China has moved boldly in the trade war with an announcement that it would increase tariffs on all US merchandise from 84% to 125% from April 12, 2025. The dramatic hike has poured oil into the fire, as the relationship between both the countries continues to deteriorate. The situation is no longer just about trade—it’s now impacting global markets, including crypto.

In response to China’s move, President Trump is reportedly considering delisting Chinese company shares from US stock exchanges. The Kobeissi Letter shared on X (formerly Twitter).

Source: X

Just hours before China’s announcement, the White House said the cumulative tariff rate on Chinese goods had already reached 145%. These back-and-forth actions are worrying investors around the world.

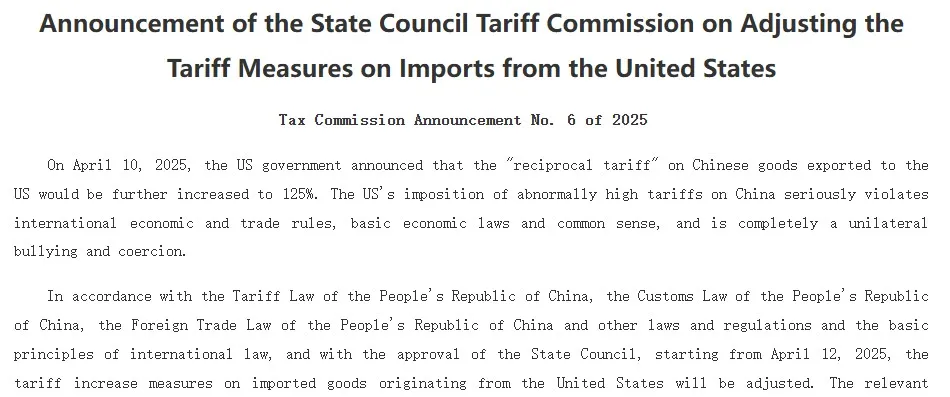

The Chinese Ministry of Finance confirmed on Friday that all US goods would now face a 125% tariff. This decision comes after months of rising trade tensions and retaliatory actions. The country also stated that it would ignore any future tariff increases from the US, calling the Trump administration's actions a "joke" and accusing them of using tariffs as a tool for economic bullying. Office of the Tariff Commission of the State Council shared the details in post.

Source: Customs Department

In a separate message, China’s Commerce Ministry added that the US's continuous use of high tariffs has become pointless and only shows its intent to pressure others unfairly. China also warned that if the US pushes further, it will “resolutely counterattack” and hold the US fully responsible for any economic damage caused.

Market reactions were swift. S&P 500 futures dropped, and Hang Seng futures also lost their gains. The US dollar weakened, showing that global investors are now worried about how deep this trade war could go. Additionally, China has started taking action beyond trade, like reducing the number of American films allowed in Chinese theaters and warning its students about safety concerns in certain US states.

This is where the situation can go two ways. Either the US hikes tariffs again, worsening the situation, or the two nations opt to settle. If Trump increases tariffs further, according to experts, it will result in a global market meltdown, impacting not just stock markets but also the crypto market.

Yet, if there's a settlement, it might calm the financial markets and provide a boost to the crypto space. The development rests largely on Trump's subsequent moves and if diplomatic negotiations occur shortly.

According to CoinMarketCap, currently, the total crypto market cap is $2.61 trillion, registering a 1.07% daily rise. But trading volume has dropped by 32.44%, now standing at $105.8 billion. Most of this volume—about 95%—is from stablecoins, which means people are being cautious and moving their money into safer tokens.

Bitcoin dominance is at 62.69%, slightly up for the day. But experts warn that if the trade war continues, there could be a major market crash, including in crypto. The coming days are crucial.

If Trump chooses to negotiate, the market could bounce back. But if tariffs rise further, we could see a crypto bloodbath, with coin and token prices falling sharply.

The China-US trade war is heating up again. With China announcing a 125% tariff on US goods, the ball is now in Trump's court. Whether he chooses settlement or retaliation will decide the fate of global markets—and the crypto market too.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.