Bitcoin (BTC) has experienced notable price volatility over the last 24 hours, with its value starting at approximately $111k and climbing to just above $113k. Currently, the price stands at $112,915, reflecting a 1.79% increase over the past 24 hours. However, over the past seven days, the crypto has seen a slight decline of 0.84%.

Even though these movements appear to be a lot, a closer examination of the broader tendencies of the supply uncovers a lot more about the possible direction of the market later on.

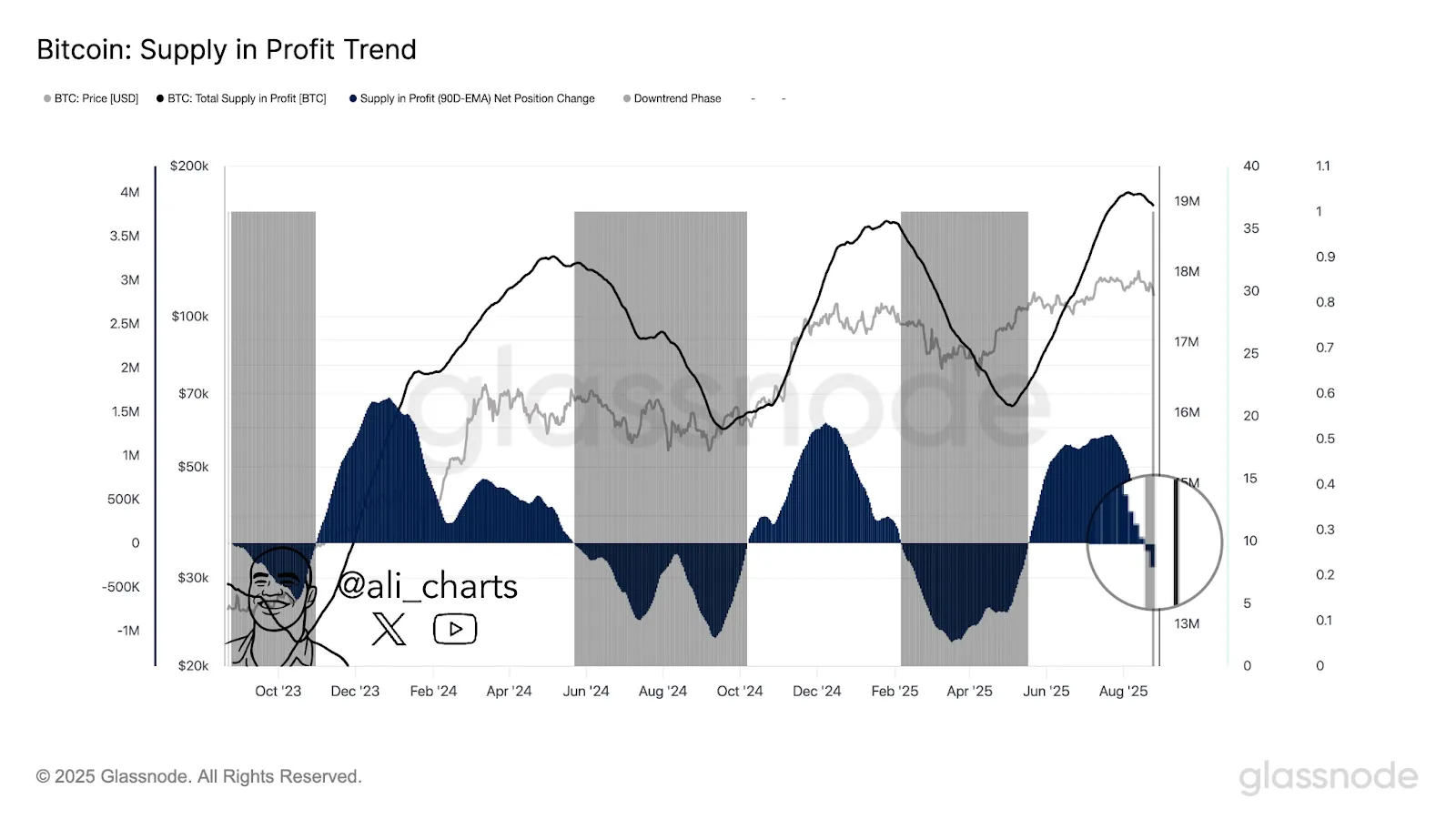

The graph provided by analyst Ali Martinez helps illustrate Bitcoin’s Supply in Profit Trend from October 2023 to August 2025, highlighting Bitcoin’s price movements in relation to the amount of coins in profit. The gray line, which represents the first born's crypto price, exhibits significant changes over the time span.

Source: X

In late 2023, the price peaked at around $75,000. This was followed by price consolidation attempts from 2024 to 2025 to stay between $30k and $50k. Bitcoin’s price attempts to stay within this range showed a mixture of correction and stabilization attempts, reflecting changes in the market’s overall outlook.

The total supply in profit is illustrated by the black line on the graph with a pattern that increases during price increases and decreases during price declines. The price spike of Bitcoin during late 2023 and early 2024 resulted in a surge of supply in profit. This surged supply in profit peaked at around December 2023.

The amount of earnings has been decreasing since April 2024. This decrease coincides with the price corrections of Bitcoin, signaling a change in the mindset of investors.

The blue bars, on the other hand, indicate the 90-Day EMA of the net position change in supply in profit. Like the blue line, these bars are associated with smoothing out market trends, and the trends shown correspond to climbing price rallies.

There were notable peaks from December 2023 to February 2024, aligning with the price rise. Significantly, the blue bars depict marked falls after April 2025, which aligns with the drop in the amount of coins turning to an earning. This decline, which may represent a profit-taking attempt by investors, can bring a bearish force to the market.

The Bitcoin Therapist noted the parallels between the movements in 2017 and how 2025 might look. The analyst, in particular, noted the similarities between the years with regard to price consolidation and the multiple retests of the critical support levels.

Source: X

In 2017, the crypto retested the $3,200 to $3,500 range during the summer. After this period, the price surged and ended the year at $7,200.

In 2025, the crypto is exhibiting the same behavior. It is retesting the support zone between $110k and $116k, which has remained firm through the recent price volatility. If it behaves the same way it did in the 2017 cycle, then we can expect the price to move up within the next few months. A strong upward movement can even drive the price towards the $150k-$160k range, similar to the sharp rise after the support retest in 2017.

Kelvin Munene is an experienced crypto and finance journalist with over five years in the industry, known for delivering detailed market insights and expert analysis. Holding a Bachelor’s degree in Journalism and Actuarial Science from Mount Kenya University, he is recognized for his thorough research and strong writing abilities, especially in cryptocurrency, blockchain, and financial markets. Kelvin consistently offers timely, accurate updates and data-driven perspectives, helping readers navigate the complex world of digital assets. His work focuses on identifying emerging trends, analyzing market cycles, exploring technological advancements, and monitoring regulatory changes that influence the crypto sector. Outside of journalism, Kelvin enjoys chess, traveling, and embracing new adventures.