SharpLink Gaming Ethereum holdings have now reached a massive $700 million, making the company the single largest corporate holder of ETH, even more than the Ethereum Foundation. This move comes after the organisation staked an additional $15.8 million worth of this cryptocurrency into LSETH, showing long-term confidence in the network. The crypto investors are closely watching this rise in institutional interest in this digital asset.

Source: Arkham X Handle

The surge in SharpLink Gaming Ethereum holdings has not happened overnight.

In an earlier update on July 8, it was revealed that SharpLink held 205,634 tokens as of July 4.

Between June 28 and July 4, the company bought 7,689 currencies at an average price of $2,501 per token.

They also raised $64 million via ATM financing, with over $37m set aside specifically for more purchases.

This latest $15.8 million buy shows it’s not just investing, but also staking for long-term gains. The staked coins are locked into LSETH, reducing supply and creating more scarcity, which may push prices up over time.

This organisation isn’t alone in this strategy. Whale tracking data from Lookonchain shows that other big players are heavily investing in this cryptocurrency

Wallet 0x9684 bought 27,806 ETH worth $85.57 million from FalconX just three hours ago. Over the last four days, this same wallet has bought a total of 68,141 tokens, around $213.8 million worth.

Source: Lookonchain

Another whale, 0x35fb, grabbed 8,262 ETH ($25.17 million) from Kraken just five hours ago and now holds 80,312 ETH, valued at over $250 million.

A third whale, 0x3c9E, added 1,000 ETH from Kraken and now holds 26,000 in total. This rising interest from institutional buyers lines up with the pattern started by SharpLink Gaming Ethereum holdings.

With whales and companies withdrawing so much ETH from exchanges and into staking, it's supply available on the free market is diminishing. This normally results in price pressure upward because there's less availability coupled with increasing demand.

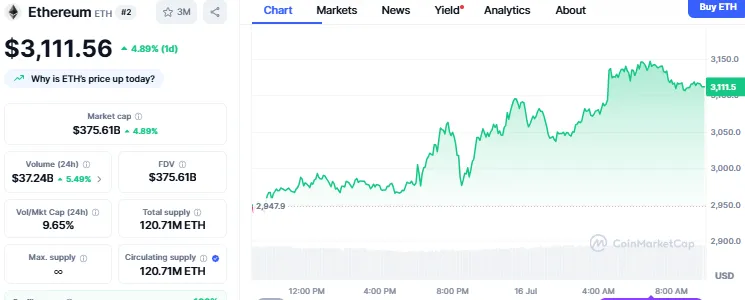

Most analysts think the digital currency may be about to move dramatically higher, if more organisation follows strategy of SharpLink Gaming Ethereum holdings. The currency is now trading at $3,111 with an increase of almost 5% within the last 24 hours.

Source: CoinMarketCap

The price is being pulled in different directions:

On the favourable side, strong demand from ETFs brought in $1.1 billion in July 2025. The recent Pectra upgrade has made staking and Layer 2 scaling more efficient. These factors can assist push the prices at higher level.

However, the crypto still faces hurdles. The $3,100 level remains tough to break, and ongoing regulatory uncertainty about the digital currency classification continues to worry investors.

That SharpLink Gaming Ethereum holdings now surpass the Ethereum Foundation's is a big statement. Blackrock is also continuously doubling down on ETH. It indicates a change where legacy firms are stepping up to serious plays in crypto assets, specifically in this digital asset.

The jump in SharpLink Gaming Ethereum holdings shows increasing faith in this digital currency as a value store and long-term investment. Combined with whale action and staking strategy, the crypto market seems to be taking a new direction, one dominated by institutions. And if this is the way the trend is heading, it may soon be a corporate reserve asset, like Bitcoin.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.

2 months ago

Good