In a striking new sec memecoin statement, U.S. SEC Commissioner Hester Peirce confirmed that meme coins, including the controversial $TRUMP token, won’t receive protection from the country’s top securities regulator. This move marks a clear shift in Washington’s stance, especially as former President Donald deepens his involvement in crypto.

Speaking at Bitcoin conference 2025 in Las Vegas, Peirce said the U.S Security and Exhcange Commission has stepped away from regulating these coins altogether. “If you're expecting any protection on these assets, you're mistaken,” she noted—adding that this is the time for personal responsibility, not legal safety nets.

Since its launch in January, the token skyrocketed to a $15 billion market cap—driven largely by its online endorsements and a flood of new buyers. But the rally was short-lived. Within days, the token lost most of its value, signaling what many now call a major $TRUMP token crash.

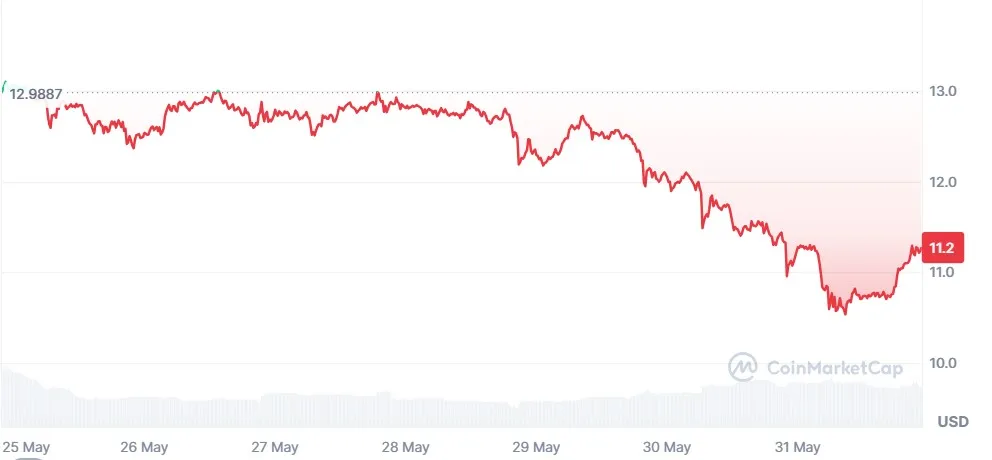

Source: CoinMarketCap

As of today, its price is $11.26, down 14.10% over the past 7 days. Market cap stands at $2.25 billion, and 24-hour trading volume has slipped by 13.09% to $667.78 million, according to CoinMarketCap. That’s a steep fall, reflecting the growing fear of another meme coin crash.

Peirce’s recent Hester Peirce sec statement drew comparisons to the 2021 NFT boom. NFTs weren’t regulated as securities either, but prices fluctuated wildly based on hype.

In her statement, Peirce made it clear: “You can package anything as a securities transaction. But meme coins? Don’t count on the us to save you.”

She also acknowledged that the commission missed its chance to provide clarity during previous crypto surges—and doesn’t intend to repeat that mistake by pretending to protect what it won’t.

Critics say Trump deepening ties to crypto—including the its own organization allegedly holding 80% of the token supply—raise red flags. Democratic lawmakers worry this could serve as a backdoor for foreign influence or corporate lobbying.

Meanwhile, Binance founder Changpeng Zhao, once targeted by this commission, had his lawsuit dismissed just this week. His company’s new USD1 stablecoin reportedly benefits Trump-aligned groups—adding fuel to the debate over SEC meme coin regulation.

Yet Peirce stood firm that these outcomes weren’t politically motivated. In her words, this memecoin statement was about setting realistic expectations, not targeting individuals or tokens.

This article is part of the broader sec meme coin news now dominating headlines. This approach confirms that “sec meme coins not security” is not just a policy—it’s a reality.

For investors, especially those watching the $TRUMP price today, this serves as a warning. Without regulation, projects can collect fees while buyers carry all the risk. As always, do your own trump token analysis before putting money into speculative assets.

With the U.S. Securities and Exchange Commission officially stepping aside, the market is now on its own. This latest sec memecoin statement isn’t just a legal clarification—it’s a wake-up call. In a world of meme coins, the risks are real, and the protections are gone.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.