Donald Trump Jr. Bitcoin investment just dropped millions on a company that made only $151 in revenue last quarter—but holds over $2 million in $BTC. Why? Because this isn’t just an investment—it’s part of a radical crypto treasury strategy being shaped by the Donald family ahead of the 2025 election.

As Thumzup Media quietly builds a multi-coin crypto war chest, bulls are watching closely—and the markets are reacting.

According to Bloomberg and Wu Blockchain, the U.S. President's son recently made a high-profile bitcoin investment, buying 350,000 shares of Thumzup Media through a $6 million private placement.

This aligns him with one of the most aggressive Thumzup crypto treasury projects in the social media space. And the timing couldn’t be more strategic.

The Media Corporation, a money-losing but fast-moving app that pays users to recommend products on Instagram, now holds over $2 million in tokens and just announced it will expand its treasury strategy with six additional coins.

And here's the kicker: All this is happening while President Donald himself intensifies his promise to make America “the cryptocurrency capital of the world.” This makes the Trump family crypto plan a serious driver of sentiment in the current bitcoin news today cycle.

Donald Trump Jr. Thumzup shares: He acquired 350,000 shares, now valued at over $4 million based on the current $12.36 share price.

Private Placement: Part of a $6M deal arranged by Dominari Securities.

Thumzup BTC Holdings: Over $2M in BTC, with plans to add six more cryptocurrency assets to strengthen their position.

Source: Thumzup Media Corporation

Company Financials: The media Coropration reported just $151 in revenue and $2.2 million in losses in Q1 2025.

Stock Movement: Despite prior rallies, shares dropped 17% on Wednesday post-disclosure.

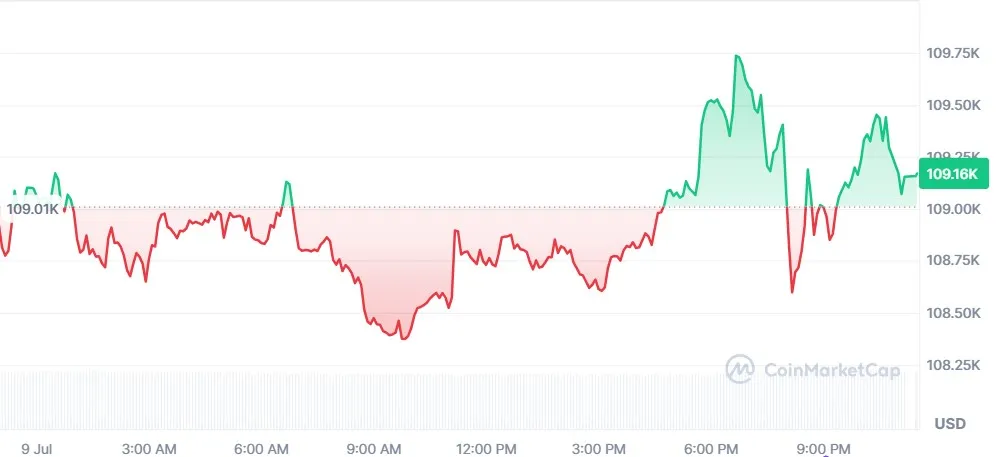

It was trading at $109,210.39 at the time of writing, with a modest 0.16% daily gain and a $43.41B trading volume, according to CoinMarketCap. While the number seems small, its price impact could be significant.

This news is bigger than it looks and adds new momentum to the btc news cycle.

Short-Term Price Outlook (3–5 Days):

This narrative is likely to spark retail FOMO, pushing BTC toward the $110,500–$112,000 range. As per my CoinMarketCap chart analysis: "Expect a retest of $110K resistance if the this story dominates headlines."

Long-Term Forecast (By End of 2025):

With growing U.S. political support—especially from high-profile candidates, Bitcoin price prediction 2025 may well see it breaking past $125K, provided institutional inflows continue.

As Donald Trump Jr. Bitcoin investment joins the ongoing cryptocurrency stockpiling trend, the token gains more than just investor dollars—it gains political weight and credibility.

As the Trump family crypto plan engages in significant financial maneuvers, short-term traders and long-term holders will be watching the developments in sentiment rallies and pre-election’s narrative.

So if you choose to watch the markets, keep a close eye on the BTC Trump news cycle to stay agile in the rapidly changing world of digital economy.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.

3 months ago

Good