A recent moment between two well-known crypto leaders has caught everyone’s attention. Tyler Winklevoss, co-founder of Gemini, posted on social media X (previously Twitter) that he personally handed over a Gemini Credit Card to Michael Saylor, the Executive Chairman of MicroStrategy and one of the biggest supporters of digital assets. Tyler said that they gave Saylor the “whale limit” because, well, he’s more than good for it.

Reply by Michael Saylor to it was: “Bitcoin is money. Everything else is credit.”

Source: Michael Saylor

While that may sound like a short and clever quote, it reflects a growing belief — one that’s starting to reshape how people think about the future of finance.

This move by Gemini isn’t just a story about a new payment card. It is a signal of a much bigger movement. The involvement by Michael Saylor takes things to another level. His company holds over 580,250 units of this digital asset, worth $63,264,448,610. His words carry weight, and when he publicly accepts this kind of product, it shows his faith isn’t just for holding, Saylor sees it as usable money.

Online, the community responded quickly. One user predicted that his company, Strategy previously (microstrategy), might even issue its own payment product within five years. Others praised the idea as “the future of money and banking.” These reactions were not just hype, they reflect real expectations about where this space is heading.

Major companies are joining the movement.

Michael Saylor’s MicroStrategy has been one of the largest corporate buyers of Bitcoin for years. He recently acquired 4020 BTC from the last purchase.

Semler Scientific added 455 coins to its balance sheet, making the total number of coins to 4264.

Investment giant BlackRock also confirmed it had recently purchased Bitcoin on May 23, total holdings becoming 655,570.

If the U.S. joins corporations like Strategy owned by Saylor and investment firms like BlackRock in holding reserves, demand could rise. It would reduce the supply in the open market, which could result in driving the prices higher.

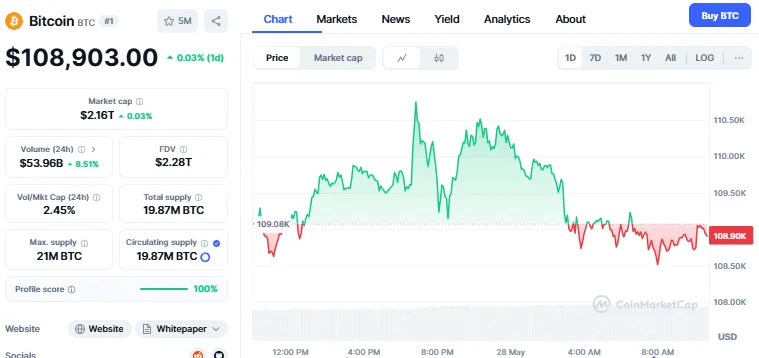

Investor and author Robert Kiyosaki, known for Rich Dad Poor Dad, has also made bold predictions. He believes Bitcoin could hit $500,000 by 2025. The statements from crypto enthusiasts are coming after the currency hit its all time high at approximately $111,000. Governments are backing it, major corporations are showing interest by purchasing BTC, and robust institutional investors are leaning towards it, Bitcoin's future looking bright. As of writing, the currency is trading at $108,903.00, with a 0.03% increase within a day and 1.28% increase within a week. Trading volume has increased by 8.51% within the last 24 hours as per the CoinMarketCap.

Source: CoinMarketCap

And then there's the BITCOIN Act, a piece of legislation that would enable the U.S. government to technically hold reserves. President Donald Trump has already expressed willingness to support it, and since there's already a team in place working on the specifics, it's no longer empty talk. Making things even more exciting is the news that the U.S. government could start buying large quantities of Bitcoin soon. That would drive demand higher and lower the supply in the open market, which could drive prices even higher.

Events like new card by Gemini given to Saylor may not seem significant, but they’re part of a larger cultural shift. These aren't just signs of adoption, they're proof of growing trust in the digital currency, something many once doubted.

With major leaders using it, top investors calling it the future, and companies reshaping how they think about value, the crypto market could be stepping into a new financial era. And if that happens, it won’t just be about buying and selling. It’ll be about how people think, spend, and save in a very dynamic crypto world.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.