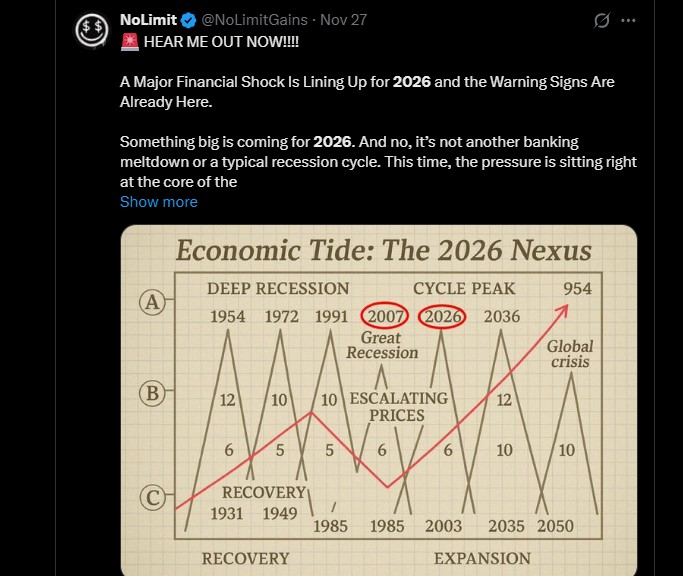

2. 2026 Macro Shock Signals Are Rising — What History Tells Us

Top Macro analyst NoLimit has pointed out that 2026 may see the onset of a global sovereign bond stress event due to the following reasons:

Bond Market Volatility (MOVE Index)

Record US Treasury issuance

Even Japan’s fragile yen carry trade may not avoid

China’s local government debt pressure

If there’s weakness during the US 10-year or 30-year Treasury auction, it could spark temporary stress within the markets fueling the new token listing downwards.

Despite macro uncertainty, project’s fundamentals remain intact:

Amount raised through Presale: $12,321,629.44

Tokens sold: 541,886,

Total supply: 1,000,000,000

Exchange allocation: 11%

Holder incentives: 11%

Chain: Ethereum

Over 8,000 casino/sportsbook games in play

This puts the token into an operational GambleFi platform, rather than a speculative one. However, As per Coingabbars analyst’s marker research, the current Rollblock listing date risk indicators suggest that the multi-exchange debut might shift to Q2 if industry sentiment doesn't improve

Bearish Scenario: If BTC and ETH Outflows continue, no institutional demand enters the industry, the price of $RBLK may range within $0.03 to $0.06.

Base Case Scenario: Considering the potential listings on top exchanges like Binance, ByBit, KuCoin, MEXC, might support a price range of $0.08.

RBLK Rollblock Price Prediction Bullish Scenario: The price may go up to $0.25-$0.40 if Rollblock launch date Q1 2026 lands under bullish market conditions.

A lack of a fixed listing date does not imply delay but rather the discipline of timing. Aligning the Rollblock Launch Date Q1 2026 with improving liquidity and institutional re-entry might lower launch-related risks.

Traders should note that the strategic debut shift remains speculation until the team confirms the same.

Investors are presently paying more attention to macro data than announcements

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency markets are highly volatile and influenced by macroeconomic conditions. Always DYOR before making any investment decisions.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.

1 month ago

Where did you see the staking of rollblock? Did not see it anywhere by my tokens.