The Hyperliquid coin news got a major boost today—not from a tweet or airdrop, but from a Nasdaq-listed company merging to form a $888 million crypto treasury firm.

Today’s massive HYPE token price surge is turning heads across both crypto and Wall Street. With 12.6M tokens in play, investors are now watching closely.

In a bold move that’s turning heads across both Wall Street and Web3, Sonnet BioTherapeutics has officially merged with Rorschach I, forming a new public entity called Hyperliquid Strategies Inc.

Source: Wu Blockchain X Post

The deal, valued at $888 million, is now one of the most talked-about stories in the space. Backed by legacy and crypto investors alike, this Sonnet merger news is setting the tone for a new class of onchain treasury companies.

And right at the center of this strategy? 12.6M $HYPE tokens.

Upon closing, this token's Strategies will not only be listed on Nasdaq — it will hold a reserves of $305 million in cash along with 12.6 million tokens.

| Metric | Details |

|---|---|

| Merger Value | $888 Million |

| Tokens in Treasury | 12.6 Million $HYPE |

| Nasdaq Listing | Yes |

| Short-Term Prediction | $55 |

| Long-Term Forecast | $100+ |

This isn’t just another acquisition. It’s a signal that DeFi-native assets like this cryptocurrency are becoming real treasury instruments.

Such a structure is unusual in traditional finance, but it's a game-changer for onchain tokens. It’s no surprise this news has fueled the latest Hyperliquid price surge.

The move gains more legitimacy based on the calibre of its backing investors - it has names like Paradigm, Galaxy Digital, Pantera Capital, and Republic Digital as valued shareholders.

Even former Boston Fed President Eric Rosengren is joining the board — blurring the line between traditional financial governance and decentralized assets.

This level of confidence is helping the coin dominate hyperliquid coin news headlines globally.

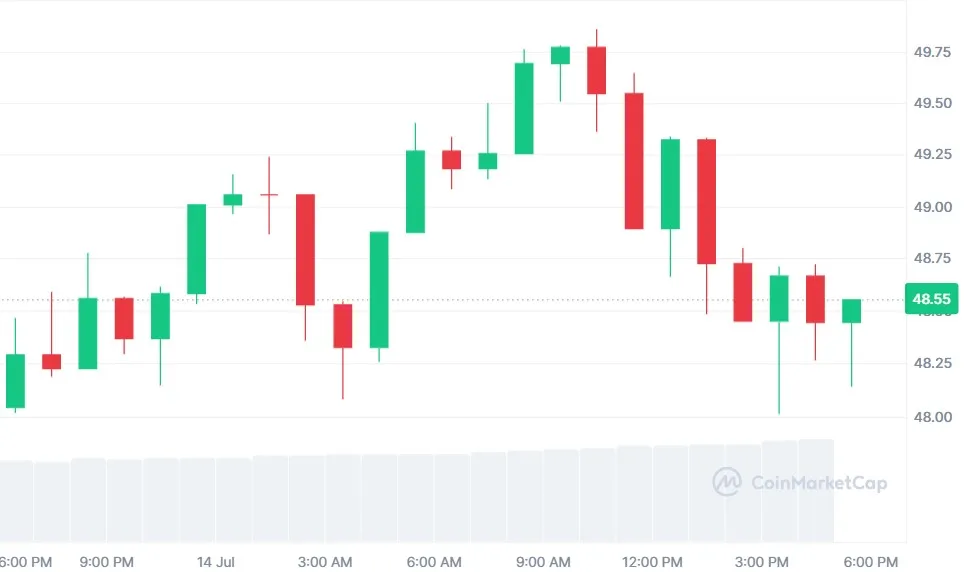

Following the merger news, the price increased by over 1% daily, with volume spiking past $493 million — a clear indicator of rising interest.

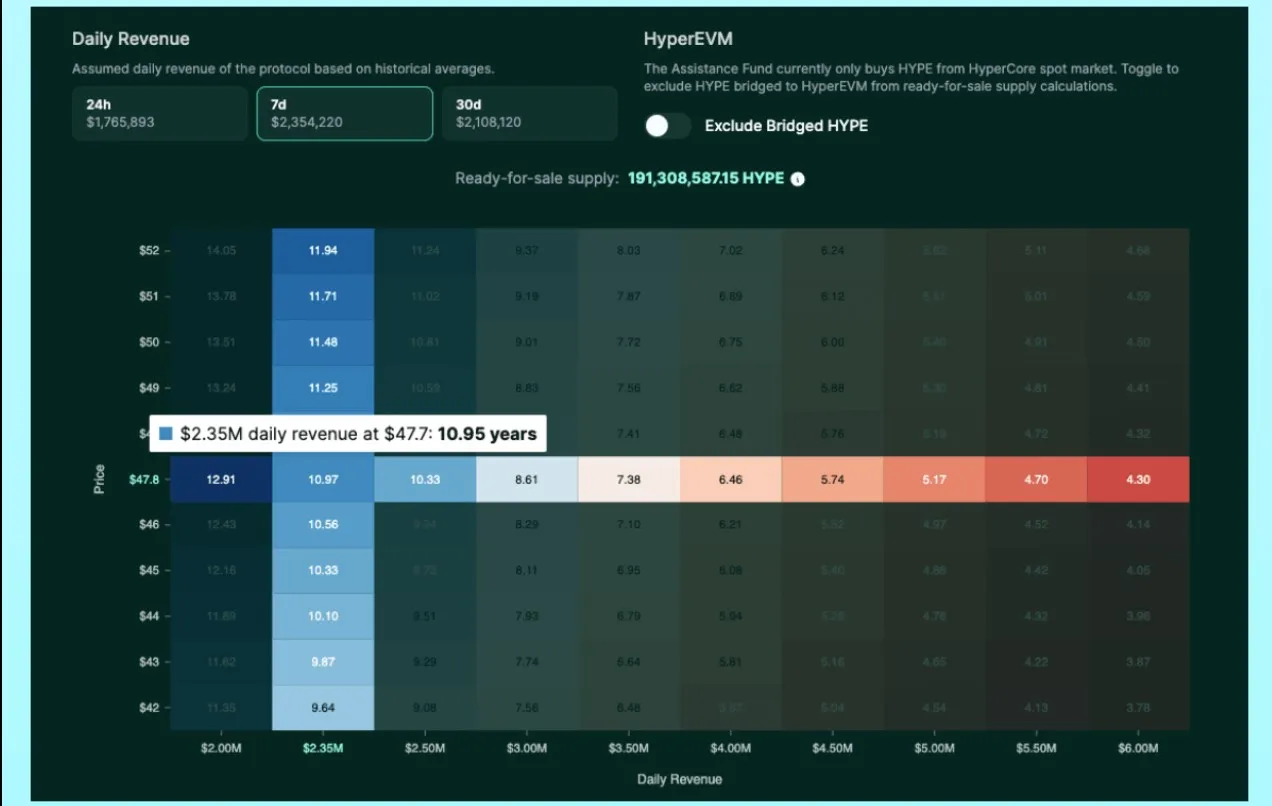

According to onchain analyst Tindorr, the current HYPE valuation is still balanced with revenue, suggesting it’s not overpriced despite the surge.

If it gains institutional traction post-Nasdaq listing, the price prediction could reach:

Short-term: $55

Mid-term: $70–$85

End of 2025: $100+

After observing the CoinMarketCap chart, these figures aren't guaranteed but reflect growing demand, especially now that people are asking: why is Hyperliquid pumping?

This isn’t just about Sonnet BioTherapeutics merging with Rorschach. It’s about a new treasury model built around DeFi tokens — clearly indicating that crypto-native assets are now entering traditional financial ecosystems.

With rising investor interest, a massive treasury, and strong market momentum, this surge could be the start of something much bigger.

For now, all eyes remain on the HYPE token price surge—and whether this new public listing truly redefines what it means to hold value onchain.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.