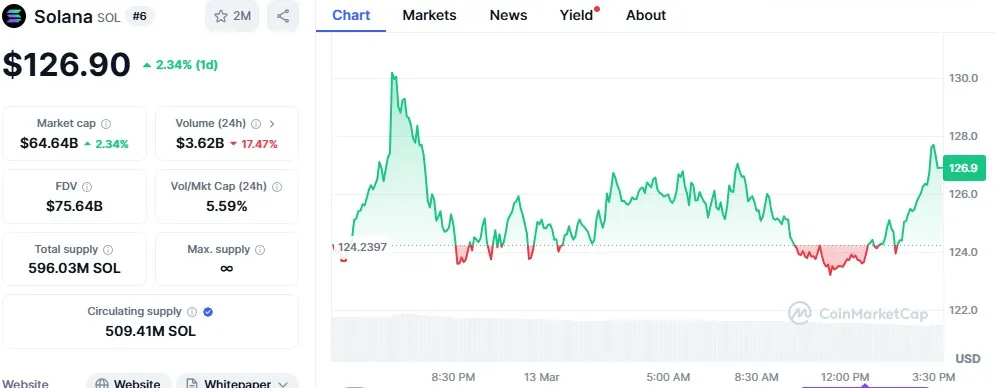

After a sharp decline of over 15% in the past week, Solana (SOL) has made a notable recovery. At the time of writing, Solana price is trading at $126.90, reflecting a 2.34% intraday gain, with a market capitalization of $64.64 billion and a 24-hour trading volume of $3.62 billion.

Source: CoinMarketCap

This bounce back has sparked curiosity—why is Solana rising today? Let’s explore the key reasons behind this recovery and what lies ahead for SOL.

Franklin Templeton Files for Solana ETF

One of the biggest catalysts behind Solana price recovery is Franklin Templeton’s recent ETF filing. The financial giant, which manages $1.53 trillion in assets, has officially filed for a Solana ETF in the U.S. via the Cboe BZX Exchange. This move follows its recent XRP ETF application, making Franklin Templeton the largest player to enter both ETF markets.

The Solana ETF race began on June 27 when VanEck made the first filing. With multiple firms following suit, investor optimism has surged. Despite the SEC’s delay in deciding on both XRP and Solana ETFs, market sentiment remains bullish. Polymarket bettors currently predict a 90% chance of Solana ETF approval, thanks to a crypto-friendly SEC administration. This growing institutional interest has fueled the latest SOL price recovery.

SOL Inflation Cut Proposal Gains Validator Support

Another factor behind why is Solana rising is the ongoing debate around the SIMD-228 proposal, which suggests cutting Solana’s inflation rate by 80%. So far, 37.5% of validators support the proposal, with 17.2% opposed and 1.2% abstaining. If approved, this move could reduce staking rewards and limit new SOL supply, which may ease selling pressure. However, concerns remain over its impact on network decentralization.

Galaxy Digital Stakes $39M in Solana

Further boosting market confidence, Galaxy Digital, led by Michael Novogratz, recently staked 274,253 SOL ($39.15 million) after withdrawing 282,500 SOL ($40.5 million) from Coinbase and Binance. This institutional activity suggests a strategic investment approach, reinforcing faith in Solana’s long-term potential. Galaxy Digital previously acquired SOL from the FTX bankruptcy auction on March 1, 2025, further demonstrating its commitment.

Despite Solana’s outstanding performance, there are a few factors that may affect its current price and drive a Solana Price Crash.

Sol Transfer from Binance Raises Questions: A recent large SOL transfer from Binance has also drawn attention. According to Lookonchain, within the past few hours, 201,755.31 SOL (~$25.01 million) was withdrawn to an anonymous wallet. Significant fund movements like this often indicate potential investments, staking, or security measures.

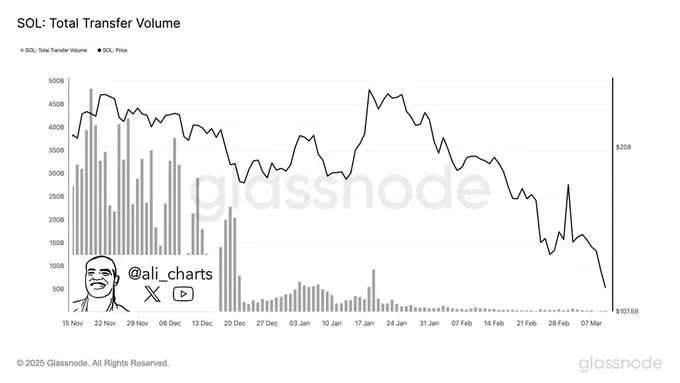

Declining Solana Transfer Volume Sparks Concerns: While Solana price has recovered, concerns remain over network activity. Analyst Ali Martinez highlights a decline in transfer volume, which has dropped from 4,500 million in November 2024 to below 500 million in March 2025.

Source: X

Alongside this, DeFi activity has shrunk from $12 billion to $7 billion, and monthly fees have dropped from $250 million to $89 million. If this trend persists, investor confidence and network utility could be affected, raising questions like will Solana crash again?

If Solana price fails to break the $130 resistance, it may face another downturn. Initial support lies at $124, with major support around $120. A break below this level could push SOL price toward $110 or even $100, especially if network activity continues declining.

On the other hand, if Solana price crosses the $130 resistance, it could rally toward $150 in the near term. However, achieving $500 in 2025 remains uncertain, given current market conditions and regulatory factors.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.