In a landmark crypto case, Roman Storm, developer of Tornado Cash, has been found guilty of conspiracy to operate an unlicensed money transmitting business, shaking the foundations of the decentralized finance (DeFi) world.

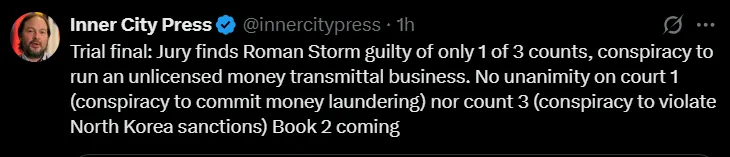

The Manhattan jury reached the partial verdict on Wednesday, but could not agree on two other charges: conspiracy to commit money laundering and conspiracy to violate U.S. sanctions tied to North Korea.

Source: Inner City Press Official X Account

The trial verdict adds a major chapter to the ongoing debate over privacy-focused crypto tools, open-source development, and government regulation. The Roman Tornado Cash saga is now being viewed as a defining moment in how crypto developers may be treated under U.S. law.

After four days of intense deliberation, the jury remained split. Judge Katherine Polk Failla issued an Allen charge—a directive urging jurors to continue in hopes of reaching consensus.

Still, they could only deliver a guilty verdict on one of the three charges in the Roman Storm case.

He was arrested in 2023, was accused of helping build Tornado Cash, a decentralized, non-custodial protocol that allows users to anonymize their crypto transactions. While prosecutors argued the protocol enabled large-scale laundering, the defense maintained it was created as a privacy-preserving tool for everyday users.

Federal prosecutors have not yet confirmed if they’ll seek a retrial on the unresolved charges, but they’ve asked that Storm be held in custody, citing his alleged ties to Russia as a flight risk.

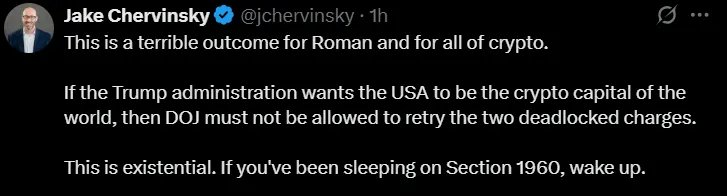

Prominent crypto lawyer Jake Chervinsky reacted strongly, stating that Section 1960—which Storm was convicted under—“should not apply to developers who don’t control user funds.” He called the verdict a “terrible result, and all of crypto.”

This trial could set a dangerous precedent, he warned, if software developers are held criminally responsible for open-source code that others use.

The Roman Storm Tornado Cash verdict is already being seen as a flashpoint for the DeFi world. The government cited Cash’s alleged role in $7 billion in laundered funds, including transactions from North Korea’s Lazarus Group, but many analysts argue the data lacks context.

The defense also pushed back against key witness claims—like a woman who said she lost $250,000 through a scam involving Tornado—calling the evidence weak and misleading.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.