The gaming company has amended its sales agreement with A.G.P. Alliance Global Partners to fund up to $5 billion. The money will be used to acquire Ether and fund the company's continued activities. SharpLink Ethereum investment decision to boost the offering from $1 billion to $6 billion is part of a larger effort to invest aggressively in ETH. The corporation has already established a treasury and intends to increase its holdings further. This massive purchase between July 7-13 makes them the biggest corporate ETH whale

Source : X

Source: X

On May 30, 2025, SharpLink Gaming entered into an ATM Sales Agreement with A.G.P./Alliance Global Partners to sell up to $1 billion in common stock shares. On July 17, 2025, the agreement was amended to increase the offering to $6B and include forward sale provisions. The company is seeking stockholder approval to increase authorized stock, which is crucial for utilizing the ATM Offering, as it currently cannot issue more than 48,058 shares. The amendment impacts the company’s ability to raise capital and potentially affects the company's market positioning. The organisation is currently seeking stockholder approval to increase authorized stock at a meeting scheduled for July 24, 2025.

SharpLink Gaming has amended its rules to allow the company to sell shares of the common stock through the ATM Offering, with A.G.P./Alliance Global Partners receiving a commission of 2.5% for the first $1 billion of shares sold and 2.0% for stock sold beyond that amount. The commission rate for sales under the Forward Sales Agreements will be 4.0%. The company can enter into one or more Forward Sale Agreements with A.G.P./Alliance Global Partners, acting as Forward Purchaser, Forward Seller, or Sales Agent, with settlement expected within two years. The company retains the option to settle these agreements in cash or shares and may terminate or settle early under certain conditions.

Source : intel.arkm.com

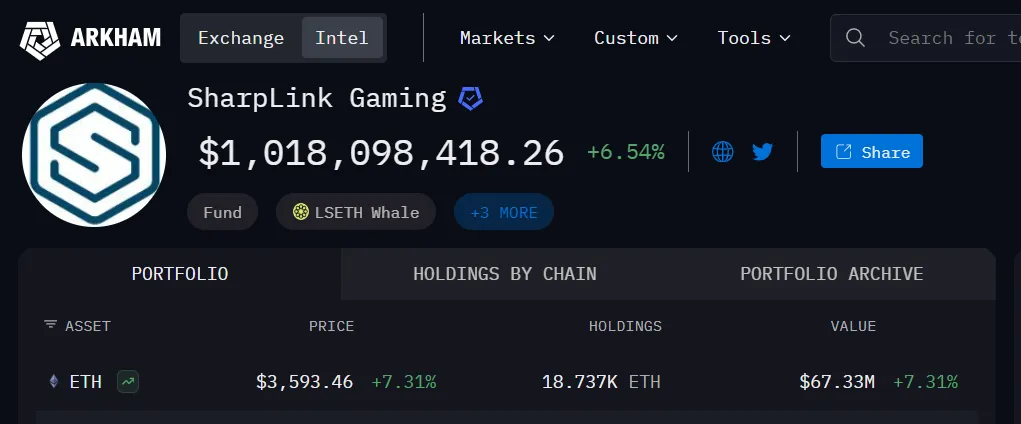

According to Arkham data the company's total holding is 18.737K with a valuation of $67.33M. The company stated that it will use "substantially all" of the proceeds from the offering to purchase ETH. SharpLink Ethereum investment has been focused on expanding its treasury strategy, which began in June.

Source : Yahoo Finance

The company, currently valued at $3.31 billion, has seen its shares demonstrate significant volatility, with the stock price reaching $36.40 in recent trading. The amendment also introduces the option for forward sales of shares through Master Forward Confirmation Letter Agreements. SharpLink Ethereum investment decision to make a significant in line with its larger objectives of strengthening its financial situation. Additionally, the business will use the money for affiliate marketing, operating costs, and basic working capital.

Source : Coinmarketcap

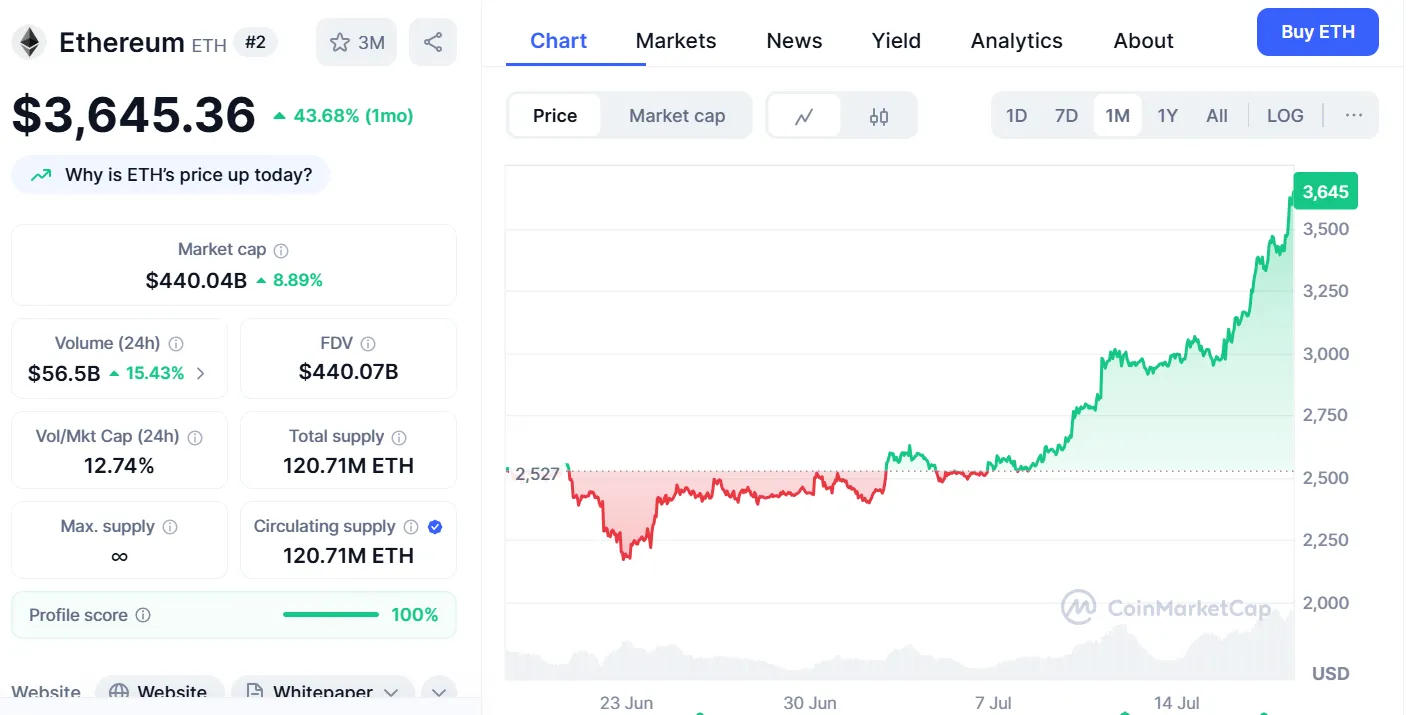

This bold move illustrates the growing institutional interest in Ether, as well as its adaptability beyond Bitcoin. An emphasis on staking and DeFi to generate passive revenue! SharpLink's efforts contributed to a ~23% increase in ETH concentration among top holders since June 13. The layer-2 token is trading at $3,632.96 USD and is up 8.58% in the last 24 hours. Due to institutional buying the layer -2 token has massively surged to 43.68% in just one month. Are we seeing a new corporate gold rush?

Sheetal Jain is a seasoned crypto journalist, content strategist, and news writer with over three years of experience in the cryptocurrency industry. With a strong grasp of financial markets, she specializes in delivering exclusive news, in-depth research articles and expertly optimized on-page SEO content. As a Crypto Blog Writer at CoinGabbar, Sheetal meticulously analyzes blockchain technologies, cryptocurrency trends and the overall market landscape. Her ability to craft well-researched, insightful content, combined with her expertise in market analysis, positions her as a trusted voice in the crypto space.