Could holding Bitcoin on an exchange put your crypto at risk of seizure in South Korea? The country’s Supreme Court has now answered that question. For the first time, it officially confirmed that Bitcoins stored on regulated exchanges can be legally seized under the Criminal Procedure Act.

Source: The Chosun (Official Korean Media Outlet)

Major crypto trading platforms of the country like Upbit and Bithumb come directly under this Bitcoin Seizure verdict. Where Upbit accounts for 53% of the total 10.17 million crypto users of the country, Bithumb holds around 37% of total accounts. Seizure on this exchange could directly affect the users perspective.

However, legal experts say this decision sets an important precedent for future crypto investigations, trials, and legislation.

The ruling is a result of the 2020 money laundering case. The lawsuit started with Mr. A, who was under investigation for money laundering in 2020. Authorities seized 55.6 BTC from his exchange account, worth about 600 million KRW at the time. Mr. A argued that Bitcoin is not a “physical object” and therefore should not be confiscated.

The lower courts disagreed, saying Bitcoin has real economic value and can be controlled by the owner using private keys or wallets. The case went to the Supreme Court, which dismissed Mr. A’s appeal in December 2025. The Court ruled that Bitcoin, even when held on exchanges, is an electronic asset that can be seized just like any other property.

This decision clears confusion about the legal status of cryptocurrencies on exchanges. The ruling states that digital assets also hold value and come under asset laws, and can be verdictable.

It builds on earlier rulings on similar topics:

In 2018, the Supreme Court recognized Bitcoin as intangible property that can be confiscated if earned illegally.

In 2021, it confirmed BTC as a virtual asset that can be transferred, stored, and traded electronically.

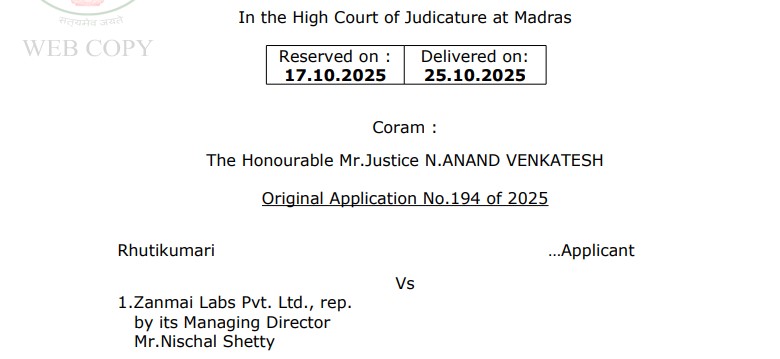

Before that, the Madras High Court of India also presented a landmark ruling on crypto’s status. The court has officially recognized cryptocurrency as a form of property, granting it the same legal protection as tangible assets in the Rhutikumari v. Zanmai Labs case.

Source: Govt. Official

For crypto-holders: While this provides clarity, it also highlights areas to watch carefully. Storing coins on centralized exchanges carries risk. Users may consider self-custody wallets for better control.

For law enforcement: Investigations into fraud, money laundering, and other crypto crimes become easier.

For the crypto-market: The ruling gives BTC and other virtual assets stronger recognition as legal property and economical value.

Lawyers say the decision sets an important precedent for future investigations and legal cases, making the treatment of cryptocurrencies more consistent.

As crypto adoption grows, especially in countries like South Korea where about one-third of the population holds digital assets, this Bitcoin Seizure ruling could change how people store and protect their coins.

Could this be the moment for cryptocurrency to get a clear space as a monetary value and users to rethink where they keep their assets?

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.