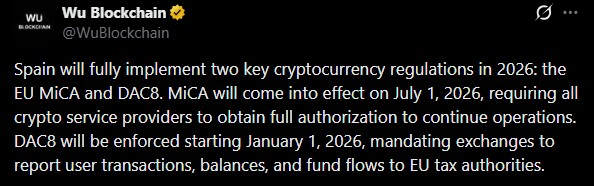

Spain crypto regulations are expected to go through a complete makeover in the next year. From 2026, crypto users and exchanges in Spain will face one of the strictest regulatory shifts in Europe, as MiCA and DAC8 come into force. With these decisions, Spain is looking forward to a mature cryptocurrency space with proper regulation in place, protecting users in the process.

Source: Wu Blockchain

So, how will the new Spain crypto regulations really affect cryptocurrency users and providers in this country?

MiCA defines rules for operations in the crypto market in terms of categorization such as utility tokens, security tokens, and stablecoins. The National Securities Market Commission (CNMV) is responsible for regulating MiCA, which has already registered more than 60 companies, including big banks and exchange operators such as BBVA, Cecabank, and Renta 4 Banco.

The MiCA is to be fully enforced as a part of Spain Crypto Regulations from July 1, 2026. Every provider of cryptocurrency services has to receive full authorization to continue operation. Any firm that does not meet European specifications can be forced to close down.

This action aims to protect investors, as well as ensure the regulation, transparency, and control of the digital asset market at an appropriate level within Europe.

To complement MiCA, the Administrative Cooperation Directive 8 (DAC8) enters into effect as of January 1, 2026. Under DAC8, exchanges and service providers must report user transactions, balances, and fund movements to EU tax authorities.

This law removes anonymity in regulated crypto operations. The Spanish Treasury can track, freeze, or seize digital products to collect taxes, giving the government more detailed information than before.

Experts have highlighted the significance of self-custody because DAC8 only concerns those assets which are held in custody by exchanges/service providers. Persons who hold a cryptocurrency in self-custody are beyond the DAC8 obligations.

José Antonio Bravo Mateu, a digital asset taxation expert, advises careful planning: “From January 1, 2026, any crypto held on exchanges can be seized directly for tax debts. P2P (peer-to-peer) transactions and privacy tools can legally protect user privacy if not conducted as regular economic activity.”

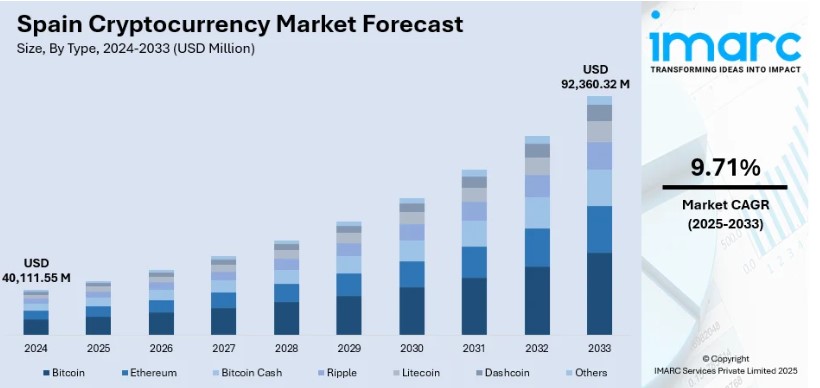

Spain’s cryptocurrency market remains strong and fast‑growing, despite the lack of regulatory frameworks. The sector reached an estimated USD 40,111.55 million in 2024 and is projected to climb to USD 92,360.32 million by 2033, according to imarc groups reporting.

Driven by increasing investor interest, wider adoption of bank‑backed digital asset services, and stronger financial education efforts, the nation lies in the top ten cryptocurrency adopting countries in Europe under Chainalysis list.

User adoption is also growing, with a forecast of over 25 million crypto-users in 2026 by Statista, supported by a 51.5% adoption rate in 2025. However, plans in Spain, like the Sumar party’s proposal to raise crypto tax rates to 47%, could create tension in the market.

The 2026 regulations make it clear that Spain is gearing up towards a more organized, transparent, and structured world of cryptocurrencies, striking a perfect balance between innovation and protection of investment as well as fiscal conservatism. As such, Spain aims towards developing a mature market.

As all these regulations come into effect, Spain's cryptocurrency space is facing an important question: Would strict regulation help the market to invest and adopt in a safer way, or would it in any way trigger people to adopt decentralized platforms instead? The year 2026 would be pivotal in determining Spain's cryptocurrency regulations.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.