MicroStrategy Bitcoin news is back in the headlines today with a bold Strategy Bitcoin Purchase. The company recently bought 430 BTC for about $51.4 million, paying around $119,666 per coin, according to Michael Saylor latest X post.

With this purchase, the company now holds 629,376 tokens, worth about $46.15 billion, at an average price of $73,320 per coin.

Big buys like this show strong interest from institutions and have started discussions in the crypto world about how it might affect the $BTC price chart analysis and the overall market.

MicroStrategy’s official X account also updated its MSTR Equity ATM Guidance, giving the company more flexibility in its financial strategies.

For investors, big purchases like this are more than numbers—they act as psychological support. Buying above the current market price of $115,441 shows confidence in the cryptocurrency’s future.

Analysts say this can create:

Support at : $112,000 → $108,000

Resistance around: $118,000 → $120,000 → $124,000

This helps both small investors and institutions feel more confident. It may also prevent sudden drops, influencing Bitcoin price consolidation sell off patterns.

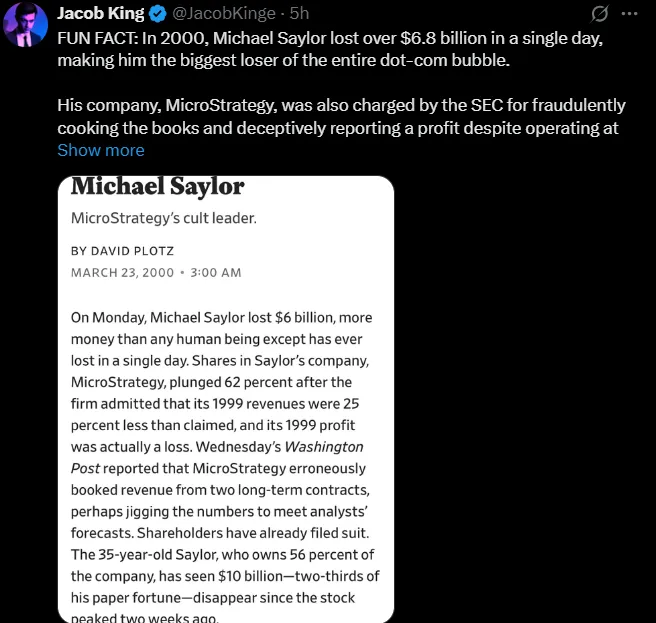

Financial analyst Jacob King reminded followers on X that in 2000, Saylor lost over $6.8 billion in one day during the dot-com crash. Strategy also faced SEC charges for reporting misleading profits, but Saylor settled quietly and got support from foreign investors.

This shows that even big currency advocates like Saylor know how to handle risky financial situations. While today's buy looks positive, investors should remain aware of possible market ups and downs.

Experts point out these key signals for $BTC future price actions:

RSI 46 → weak buying momentum.

MACD → signals caution.

Price Action → BTC price crash today faced resistance near $120,000 and is now testing support levels.

Short-term: The token may trade between $112,000–$120,000. Falling below $112,000 could take it to $108,000, while breaking $120K could reach $124K.

Medium-to-long-term: Institutional buying like Saylor bitcoin news today may push the price to $135K–$150K by year-end, though any negative news could cause a crash toward $100K.

Psychological Boost: This Purchase shows strong institutional demand, which makes investors more confident. Buying at $119,666, above the current $115,441 price, signals that the company is bullish on currency long-term.

Volatility and Market Sentiment: Large purchases like this are often OTC or pre-announced, so they may not push prices up immediately.

MicroStrategy continues to lead as a corporate $BTC whale, and every purchase gets attention. This latest Strategy Bitcoin Purchase shows strong institutional belief in the cryptocurrency.

Investors should watch key support zones to know whether price breakout or crash further in the upcoming days .

While short-term ups and downs are normal, the long-term story remains bullish. Saylor’s history shows that even big moves need patience and careful watching.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.