In a sweeping return to his trademark trade strategy, President Donald has issued multiple letters to over 30 nations, reigniting fears of a renewed global trade war. The move is described by many as both pre-election power play and a potential policy shift– and it may have a surprise side effect: boosting interest in Bitcoin and other cryptocurrencies.

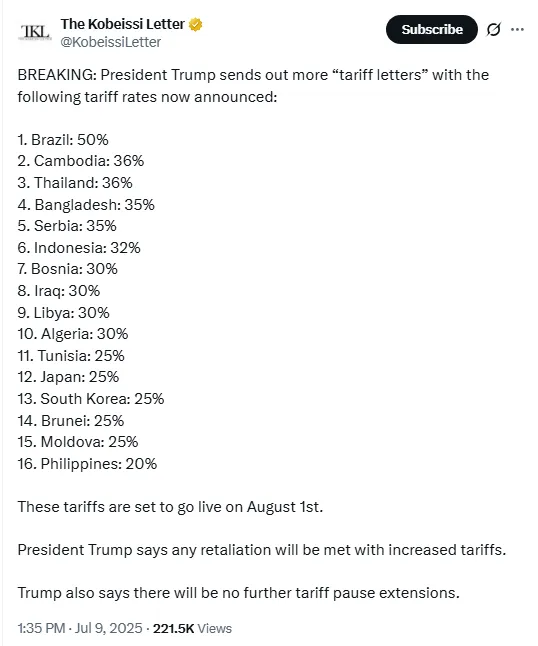

As per the latest Trump new tariff news include countries like Brazil (50%), Thailand and Cambodia (36%), Bangladesh and .Serbia (35%), Indonesia (32%) and Japan and South Korea (25%) are among those hit with rates. These letters follow an earlier batch sent to countries such as Malaysia, South Africa and Myanmar, bringing the total list to over 30 nations.

Source: X

Together, these countries represent major hubs for manufacturing electronics and digital infrastructure– all sectors critical not only to traditional economies but also to the crypto ecosystem.

Financial markets have started showing signs of stress, investors are bracing for higher costs, disrupted supply chains, and possible retaliatory.

Tech-based economies from Japan, South Korea and Indonesia may feel an extra sting, as they were known as the backbone of the crypto mining hardware and semiconductor industries.

The immediate result? Caution in traditional markets, and growing curiously in alternative asset classes.

With fiat systems again under pressure from aggressive trade moves, the natural question arises: Will bitcoin shine again as a safe haven?

Yes the historical patterns shows, In 2025, the Trump new tariff news war, shapes a turn after the announcement By President on April 8, the BTC market faces a downfall on April 9. The prices came on ($76,239) which had a downfall after reaching a high of ($83,000).

Source:TradingView

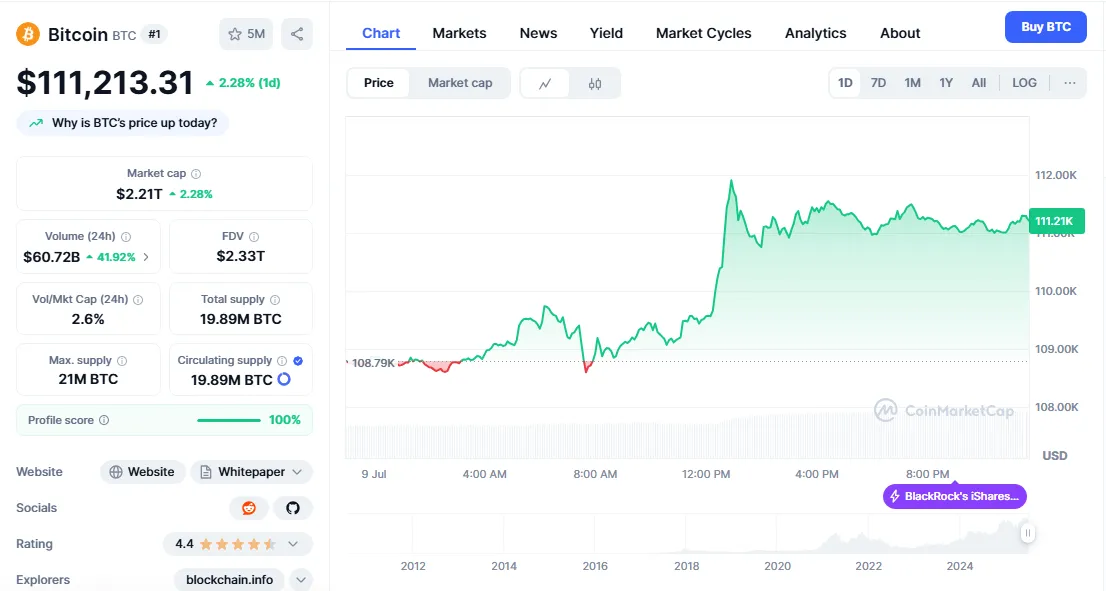

But after this, the BTC faced a hike of 45% this year and is currently trading at $111,213.31.

Source: CoinMarketCap

This time, as Trump new tariff news hits key countries that also support the digital economy, the case of crypto reliance becomes even stronger.

The juxtaposition has never been clearer. While traditional battles accelerated, crypto remains borderless, permissionless and immune to political retaliation.

Experts argue that if Trump new tariff news escalation continues, it could accelerate crypto adoption, in two key ways:

As a hedge against fiat volatility and inflation

As an alternative financial network, especially in countries affected by US trade policy.

“Tension is real, but so is the growing trust in decentralized assets. Every trade disruption adds fuel to crypto’s relevance.” noted a digital economist.

Whether Trump’s latest trade actions are short term political moves or a return to long-term economic hardball, the effects are already being felt. new tariff news has sparked more than global trade anxiety– they’ve triggered questions about the future of finance itself.

As traditional systems strain under geopolitical tension, crypto may emerge not just as an investment, but as a necessity.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.