In a huge step that could reshape crypto regulations in the United States, the U.S. SEC has finally dropped its lawsuit against Binance U.S., Binance, and the cofounder Changpeng Zhao. After about three years of legal conflicts and uncertainty, both the parties the SEC and Binance have agreed to end the case via a joint filing in a U.S. federal court on May 29, 2025.

This decision marks a major shift in how the U.S. government is treating cryptocurrency business organisations. Under the new leadership of SEC Chair Paul Atkins, the Commission has started backing away from aggressive legal actions that defined the Gary Gensler era.

The SEC started the case in 2023 by accusing the exchange of helping users trade cryptocurrencies such as Solana (SOL), Cardano (ADA) and Filecoin (FIL), without proper registration. The commission also said it was using customers’ money without authorization and deliberately changing trading numbers.

With the passage of several years and many negotiations, the SEC has finally dismissed the case on the grounds that it cannot be refiled. So, the case cannot be investigated or appealed after this decision. The platform quickly celebrated the news, calling it a “huge win for crypto” on X (formerly Twitter). CZ also confirmed the end of the long legal battle, thanking the new SEC leadership for their balanced approach.

This move by the agency signals a sharp change in direction. Paul Atkins, who took over as SEC Chair earlier this year, is known for his pro-innovation stance. Since taking charge, several high-profile cases against crypto firms, like Coinbase, Gemini, Kraken,and Robinhood, have also been dropped.

Atkins has openly said he wants to make the U.S. a global leader in crypto and web3 innovation. The exchange acknowledged this change, by taking it to the social media X (previously twitter), that they are thankful to the Chairman Paul Atkins and the Trump administration.

Source: Binance

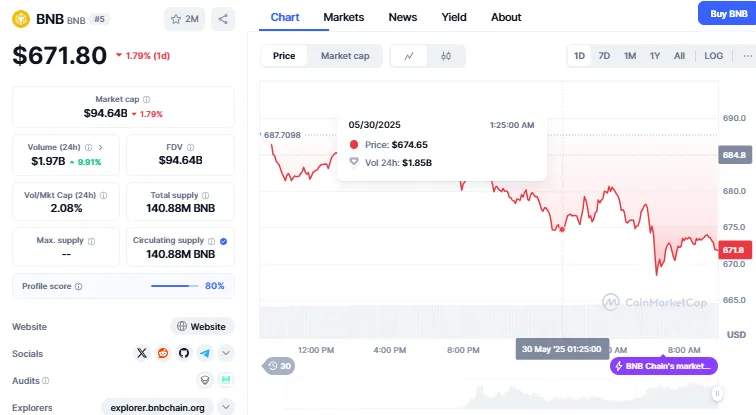

The news had an immediate impact on BNB, native crypto of the platform. Analysts observed that BNB has been forming a bullish continuation pattern in recent weeks. The dismissal of this case could push the token into a strong rally. It is also possible to enter price discovery mode if momentum continues. After this announcement the BNB experienced a slight upward movement in the price. As of writing the currency is trading at $671.80 with a decrease of 1.79% from the last day. The trading volume has increased by 9.91% as per the CoinMarketCap.

Source: CoinMarketCap

Source: CoinMarketCap

This development brings huge peace relief to anyone who uses this exchange. BNB and Binance were both affected by the case. As the case ends, the platform is able to focus entirely on introducing updates such as the live trading feature introduced in 2022.

Treating the case as meaningless for Binance is good news for the entire cryptocurrency community. This decision here signals a change in how Washington views digital currencies. It suggests that lawsuits will be dropped or made fewer and will help clarify future guidelines.

This makes investors feel safer, modernizes the market and encourages positivity. In addition, it could open doors for ETFs and better financial services for businesses involved in crypto.

Basically, the end of the Binance lawsuit could be the moment that crypto in the U.S. begins new chapters of growth, not more lawsuits.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.