Tether has launched USDT on the RGB protocol, enabling the first stablecoin transactions to occur directly on the Bitcoin blockchain. This process broadens the performance of Bitcoin to well beyond that of a store of value and makes it a transactional network.

The RGB protocol recently released its 0.11.1 mainnet release, directly aimed at enabling private, scalable and user-controlled issuance of assets. Through this protocol, Tether can make sure that USDT can run natively on Bitcoin and without losing decentralization.

https://x.com/Tether_to/status/1961037059331678674

Some of the features that are introduced by RGB to enhance usability are the possibility to make light payments and offline transfers. Such tools are supposed to establish a more adaptable payment system so that even transactions in low-connectivity areas can still occur.

The integration enables users to store and transfer USDT and Bitcoin in the same wallet, providing stablecoins a smooth spot in the Bitcoin ecosystem. This decreases the dependence on external chains in the stability of the activity of stablecoins and increases the presence of BTC in everyday transactions.

The launch provides a new structural layer of functionality by integrating Tether with unmatched liquidity with the security of settlement of Bitcoin. It creates another method that allows stablecoins to circulate without losing the original decentralized structure of the top crypto.

The evolution is also an indication of a change in the use of crypto. In addition to serving as a store of value, BTC has become the foundation of stablecoin-based payments that are private, scalable, and global.

As of August 28, 2025, the stablecoin issuer has $167.34 billion USDT circulating, and its market capitalisation is equal to the supply. Its 24-hour turnover volume of $117.93 billion demonstrates how the token plays a vital role in the liquidity of the market in both centralised and decentralised platforms.

USDT Chart : Source : CryptoRank

The chart data shows USDT has maintained its dollar peg while steadily growing in market cap since 2020, with the most aggressive phase of expansion continuing through 2025. However, the USDT issuer market share has declined by 1.8% since August 1, reflecting rising competition from USDC, FDUSD, and DAI.

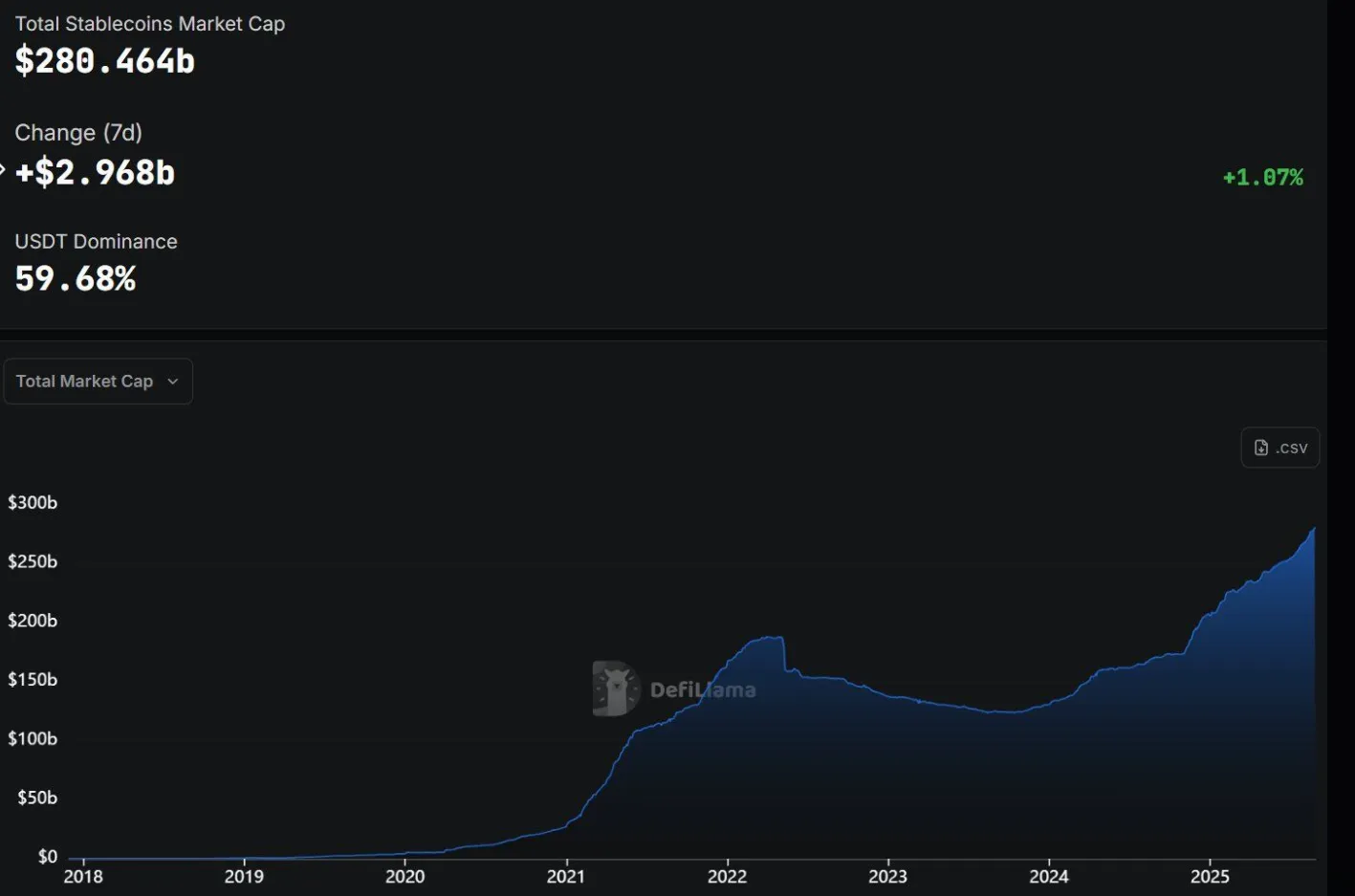

The market size of all stablecoins has topped an all-time high of $280.46 billion USD according to DefiLlama. Strong demand in dollar-pegged assets and their continued role as liquidity tools in trading and DeFi ecosystems is evidenced by weekly inflows of $2.97 billion.

Total Stablecoin Market Cap : Source : DefiLlama

The leading issuer is Tether, which holds a 59.68% portion of the entire market, yet the rise of competitors indicates a need to focus more on diversification. Such a setting stimulates issuers to increase infrastructure and enhance functionality because liquidity is no longer concentrated in one stablecoin.

Besides the issuance metrics, Tether is growing due to strategic investments. In the earlier part of the month, it took a minority share in Bit2Me, a Spanish crypto platform, and spearheaded a 30 million Euro funding round to help the company expand into Europe and Latin America. These investments fit into the strategy of Tether to reinforce its ecosystem and guarantee a wider adoption in the international markets.

With the rollout of USDT on BTC via the RGB, Tether can consolidate its current liquidity with the unparalleled decentralization of Bitcoin, further cementing its market dominance. Simultaneously, it responds to competitive forces by integrating USDT into the infrastructure of the top crypto, establishing a system in which stablecoins become an inherent part of BTC and not a third-party addition.

This action is highlighting a structural move by both Tether and BTC, with stablecoin payments now part of the most secure blockchain in the world. It is not only the act of defense against competitors but also the act of expansion that is intended to determine the future of stable everyday digital money.

Ronny Mugendi is an experienced crypto journalist with four years of professional expertise, having made substantial contributions to multiple media platforms covering cryptocurrency trends and innovations. With more than 4,000 published articles to his name, he is dedicated to informing, educating, and bringing more people into the world of Blockchain and DeFi. Beyond his journalism work, Ronny finds excitement in bike riding, enjoying the adventure of exploring fresh trails and landscapes.