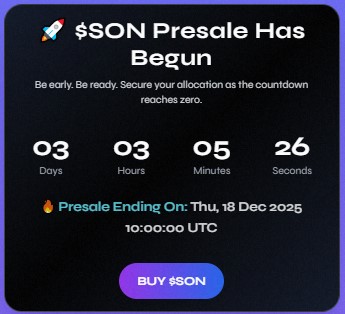

Is Spur Protocol about to become one of the most talked-about Web3 projects before 2026? As the SON presale enters its final three days, investors are closely watching its ICO, IDO, listing timeline, and long-term price potential. With multiple funding rounds ending on December 18, interest around Spur Protocol price prediction is rising fast.

The Spur Protocol presale officially started on December 10, 2025, and is scheduled to close on December 18, 2025. With only three days left, this phase is clearly designed as a first-come, first-serve opportunity for early participants. The token is currently priced at $0.03 in the presale, with a minimum buy of $10 and a maximum of $10,000.

Source: Website

The presale supports multiple chains including BNB, Polygon, Base, Avalanche, Solana, and Tron. An audit is already available on the official presale page, which adds a layer of transparency and trust for participants evaluating its funding and security.

At the same time, the project is moving into its next funding stage. Aidica is hosting the first SON ICO from December 16 to December 18, 2025, as part of the pre-TGE phase. The ICO price is set at $0.02 per token, with a target commitment of $100,000 USDC on Solana.

Source: X

Alongside this, an IDO on Huostarter will run from December 16 to 18 at a price of $0.03, marking a busy and critical funding window for the project.

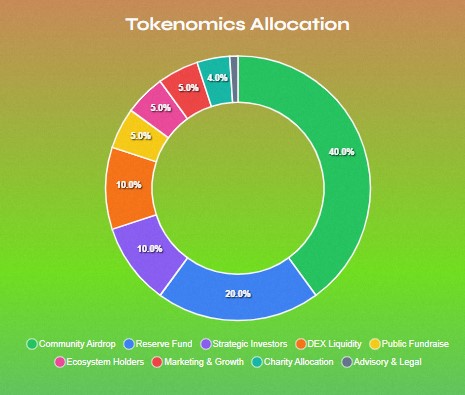

Understanding tokenomics is essential when analyzing any realistic Spur Protocol price prediction. The SON token has a fixed total supply of 1 billion tokens.

Source: Website

Community allocation (40%) – Used for incentives, SON airdrop, and future ecosystem rewards

Project future reserves (20%) – Locked for 24 months with a 6-month cliff to reduce early sell pressure

DEX liquidity (10%) – Reserved to support on-chain trading liquidity

Investors (10%) – Allocated to early backers

Marketing (5%) – Dedicated to promotions and growth initiatives

Fundraising (5%) – Set aside for strategic capital raising

PoG holders (5%) – Rewards and incentives for PoG participants

Charity initiatives (4%) – Allocated for social impact programs

Advisory roles (1%) – Reserved for advisors and consultants

This structured distribution shows a balance between ecosystem growth, liquidity, and long-term sustainability, which directly impacts the coin price expectations.

Many investors are now asking about the Spur Protocol listing date. The team has clarified that the current focus remains on completing the presale, ICO, and IDO phases, all ending on December 18, 2025. After this milestone, exchange listings will be finalized. As of now, the listing is expected in 2026, most likely in Q1, though the exchange names are still under discussion.

Based on current demand, funding structure, and tokenomics, early SON price prediction models suggest a possible listing range between $0.52 and $0.85. Optimistic scenarios indicate that SON could reach up to $1.50 shortly after listing if market conditions remain favorable. If major exchange support such as Binance or Bybit emerges, some community forecasts extend the price prediction toward $3 in the short term and even $5 in the medium term, though these remain speculative.

As the SON presale closes in just three days, momentum around funding, tokenomics, and long-term value is building rapidly. With ICO and IDO stages nearing completion and a 2026 listing expected, Spur Protocol price prediction remains closely tied to execution, adoption, and market sentiment.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or trading advice. Cryptocurrency investments are high-risk and speculative. Always do your own research (DYOR) before investing. Consult a qualified financial advisor if needed, and never invest money you cannot afford to lose.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.