With Kevin Hassett as the next Federal Reserve Chair, President Trump indicates a possible change in the monetary policy of the United States. Markets prepare to cut rates, tax refunds, and economic stimulus.

President Trump has recently given hints that he has decided on the next Federal Reserve Chair, and it may be announced early in 2026. Kevin Hassett, the current director of the White House National Economic Council and the previous director of the Council of Economic Advisers, under Trump, comes out as the top candidate.

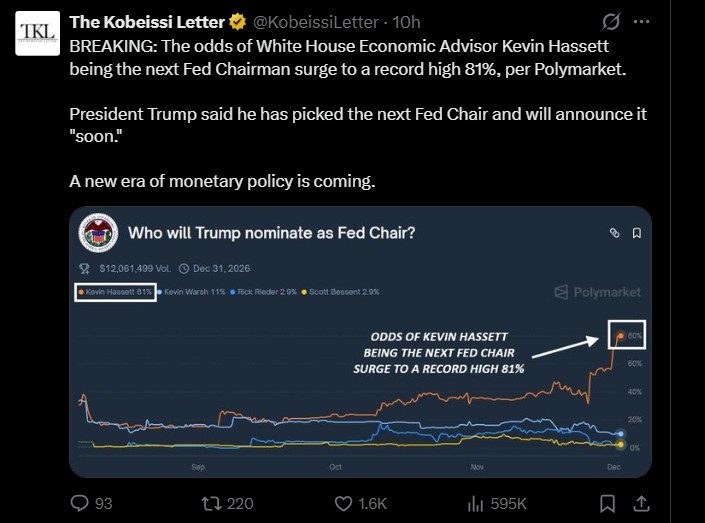

Source: The Kobeissi Letter X

Hassett has an all-time high odds of 81% at Polymarket, a prediction market site, compared to his odds of 40% in November. Such a rush is an indication of high trader confidence in his nomination and an increase in market expectations.

Hassett is a pro-growth supporter and has co-written Dow 36,000 and prefers policies that promote economic growth by cutting taxes and deregulation. His possible appointment is likely to change the course of the Fed towards more vigorous rate reductions and less independence.

Hassett may shift the U.S. policy dramatically in case he becomes the Fed Chair:

Analysts are forecasting quicker interest rate cuts, along with Fed reforms that are governed by rules, directed at raising transparency. This is unlike the inflation-conscious cautiousness of Jerome Powell.

Together with possible Fed rate cuts, Treasury Secretary Scott Besset promised big tax refunds in Q1 2026.

These refunds are included in a wider fiscal stimulus, such as potential dividend-like payouts based on Trump-era tax cuts that historically paid out some $1,700 per filer.

Source: X

The rate cuts, tax refunds, and possible stimulus check may be similar to the 2020 fiscal response that boosted equities by 20-30% but also raised inflation to 7%.

Investors and other traders will be considering short-term returns against long-term risks such as asset bubbles and inflationary pressures.

There is already a market reaction to the possible nomination of Hassett:

The optimism has been in the equity and gold markets, and social media posts are showing excitement about the looser monetary policy.

Meanwhile, there are also warnings of threats to the stability of the economy, including the increase in prices and unemployment.

The high odds of Hassett at Polymarket indicate how much the participants of the prediction market are convinced of his appointment.

Traders are looking forward to his policies potentially leading to asset price booms in the short term, and there are still debates on the long-term impacts.

To further fuel the market speculation, on December 3, 2025, President Trump has a big announcement to make at the Oval Office at 2.30 PM ET. The speculations are on immigration reforms in labor markets to other economic initiatives.

Source: X

The most recent announcements, such as a promise of $6.25 billion to U.S. children and agreements to lower the prices of weight-loss drugs, indicate that pro-growth, populist policies are still being emphasized.

The probable appointment of Kevin Hasset as Fed Chair can be viewed as an indication of a new era of monetary policy under Trump, which will entail aggressive growth policies along with fiscal stimulus. The markets must be ready to receive short-term volatility and long-term economic arguments.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.