Donald Trump said he would appoint a new Federal Reserve chairman who supports lower rates. Trump claims a Federal interest rate cut would reduce mortgage costs and trigger an economic boom.

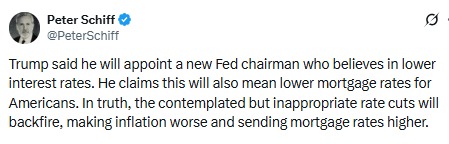

On the contrary, according to Peter Schiff, forcing cuts at the wrong time often leads to higher inflation and rising mortgage costs.

Source: X (formerly Twitter)

An interest rate cut has a limited effect on short-term borrowing costs, such as the interest on overnight loans between banks. The president can influence indirectly by guiding the leadership of the Federal Reserve.

But mortgage rates don't rely on short-term rates. They're closely linked to long-term Treasury yields, specifically the yields on 10-year and 30-year bonds.

If markets believe that an cut is forced while inflation remains high, investors get nervous. They demand higher returns against future rsing prices. And that can push long-term bond yields up. As they do, mortgage rates normally rise instead of fall.

Several market experts point out a key risk. Forcing an interest rate cut during “sticky inflation” often leads to a higher term premium. This means lenders charge more for long-term loans. The U.S. dollar may weaken, inflation fears grow, and long-term interest rates move higher.

A user asked if it should be raised instead, Peter replied, “Yes.” His point reflects a broader concern: lowering rates too early can damage trust in monetary policy. Once that trust is lost, mortgage rates can spike fast.

Trump says fed rate cut will help Americans by lowering mortgage prices and making homes more affordable. At first, this idea sounds good, especially for people struggling with high housing costs.

If rate cuts lead to higher inflation, lenders will raise mortgage rates to protect themselves. Homebuyers could end up paying more each month, not less. In this way, a policy meant to help buyers could actually make homes even more expensive.

Market stress is rising because key U.S. economic data is incomplete. The government shutdown delayed employment and inflation reports. There is no official unemployment rate for October, and the headline CPI was not released.

Investors fear uncertainty. If there is a lack of data, markets are usually going to assume the worst, and such is the case with increased volatility across stocks, bonds, and crypto.

The US CPI data will be important as inflation is proving sticky. The September CPI came in at 3%, and economists expect a slight increase to 3.1% as per CNBC reporting.

Right now, markets are already nervous. Risk assets like crypto are highly volatile and bearish. The current crypto market cap is at $2.19 Trillion with a decrease of 1.7%. Bitcoin and the altcoins struggle as money moves out to safety assets. Prices of gold and silver have been going up, really quite indicative of some sort of risk-off behavior.

If a federal reserve cut ignites fears of price rise, crypto markets could see some short-term selling pressure. Higher longer-term yields are deleterious for liquidity, and this especially hurts speculative assets. Meanwhile, gold may continue its current uprise as investors seek hedge against price increase.

Trump’s interest rate cut promise sounds positive on the surface, but markets care more about living-costs control than political goals. If cuts are seen as reckless, the result could be higher mortgage, unstable markets, and deeper pressure on risk assets.

In the end, an interest rate cut only works when inflation is under control. Without that, the cure may become the problem itself.

Disclaimer: This article is for informational purposes only, do your own research before investing.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.