In today's cryptocurrency market, the Solana price increase is drawing a lot of attention. As of this writing, SOL is up 4.07% over the last day, trading at $164.51. Supported by bullish technical indicators, ETF speculation, and whale activity, the current trend points to more upside potential.

Current Price: $164.51

24-Hour Change: +4.07%

24-Hour Trading Volume: $5.7 Billion (+54.97%)

This shows that more people are buying and trading $SOL. The big jump in trading volume means that investors are really watching it, and this is helping the Solana price increase even more.

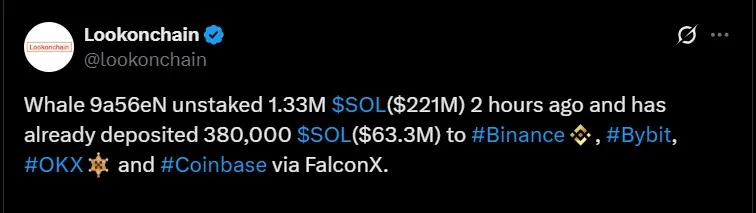

According to on-chain data from Lookonchain, a whale wallet (named 9a56eN) recently unstaked 1.33 million tokens, which is worth around $221 million.

Source: Lookonchain X

Just two hours later, 380,000 SOL, worth about $63.3 million, was sent to big exchanges like Binance, Coinbase, OKX, and Bybit through a platform called FalconX.

This latest news shows that there’s still strong demand and positive vibes around this cryptocurrency’s price right now.

One big reason for the price increase is a new update from the its another Floor account. A well-known Bloomberg ETF expert, Eric Balchunas, said that the chance of a Solana spot ETF getting approved is now 90%, up from 70%. He explained that the U.S. SEC is starting to see this coin as a commodity, not a security.

Source: X Account

Its TradingView price chart is looking really positive right now. Here’s what’s going on:

Source: TradingView Chart

RSI is at 54.85, which means people are buying more and the momentum is going up.

MACD just made a bullish crossover, and the histogram turned green. That usually means the price could go up soon.

In terms of price movement, it has broken out of a key consolidation zone around $150. Now, it’s making higher highs and higher lows, which is a classic signal of an uptrend.

Also, the 24-hour trading volume jumped nearly 55%, showing a lot more people are trading right now.

As per my analysis being a crypto writer, all these signs point to a possible short-term price rally. Traders and investors are watching closely to see if $SOL will keep climbing toward the next price target.

Bullish Scenario:

If the current momentum continues, the next targets are:

$172 (short-term resistance)

$185 (April high and significant resistance level)

Bearish Scenario:

If it fails to hold above $160–$162:

Downside Target: $150

Additional support around $145

While short-term pullbacks are possible, the overall technical structure remains bullish.

Whale movements absorbed with minimal price drop, showing strong market demand, along with the ETF approval news, and bullish technical indicators.

If this momentum continues $SOL may soon test the $185 level. However, traders should watch for support at $160–$162 in the short term.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.