Sahara AI surge stunned the crypto community this week by leaping more than 50% in only 24 hours. The unexpected rally followed its new Artificial Intelligence data-labeling platform release and a powerful vote of support from Binance.

With Artificial Intelligence tokens picking up pace throughout the market, the Sahara AI surge has fueled renewed interest among traders seeking true utility and new momentum.

The largest catalyst for the Sahara AI surge was the rollout of its Data Services Platform (DSP) on July 22.

The platform allows individuals to earn these tokens through the accomplishment of Automated tasks such as image tagging or audio transcribing.

In an effort to recruit participants, the team implemented a $450,000 reward pool.

Source: X (Twitter)

The launch generated a huge interest surge. Within a single day, SAHARA's Trading volume increased over 2,600%, to $2.5 billion.

This indicates individuals weren't curious; they were willing to put their money in, either for the utility of the platform or short-term gain.

Another major reason behind the Sahara AI surge is removal of the “Seed Tag” by Binance on July 21. This tag often warns investors of high-risk tokens.

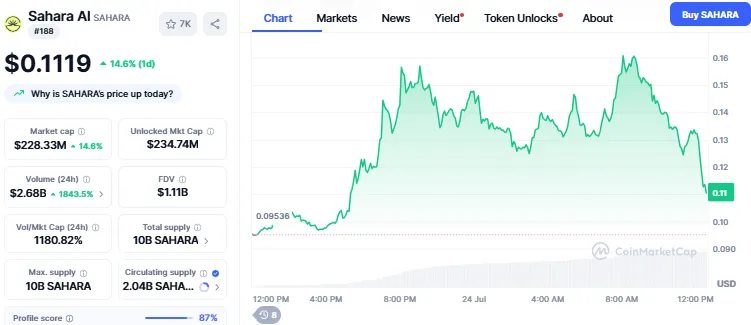

Now, the market viewed this cryptocurrency as more stable and trustworthy. It also motivated the institutional traders that had been reserved previously. The coin is now trading at $0.1119.

Source: CoinMarketCap

Amazon’s recent AI agent marketplace launch has added fuel to the fire. With its decentralized Web3 model, it offers something different from centralized giants and it contributed to the momentum growth.

Notwithstanding the substantial rally, there might be short-term challenges in the Sahara AI surge. These tokens will also be unlocked on July 26, approximately 84 million worth about $6.9 million.

This may put pressure on the people to sell due to the entry of more tokens.

Investor sentiment is currently positive, and it is owing to the roadmap the team presented and the mainnet launch that is tentatively scheduled to take place during Q3 2025.

Short Term

The 14-day RSI at 82.76, the token appears overbought. Which makes it vulnerable to a short-term correction.

Support Level: $0.12

Immediate Resistance: $0.15 (historical and psychological barrier)

7-day SMA: $0.0916 (depicts how far price is from average)

Looking at this scenario, if bullish momentum continues and the July 26 unlock does not trigger massive selling, it could test $0.16–$0.18 in the short term.

On the other hand, If sellers dominate post-unlock, the price may go toward $0.11–$0.12 before finding new support.

Long Term

If the mainnet launch in Q3 2025 goes smoothly and the Artificial Intelligence platform sees real growth, it could aim for a price between $0.60 and $1.10 by 2026.

Base case (realistic): $0.45 - $0.60 by middle of 2026

Bull case: $0.80 - $1.10, in case of strong partnership and user growth.

Bear case: $0.08 - $0.12, in case of selling pressure after unlock and adoption slows down.

The Sahara AI surge is an example of what can go on once there is true utility and a growing interest in the sector.

On a working platform, favorable changes in high-quality posts, and artificial intelligence hype, the attention of the audience is towards this coin.

Although the token unlock and technical oversold indicators are a short-term threat, the long-term success will be determined by implementation and adoption.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.

6 months ago

🙃🙃🙃🙃🙃🙃