When a project says, “The Market Will Decide,” it shows confidence. But today, the Spur Protocol presale is facing a tough market test. With only one day left before the SON presale end date on January 25, 2026, most of the tokens are still unsold.

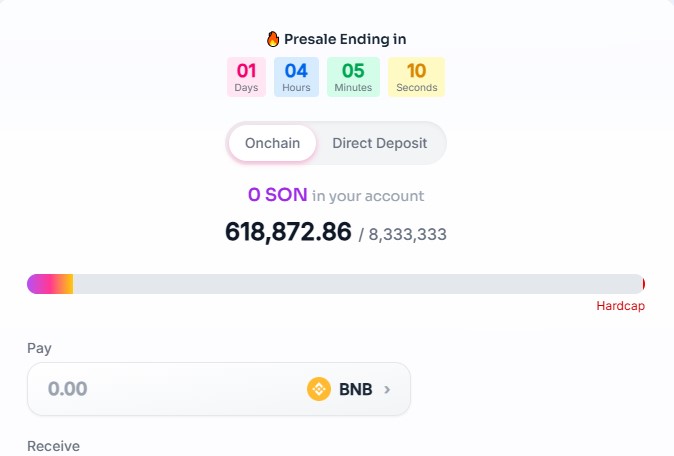

Out of 8,333,333 tokens, only 618,872.86 are sold. That means 92.57% of tokens are still unsold. This data alone has created serious fear about whether the Spur Protocol listing date on January 26 can really happen on time or whether the timeline will shift again.

Source: SpurSwap Website

The current price is 1 $SON=0.0000337 BNB. Selling more than 7.7 million coins in just one day looks almost impossible. This is why the Spur Protocol presale update is now under close watch by traders and analysts.

A healthy coin offering usually sells 50% to 70% of its supply before TGE. But this early-sale has sold only around 7%. This shows weak demand at the moment. Low demand creates three big risks.

First, it shows investors are not confident yet.

Second, it creates heavy selling pressure after debut. With so many unsold tokens, scarcity will not exist.

Third, exchanges avoid low-liquidity coins because prices can be easily manipulated.

Because of this, many now ask: will $SON listing delay again?

The Spur Protocol listing date is set for January 26, 2026, on MEXC, CoinStore, SpurSwap, PancakeSwap, and BingX. But history shows, in most cases, teams delay listing when less than 20–30% of tokens are sold. Earlier, the coin offering end date was January 5, 2026. It was extended because of weak sales. Now the same situation is repeating, but at a larger scale.

When more than 90% of tokens remain unsold, teams usually extend the early-sale. Lunch with such low distribution can damage price stability and trust. This makes a delay highly possible, even though it is not officially confirmed yet.

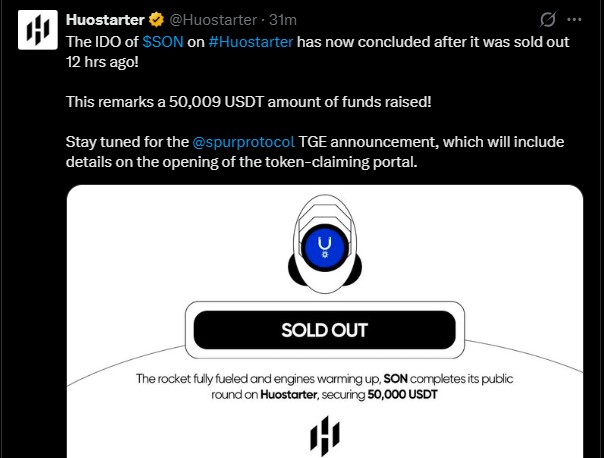

There is one positive sign. Huostarter posted that the SON IDO round was sold out on Huostarter platform, raising about 50,009 USDT in 12 hours. This shows some demand still exists. But compared to the full presale supply, this amount is very small. It improves sentiment slightly, but it cannot change the overall market picture.

If the launch happens on time, CoinGabbar analysts see the price prediction between $0.40 and $0.60. In a strong bullish market, it could even reach $2 in six months.

But if the launch is delayed again, trust will drop. Then the price may fall to $0.08–$0.30. Reaching $1 would become very difficult. This shows how closely the $SON presale and launch date are connected.

The presale end date of Jan 25 is now at a critical point. With one day left and over 92% of tokens unsold, the pressure is extreme. Either strong demand must appear suddenly, or a Spur Protocol listing delay becomes likely. The next update will decide the future direction of the project and investor confidence.

YMYL Disclaimer: This article is for informational purposes only. It does not offer financial advice. Cryptocurrency investments carry risk. Always conduct independent research before making any investment decisions.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.