SPK, one of the June's most hyped token launches, debuted trading on June 17 among leading crypto exchanges such as Binance, Bybit, KuCoin, Bitget, and Bitunix. Despite the token trending and making headlines throughout social media, its price plummeted more than 25% in its first 24 hours of trade. What happened with this much-hyped debut?

The primary cause of the crash was the enormous supply shock resulting from the SPARK airdrop. Binance had a unique "HODLer Airdrop" wherein users who staked BNB for merely four days were given SPK tokens for free. This action alone dumped 200 million SPK into circulation, and a total of 300 million tokens found their way to market within hours of listing.

These free tokens were immediately dumped by users who, in many cases, did not plan to hold SPK in the long term. The consequence? Sustained selling pressure that sent the price plummeting quickly.

At its Peak, the 300M SPK was valued at about $18 million, But with everyone clamoring to sell at the same time, demand couldn't catch up.

SPARK came out with 1.7 billion tokens outstanding, 17% of its 10 billion total supply, providing sellers with a great deal of ammo to inundate the marketplace.

SPARK's initial 24-hour trading volume was robust, more than $538 million on several exchanges. But most of these exchanges lacked deep order books. That is, there were insufficient buyers or sell limits at various price levels to absorb the deluge of fresh tokens.

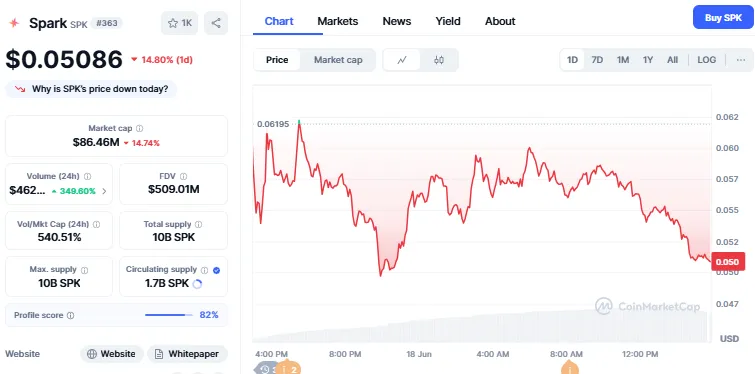

This supply-demand mismatch rendered SPK highly volatile. The token had a turnover ratio of 6.06, indicating it moved more than six times its market cap in a day, clear evidence of unstable support. Currently the SPK token is trading at $0.05086 with a decrease of 14.80% in the last 24 hours, while the trading volume has surged by 345.61% as per the CoinMarketCap.

Source: CoinMarketCap

Crypto traders were already becoming nervous. The Fear & Greed Index, a measurement of market sentiment, dropped from 65 (Greed) to 48 (Neutral) over the last week. Bitcoin dominance also increased to 64%, pulling funds out of smaller tokens such as SPARK into more secure, stable assets.

On social media platforms such as X (formerly Twitter), most users accused SPARK of being a "rug pull," which further fueled panic. The price collapse soon became a snowball effect as more individuals scrambled to close their positions.

SPARK's airdrop plan, though beneficial in terms of publicity, ultimately backfired. It largely benefited holders who were passive and short-term opportunists more than they benefited long-term project supporters. This allowed mercenary capital to quickly cash out, flooding the token.

In spite of the bumpy beginning, SPARK is continuing to draw interest. Supporters point to its $8 billion in Total Value Locked (TVL) and healthy staking rewards, with a two-week lockup timer. It may eventually curb selling pressure.

SPARK also has promising DeFi potential and arbitrage opportunities. However, if the team does not turn its focus toward liquidity and trust in the community, the token will struggle in the near future to bounce back.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.