In a major crypto milestone, Saylor and BlackRock Bitcoin Holdings now stand at 1,297,325 BTC, worth over $140.8 billion. That is estimated around 6.18% of the total supply of currency. It is signalling how much influence these two giants now have on the crypto market.

Source: X (previously Twitter)

He has become boldest believer of BTC. He predicts the coin could hit $21 million per BTC by 2046.

In a Tweet he said: "I'm going to be buying the top forever."

In Another Previous tweet: “BTC is money. Everything else is credit.”

His company, Strategy, (previously microstrategy) added 131,000 coins in Q2 alone, an 18% increase. Clearly, Saylor and BlackRock Bitcoin Holdings aren’t slowing down anytime soon.

As of now, he owns a total of 597,325 coins worth $64.95 Billion according to his portfolio tracker.

Source: Michael Saylor Portfolio Tracker

On the institutional side, BlackRock’s (IBIT) now holds more than 700,000 BTC, making it the most successful ETF launch in the history of the US. Since January 2024, it has returned 82.67%, pulling in more gains than even the S&P 500 ETF fund.

IBIT accounts for over 55% of this whole digital asset's held by U.S. spot ETFs and now generates more revenue than BlackRock’s flagship S&P 500 fund, further proving crypto's growing role in traditional finance.

In 2025 so far, Saylor and BlackRock Bitcoin Holdings have bought more coins than miners have produced. Together, Strategy and U.S. BTC ETFs acquired $28.22 billion worth of this crypto, while miners created only $7.85 billion.

Only in February did they slightly scale back, selling $842 million in this digital asset. The rest of the year has seen relentless accumulation, causing concern about limited future supply.

As these accumulations grow, the big question arises: Will Saylor and BlackRock Bitcoin Holdings dominate the market?

By owning such a large share and continuing to outpace mining, they may end up controlling a key piece of future of this digital asset, including its price direction. Many now believe they could trigger the next major bull run.

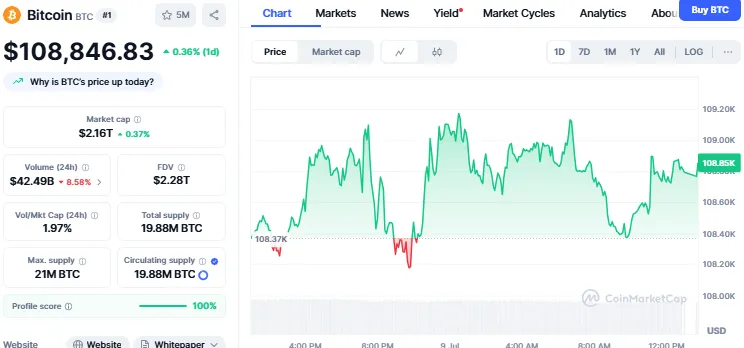

The currency price now is trading at $108.768 with an increase of 0.22% in the last 24 hours.

Source: CoinMarketCap

Others wonder if this level of control thorugh Saylor and Blackrock Bitcoin Holdings challenges concept of decentralization of cryptocurrency. Still, for long-term investors, their confidence in this digital currency may signal long-term price strength.

With his bold predictions and non-stop buying, many now see Michael as more than a corporate leader, some even call him the next Satoshi. Not because he created this cryptocurrency, but because he’s preserving its legacy through Saylor and Blackrock Bitcoin Holdings.

More companies are following this lead:

July 7: Semler Scientific holds 4,636 BTC with 29% YTD yield

July 7: Metaplanet Bought another 2205 of this crypto

July 8: Sequans launched a treasury plan after a $384M investment

Figma revealed $69.5M in this cryptocurrency in its IPO filing

54 firms recently acquired 8,400 coins

12 more announced BTC plans, including gold and AI companies

Even firms like Amber International and DV8 are preparing treasury strategies around this biggest cryptocurrency.

Following is the list of Top Public Holders:

Source: Bitcoin Treasuries Net

From tech to finance, companies are shifting from fiat reserves to Crypto. The rise of Saylor and BlackRock Bitcoin Holding has clearly inspired this trend, turning this asset into more than an investment.

It’s becoming the heart of corporate balance sheets and a potential standard for storing value in the digital age.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.

3 months ago

good