Just a day after its highly anticipated launch on major exchanges including Binance, KuCoin, OKX, and others, the Sahara AI coin crash stunned investors by collapsing nearly 75%.

The token is now trading at $0.08692, wiping out millions in market cap which is down 72.28% to $177.33 million. This sudden collapse has shocked investors and raised pressing questions: is this a rug pull, a predictable post-airdrop dump—or a golden entry point? Let’s break it down.

Source: CoinMarketCap

1. Massive Profit-Taking Post-Listing

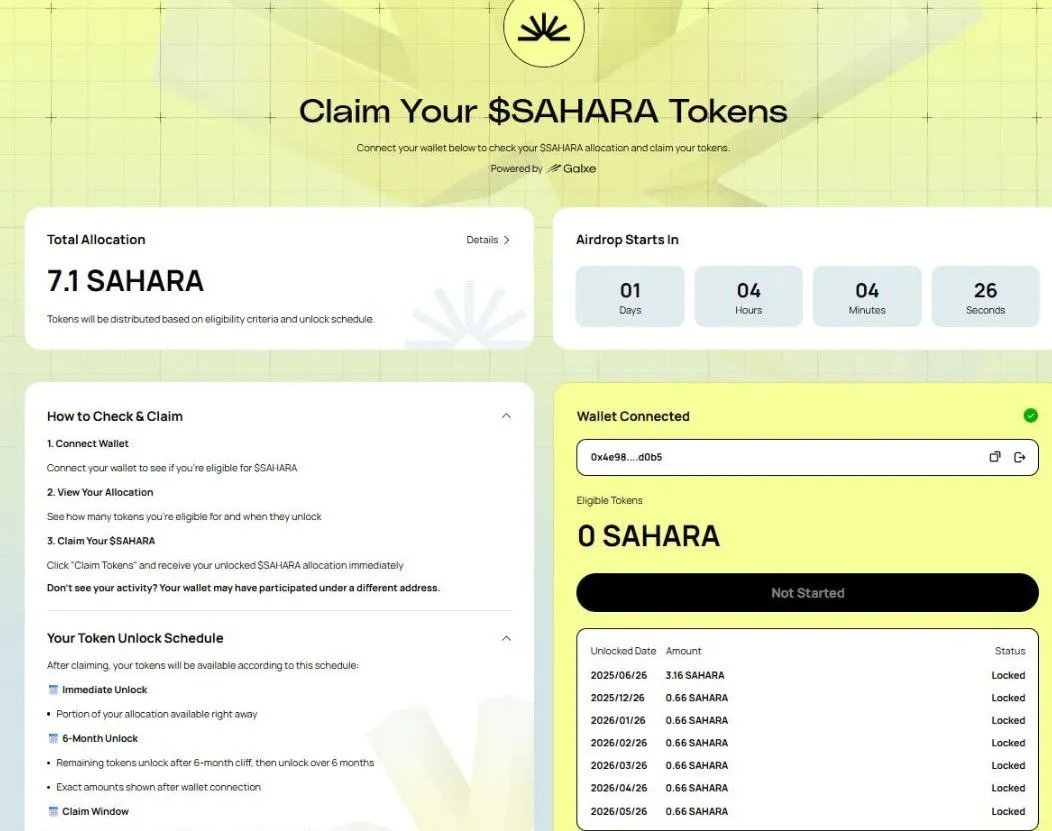

Early claimants and seed investors offloaded tokens quickly, overwhelming the buy side. The Sahara AI airdrop lacked strong vesting, accelerating the fall.

Source: X

2. Token Unlock Chaos

The post-TGE (Token Generation Event) phase unlocked a significant portion of supply, giving early wallets the opportunity to sell. Without proper vesting, this usually leads to chaos.

3. Overvaluation & Hype

Showed as the “first AI-native blockchain,” it may have entered the market at an inflated valuation. When reality didn’t match expectations, the price collapsed.

Source: TradingView

From TradingView’s 5-minute OKX chart:

Price: $0.089

MACD: Bearish crossover suggests momentum is slipping

RSI: Dropped from above 70, now at 62

Volume: Weak—buyers seem exhausted

Support Range: $0.065 – $0.075

Resistance: $0.11 – $0.115

As per my analysis being a crypto writer, Buyers are trying to defend the ₹0.085-₹0.089 zone, but volume is not supporting a recovery. Momentum is fading.

Short Term (1–3 Days): $0.065 – $0.075

Current price momentum suggests more downside. Unless a surprise catalyst appears, Sahara crypto price target could slip to its lower support band.

Mid Term (1–2 Weeks): $0.090 – $0.115

In the next week or two, once the initial dump stabilizes and if early sellers are flushed out, market sentiment may begin to recover. Crossing $0.09 would hint at returning interest, but ₹0.115 will be the true resistance to flip for upward continuation.

Long Term (1–3 Months): Bullish and Bearish

The long term forecast depends on execution. If the team rolls out features like AI utility, governance, or token burns, it may recover toward ₹0.15–₹0.18 is very possible.

However, if momentum dies out it could bleed slowly back toward ₹0.05—a level where only speculative traders or die-hard holders remain.

Crypto insight firm HC Capital remains bullish on tokenomics, tweeting:

“The crypto just listed — but its biggest edge isn’t price action. It's a token design.”

Source: HC Capital X Account

The platform converts real-world AI activity into onchain value—a model many tokens lack. This innovative structure may help it regain ground. His tweet ultimately indicates that this token is a good investment in the long term.

The cryptocurrnecy might be facing its “now or never” moment. The crash is severe, but not uncommon in crypto—especially after large airdrops. This pain not only produced fear but it also produced opportunity. Smart money will be looking for either a complete flush to ₹0.065—or on the other hand, large reversal volume.

As speculators watch for signs of reversal or total capitulation, Sahara AI coin price prediction remains a top search topic. Whether this becomes a failed launch or an epic comeback depends on execution, community strength, and upcoming announcements.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.