The U.S. SEC has delayed its decisions on two other crypto ETFs, Spot Avalanche (AVAX) ETF filed by VanEck and Spot Hedera (HBAR) ETF filed by Grayscale. This step contributes more uncertainty to the crypto market as investors are eager and waiting for clear signs from regulatory authorities about the future of crypto-based exchange-traded funds.

A popular asset management firm had applied for a Spot Avalanche ETF in March 2025. The objective of this crypto product is to allow people to invest in Avalanche (AVAX) through conventional stock markets. It does not require you to purchase the crypto directly. It would have been listed on Nasdaq, giving it big visibility in the financial landscape.

Although, the SEC stated that it would not come to a final decision until July 15, 2025. This delay came after the similar Spot Avalanche ETF filed by Grayscale. It depicts that the commission is being cautious when it comes to crypto products for investments.

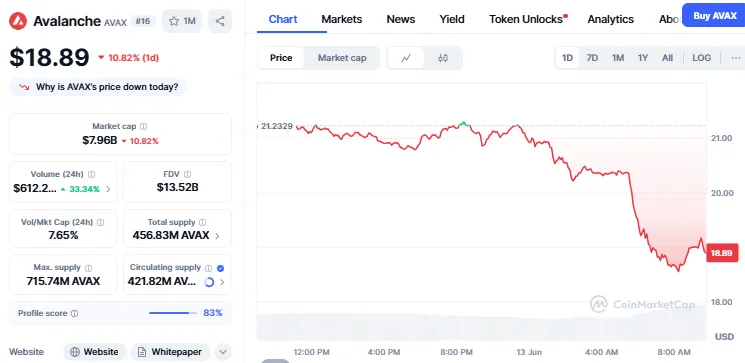

After this announcement of the delay, the price of AVAX dropped 10.82%, falling to $18.89. Trading volume has also increased by 33.34% within the last 24 hours as per the CoinMarketCap. This depicts how vulnerable crypto prices are to news about ETFs approvals, as investors were hoping that the launch of a new investment product would bring in more trust and confidence to Avalanche.

Source: CoinMarketCap

In a second blow to the market, the SEC also decided to delay its decision on Grayscale’s Spot Hedera (HBAR) Exchange Traded Funds. This application is still under review, and instead of giving an approval or rejection, the SEC has chosen to start a public comment period. This allows people and experts to submit their views on whether a Hedera investment product is suitable or risky. After this delay the prices have decreased by 9.32% going to $0.1542, while trading volume has increased by 58%.

The agency now takes time until November 11, 2025, to come up with a final decision. The same delay happened earlier this week with the Hedera ETF by Canary, suggesting that regulators are not yet ready to approve any Exchange Traded Funds tied to Hedera.

The SEC explained that asking for comments does not mean they’ve made up their mind. The commission is just using more time to understand the proposal and gather opinions before making a final verdict.

Despite the consecutive delays, market experts remain optimistic. According to Bloomberg Intelligence data, there is an 80% probability of the Grayscale Hedera approval during the later part of 2025. Solana and Litecoin ETFs also have a 90% probability of approval, according to analysts.

Others even anticipate a stampede of altcoin ETFs approvals by the end of the year. Bloomberg analyst Eric Balchunas said it as a potential "altcoin ETF summer," as Solana likely to get the first approval from all the Altcoins.

The SEC's consecutive delays have rattled investor optimism, yet optimism is high for 2025. All bets are that ETFs listings are just a matter of time, with Solana and the rest set to be at the forefront. In the meantime, the crypto community awaits and hopes for that green signal from the commission.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.