The buzz around “Trump fire Powell” isn’t just political gossip—it’s a potential financial earthquake. As rumors swirl again and the market reacts, everyone’s asking the same thing: What happens if the President actually removes Jerome from the Fed chair? Well, let’s break down the latest update now.

In a political bombshell that’s shaking both Wall Street and the crypto news today, President Donald has reportedly shown House Republicans a draft letter to fire Federal Reserve Chair Jerome, stating he was “likely” to move ahead and asked lawmakers for their thoughts. This news instantly sparked market chaos.

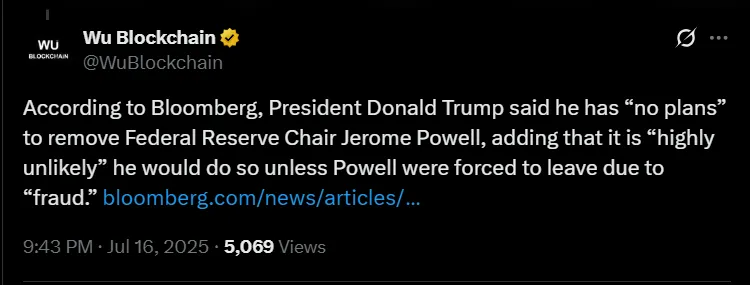

Yet, in a twist, The Kobeissi Letter confirmed via X that “reports of him firing Fed Chair are not true.” Also he claims that the chairman is already under an investigation, however it's unclear exactly what investigation is for.

Source: The Kobeissi Letter X Account

The mixed signals have left markets buzzing, but analysts warn a market crash could be near.

While he has repeatedly called for chairman's resignation over his refusal to cut interest rates, by law, the President cannot remove a Fed Chair without cause—defined strictly as misconduct, not policy differences.

Still, sources say that he asked several House Republicans if the chairman should be fired, and many even supported the idea.

Despite the President's walk-back, industry is still reacting to the political tension. The crypto market is up roughly 3% in the last 24 hours, with notable movements as per CoinMarketCap chart analysis:

Source: BTC Chart CoinMarketCap

Bitcoin (BTC) is up 2%, now trading around $119,000

Ethereum (ETH) surged 9% to $3,292.54

XRP jumped 3%, reaching $2.99

This surge has been fueled by speculation and confusion around this event, which leads to looser monetary policy—a bullish signal for digital assets. But top analyst Brian Krassenstein issued a harsh warning.

Brian Krassenstein stated bluntly, “If Republicans want interest rates to rise, firing Federal Reserve Chair is the way to get there. Confidence in the Fed and U.S. Treasuries would collapse, leading to higher, not lower rates.”

That spells trouble for the entire financial system—including cryptocurrency. If trust in the Federal Reserve erodes, both the bond market and risk-on assets could tank. The trump powell news crypto impact may flip bullish momentum into a crypto crash.

The current surge might be deceptive. While Trump denies plans to remove Head of the FED, the very idea has stirred financial waters. With prices climbing and volatility surging, this trump news today could be the calm before the storm. The headlines screaming Jerome fired might not be true today, but the damage could already be underway.

So it's always better to keep an eye on the latest updates and always do your own research before making any financial decisions in the cryptocurrency market.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.

3 months ago

Fine