The Sui blockchain has rushed to respond after a massive $223 million exploit hit its top decentralized exchange, Cetus Protocol. In a rare move, the platform launched an emergency whitelist and a restore module, both designed to skip normal security checks and help recover stolen assets.

These tools allow the platform to act fast, great news for users hoping to get their money back, but it raises concerns for decentralization supporters. Some users worry that this level of central control goes against what blockchains are supposed to stand for.

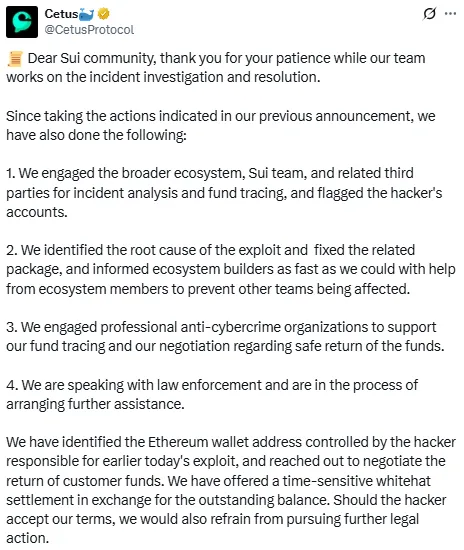

In a bold move, on the official X account (previously Twitter) of Cetus Protocol they announced, offering a $6 million bounty to the attacker behind the exploit. The team behind Cetus said they got the Ethereum wallet of the hacker and brought a “whitehat settlement.”

Source: Cetus Protocol

The offer: return 20,920 ETH and all frozen assets on the blockchain, and keep 2,324 ETH (worth about $6 million) as a reward. Cetus also promises no legal action if the hacker accepts and doesn’t try to hide or move the funds.

Law enforcement, cybersecurity experts, and even U.S. regulators like FinCEN are now involved. Cyber firm Inca Digital is leading negotiations.

The attacker used spoof tokens, fake or low-value assets, to manipulate the pricing system in Cetus' liquidity pools. By adding tiny amounts of these spoof tokens at key moments, the hacker fooled the platform into thinking trades were balanced.

Using these tricks along with flash swaps and price manipulation, the attacker drained real tokens like SUI, USDC, and ETH at incorrect rates.

Even though Cetus had passed recent audits, this kind of logic-based attack bypassed traditional bug scans. The attacker started by draining $11 million from an SUI/USDC pool and later bridged over $60 million to Ethereum, buying more than 21,900 ETH.

There is massive damage due to the hack. The SUI token dropped by 7%, and consequently CETUS fell by 30%. Tokens like SQUIRT, HIPPO, and AXOL lost almost all their value while trading volumes rose as investors rushed to exit as per the CoinMarketCap.

Source: CoinMarketCap

After that, the whitelist and restore module made the market believe things might get better. Prices have gone up slightly, yet there is uncertainty about just how much of the stolen crypto may be found.

While hopefulness has returned, doubts about the market continue. If the restore module does what it’s designed for and is verified by an audit team, frozen funds are likely to be restored to liquidity providers. Some recovery may not be possible for assets that have been moved.

This incident affected the faith people once had in DeFi protocols available on new blockchain networks like Sui and Aptos. Even though these chains move fast and experiment, this matter demonstrates that DeFi still puts them at risk. The emergency whitelist and restore rollout signals fast, centralized intervention post-exploit, good for LP restitution, but it’s a tradeoff for decentralization diehards.

The spotlight is on the platform now. Can it match efficient action with real openness and blockchain security?

It could act as a model for how L1 blockchains respond to major challenges. Whatever could be the main reason. It reminds the community about DeFi security and fiercely tests the Sui ecosystem.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.

2 months ago

Website ny li dng sneaky redirect SEO Google pht tn m c phishing attack google