What usually happens when a gaming-focused crypto token lands on a major exchange? The9bit price surge is giving traders a clear answer. Soon after KuCoin confirmed the new listing, asset's price jumped nearly 7.95% in 24 hours, signaling fresh market attention despite recent volatility.

The official KuCoin X account announced, “We are extremely proud to announce yet another great project coming to our Spot trading platform—$9BIT crypto.” While the token officially launched on January 4 across crypto exchanges like MEXC, BingX, WEEX, and others. The KuCoin listing appears to have triggered renewed buying pressure.

The exchange scheduled trading to start at 13:30 UTC on February 9, 2026, with deposits already open on the SOL-SPL network. Withdrawals will begin at 10:00 UTC on February 10, 2026.

Once spot trading goes live, the pair will support multiple trading bot services, including Spot Grid, Infinity Grid, DCA, Smart Rebalance, Spot Martingale, Spot Grid AI Plus, and AI Spot Trend.

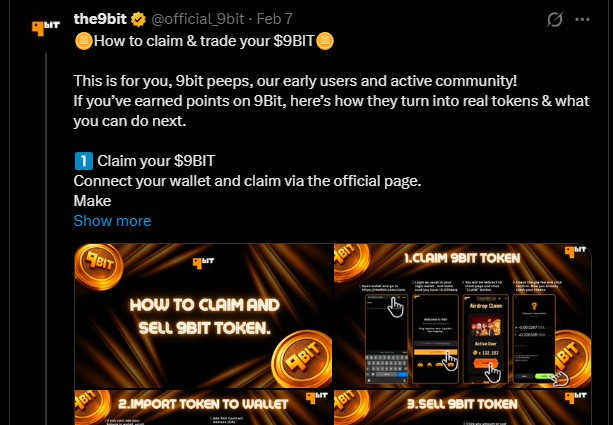

The official project also reminded early users how to claim tokens:

Connect your wallet via the official page and keep a small amount of SOL for gas.

Import the token manually if it does not appear automatically.

After importing, users can swap the coins via DEX for SOL or USDC.

Security reminders stressed no private DMs, no unofficial airdrop claims, and no fake support messages.

The9bit price surge pushed the token to around $0.006963, which is also the current price, recovering from a weekly decline of nearly 20%. As per CoinMarketCap data, before the breakout, price was moving sideways near $0.00649, suggesting accumulation.

However, 24-hour volume fell 30.57% to $3.74M, indicating that the initial hype may be cooling.

TradingView Chart highlights mixed signals:

Trend: Previously in a downtrend, now attempting a bounce.

RSI: Near 89, showing overbought conditions that could lead to consolidation.

MACD: Recently turned bullish, pointing to fresh buying interest.

Support: $0.0060

Resistance: $0.0072

In simple terms, the market shows a short-term bullish reaction but warns of a possible pullback before a stronger price rally in 2026.

Short-term forecasts suggest the token may trade between $0.0060–$0.0072. A return of buying volume could push price toward resistance again.

As per Coingabbar’s expert analysis, the mid-term projections place potential targets near $0.008–$0.0095, provided exchange exposure continues to attract traders.

But traders should stay cautious as if the asset loses the $0.0060 support price could drag toward the $0.0055 range.

Long-term price prediction indicates that steady adoption and liquidity may help the token aim for the $0.012–$0.018 zone. In a very bullish altcoin cycle with strong capital inflows, extreme projections range between $0.03–$0.05, though such moves typically require sustained demand.

Today's price surge highlights how major exchange exposure can quickly shift trader sentiment. While the KuCoin $9BIT token listing sparked immediate momentum, falling volume and overbought indicators suggest caution.

Sustained growth will likely depend on liquidity, adoption, and market conditions, making the next few sessions critical for confirming whether this rally evolves into a stable trend.

YMYL Disclaimer: This article is for informational purposes only and not financial advice. Cryptocurrency investments are highly volatile. Always do your own research before investing.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.