Trade tensions rise as Trump warns Canada of stronger tariffs in retaliation. Mexico may follow, while China has already increased tariffs on U.S. farm products.

These trade fights are making markets unstable. Bitcoin dropped below $82,000 after the tariff news but later climbed to $88,313. It is still down 8% over the last month. Trump’s support for a U.S. crypto reserve briefly pushed Bitcoin to $95,000, but it quickly fell again. Analysts say Bitcoin faces resistance at $94,000, and its future is uncertain.

The economy is showing signs of growth, with the Purchasing Managers Index (PMI) rising above 50 for two months. Experts believe this could support Bitcoin in the long run. Some predict Bitcoin may hit a new high in late 2025 or early 2026 if the economy keeps improving.

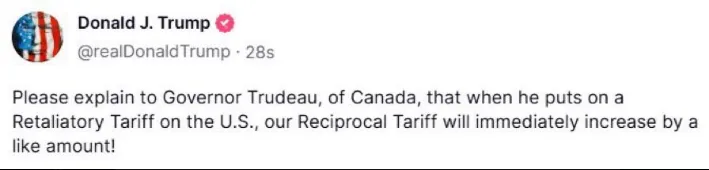

U.S. President Donald Trump has warned Canada that any new tariffs will be met with even stronger ones from the U.S. He made this clear in a post on X, saying he won’t back down in the trade fight.

In response to Trump’s tariff policies, Canada announced a 25% tariff on $20.5 billion of U.S. goods. Prime Minister Justin Trudeau called the move unfair and promised to protect Canadian businesses. “We will do whatever it takes,” he said on TV.

Mexico may announce trade penalties this week. China has already raised tariffs on U.S. farm products. Many fear bigger problems in global trade.

Bitcoin has been struggling with price swings. Trade fights and market fears are making investors nervous. Experts warn that Bitcoin could drop again.

One big reason is trade tensions. The U.S. is fighting with Canada, Mexico, and China over tariffs. These battles hurt businesses and make markets unstable. When markets are shaky, investors avoid risky assets like Bitcoin.

Another reason is Bitcoin’s price resistance. It tried to break $94,000 but failed. This shows strong selling pressure. If it can’t rise past this level, it could fall further.

Economic reports will also affect Bitcoin. The Federal Reserve will soon decide on interest rates. If rates stay high, investors might pull money from Bitcoin and put it into safer options.

Even though the economy is growing, Bitcoin is still risky. The Purchasing Managers Index (PMI) is above 50, showing growth. But if the economy slows again, Bitcoin may struggle even more.

Analysts say Bitcoin could drop below $80,000 if selling continues. Right now, its future is uncertain. Investors are waiting for better news before buying again.

Bitcoin remains highly uncertain as trade tensions, economic policies, and market fears weigh on investors. Resistance at $94,000 and upcoming Federal Reserve decisions add to the risks. While economic growth could help in the long run, short-term volatility may push Bitcoin lower. Investors are cautious, waiting for clearer signals before making big moves.

Mohit Raghuwanshi is an Indian journalist working at Coin Gabbar’s news desk, passionately following the ever-evolving crypto market. With a keen interest in blockchain technology and digital assets, he delivers in-depth reports on industry trends, regulations, and market movements. He holds a bachelor's degree in Journalism and Mass Communication and previously worked as a content writer at a PR agency, honing his skills in crafting compelling narratives and analyzing financial markets.