The largest cryptocurrnecy just touched $108,000 today, but experts say it's still undervalued. In the latest update, BlackRock’s BTC ETF now holds over 700,000 coins.

With chart signals flashing and history repeating, analysts expect a Bitcoin price prediction breakout to $130,000 soon. This could be the last chance to buy before the next major surge. Here's why today’s price might actually be a bargain before liftoff.

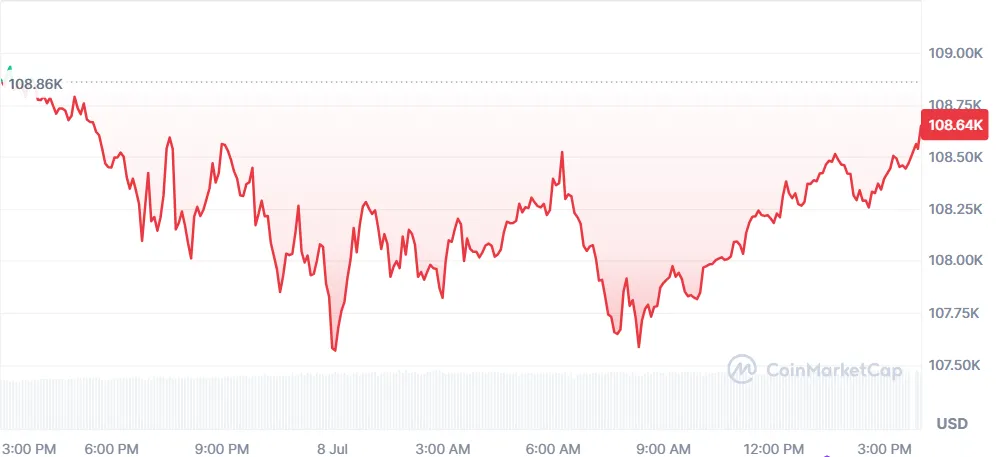

According to CoinMarketCap chart data, it is trading around $108,000, but analysts say the real breakout hasn't even started yet.

If you're wondering why it is surging today, the answer lies in a combination of technical signals, institutional demand, and market cycle positioning.

Experts across the crypto industry are now aligning behind one strong thesis: Bitcoin undervalued today, and the next major leg up could send it toward $130,000.

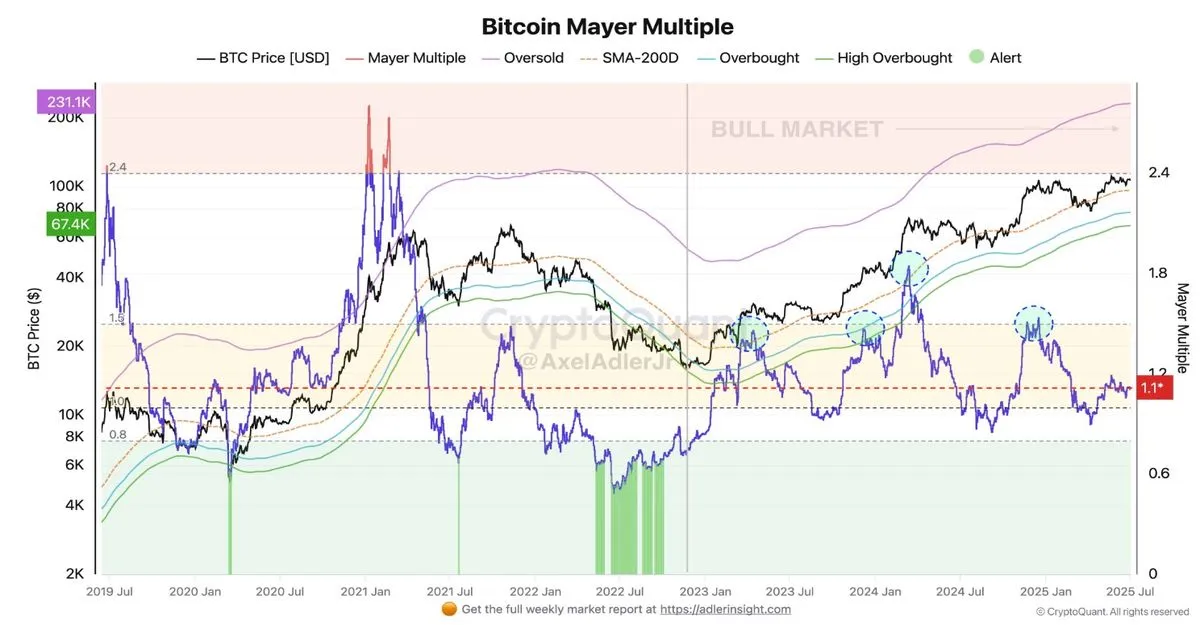

At first, $108,000 might look expensive, but according to the Coin Bureau’s Mayer Multiple tool, the token is still in the safe zone.

As seen in the chart below, this tool compares BTC’s price to its 200-day average, and right now it’s just at 1.1x—far below the 1.5x level where things usually get overheated. That’s why many experts believe it is undervalued today.

On the technical side, this largest cryptocurrency is flashing signs of a massive move.

1. Analysts like Mister Crypto have identified a rare Bollinger Band squeeze, a setup historically known to reflect explosive rallies.

Source: Mister Crypto X Account

The last time volatility compressed like this — in December 2022, October 2023, and late 2024 — It surged 80% to 160% afterward.

Now, with the Bollinger Band width at similar lows, many expect another vertical move, backing the ongoing price prediction breakout narrative.

2. Overlaying this with the Wyckoff Expansion Phase, it seems to be in Wave 3 of a five-wave bull cycle. That structure forecasts:

Source: X

Wave 3 peak: $128,000–$130,000

Wave 4 pullback: $118,000–$120,000

Wave 5 target: $132,000–$136,000

This matches the current price analysis today, offering a structured roadmap to that $130,000 target.

But it’s not just charts pushing the currency up. According to the latest BlackRock news today, their iShares Bitcoin ETF now holds over 700,000 coins — that’s more than 3.5% of all coins in circulation.

This huge buying spree is creating a supply shock, and many say it's why BTC is surging today. As per my analysis, even more critical is the BlackRock Bitcoin ETF revenue impact. As ETF buying continues, it reduces market liquidity and drives prices higher — further supporting the btc $130K prediction that analysts are highlighting this quarter.

So where does all this leave us? With the coin hovering around $108,000, on-chain indicators, technical patterns, and institutional momentum from the BlackRock ETF all point to one direction: up.

Top analysts say if Bitcoin closes above $110,000 this week, it could trigger the long-awaited bitcoin price prediction breakout to $130K or more—possibly even this month.

Whether you're trading or just watching, this could be the start of its next historic run, so keep a close eye on the latest news, and always do your own research and analysis before investing in the crypto market.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.