Disclaimer: This content is for information only, not financial advice. Crypto investments are risky and volatile. Always research and consult a professional before investing.

The Aster airdrop claim for Stage 4 officially opens today at 12:00 UTC, and the community is watching closely. Airdrop claims usually create mixed emotions in the market. Some people expect selling pressure, while others see it as a sign of growth and transparency. In this case, the situation looks more balanced and even positive.

Users who selected the 50% early claim option can now start claiming their tokens.

At the same time, most of the airdrop supply is still locked.

Around 118.5 million tokens, nearly 98.74% of the total, will remain locked until April 28.

This means only a very small amount of tokens is entering the market during this airdrop, which helps reduce panic selling.

Source: X (formerly Twitter)

On-chain data also shows that:

754,041 tokens, about 0.63%, were moved from the Airdrop Reserve to the Aster DEX Treasury contract.

Another 754,041 tokens will be permanently burned.

Burning tokens reduces total supply, which is usually a healthy sign for long-term price stability.

Most airdrops cause price drops because people sell their free tokens quickly. But the stage 4 Aster airdrop claim is different for two reasons. First, the unlocked supply is very small. Second, part of the supply is being burned instead of added to circulation.

This creates balance. Selling pressure stays limited while confidence increases because the project is managing its supply carefully. This makes the market reaction calmer and more stable.

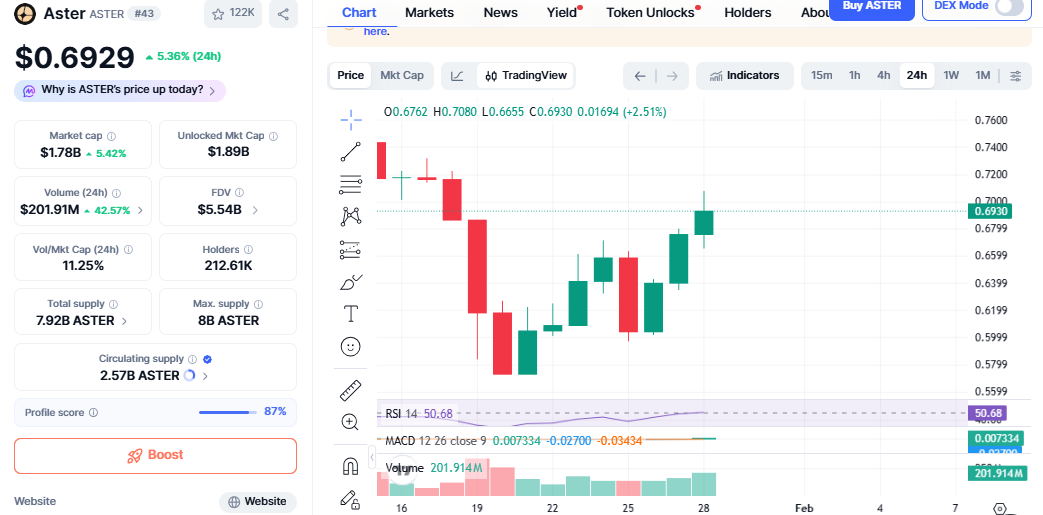

It is trading near $0.69, up more than 6% in the last 24 hours. This is much stronger than the overall crypto market, which rose around 1%. In the past seven days, it has gained almost 16%.

Source: CoinMarketCap

Instead of falling during the claim, the token is showing strength. This means buyers are absorbing any small selling pressure that comes from early claimers.

Aster DEX recently launched a $50,000 trading campaign. It offers rewards and fee discounts for new trading pairs. This has increased activity on the platform and pushed more users to trade the altcoin.

Because of this, it’s trading volume jumped over 40% and reached close to $200 million. High volume during an air-drop claim usually shows strong interest and real demand, not fear.

Technical Signals Look Healthy

It moved out of its consolidation zone between $0.58 and $0.70

Trading volume spiked earlier by 105%, showing accumulation

RSI is near 50, meaning the market is balanced

MACD has turned positive, hinting at growing bullish momentum.

These signals show that the aster airdrop claim is not hurting the market structure.

Aster’s roadmap is another reason investors are calm. The team plans:

Q1 2026: Launch of Aster’s Layer 1 blockchain

Q2 2026: Staking and governance features

Staking usually reduces selling because people lock tokens to earn rewards. This future utility makes many holders less willing to sell during the claim phase.

Short-term Aster price prediction:

Bullish case: If it stays above $0.70, price could move toward $0.76.

Base case: Price may trade between $0.65 and $0.70.

Bearish case: If selling pressure increases, it may test $0.60.

Because most tokens remain locked, big downside risk looks limited.

The Aster airdrop claim is opening in a healthy market environment. Limited token unlocks, token burning, strong trading volume, and upcoming upgrades are helping the coin stay strong. Instead of fear, this is building confidence. If the project delivers its Layer 1 chain and staking plans on time, it could continue growing even after this claim phase ends.

Disclaimer: This content is for information only, not financial advice. Crypto investments are risky and volatile. Always research and consult a professional before investing.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.